Uttar Pradesh’s real estate sector is evolving rapidly. Every property purchase in UP comes with the additional expense of stamp duty and registration charges. These charges not only give legal recognition to the transaction but also provide security and clarity for all parties involved.

This blog will walk you through the updated stamp duty and registration charges in Uttar Pradesh for 2025.

Looking for low interest rate home loans in Uttar Pradesh?

What Are Stamp Duty and Registration Charges?

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

Stamp Duty Charges in Uttar Pradesh 2025

| Owner | Stamp Duty (%) |

|---|---|

| Man | 7% |

| Woman | 6%* |

| Man + Woman | 6.5% |

| Man + Man | 7% |

| Woman + Woman | 6%* |

Suggested Read: RERA Charges in Uttar Pradesh

Property Registration Charges in Uttar Pradesh 2025

| Owner | Registration Charge (%) |

|---|---|

| Man | 1% |

| Woman | 1% |

| Man + Woman | 1% |

| Man + Man | 1% |

| Woman + Woman | 1% |

Stamp Duty and Registration Charges on Different Types of Properties

| Property Type | Male Owner Stamp Duty | Female Owner Stamp Duty | Registration Charge |

|---|---|---|---|

| Commercial Properties | 7% | 6% | 1% |

| Industrial Land | 7% | 6% | 1% |

| Agricultural Land | 7% | 6% | 1% |

Stamp Duty Charges on Gift Deed and Other Documents in Uttar Pradesh

| Document | Stamp Duty/Fee |

|---|---|

| Gift Deed | 5% of the property value |

| Gift Deed (blood relation, family members) | Rs 5,000 |

| Will | Rs 200 |

| Exchange Deed | 3% |

| Lease Deed | Rs 200 |

| Agreement | Rs 10 |

| Adoption Deed | Rs 100 |

| Divorce | Rs 50 |

| Bond | Rs 200 |

| Affidavit | Rs 10 |

| Notary | Rs 10 |

| Special Power of Attorney | Rs 100 |

| General Power of Attorney | Rs 10 to Rs 100 |

Suggested Read: Circle Rates in Uttar Pradesh 2025

Stamp Duty on Property Gifting Within a Family in UP (2025)

A recent amendment has reduced stamp duty for property transfers among blood relatives in Uttar Pradesh.

- Standard Stamp Duty: Rs 5,000

- Processing Fee: Rs 1,000

- Total Charges: Rs 6,000 (Rs 5,000 + Rs 1,000)

Note: A previous cabinet decision set overall charges at Rs 7,000 (Rs 6,000 stamp duty + Rs 1,000 processing fee) for a limited period.

Eligible Family Members:

- Father

- Mother

- Brother

- Sister

- Spouse

- Son

- Daughter

- Son-in-law

- Daughter-in-law

- Grandchildren (from both son’s and daughter’s sides)

Transfer Methods:

Property transfers can be executed via:

- Gift Deed

- Relinquishment Deed

- Partition Deed

How to Pay Stamp Duty in Uttar Pradesh Online?

- Visit the official website of Stamp and Registration Department, Uttar Pradesh. Click the ‘Apply’ button under the ‘Property Registration’ section on the left.

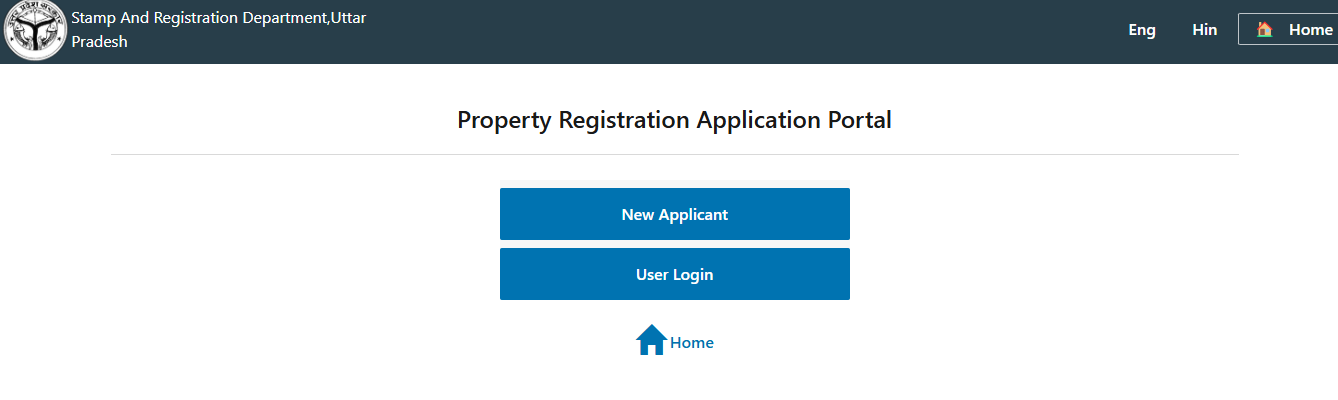

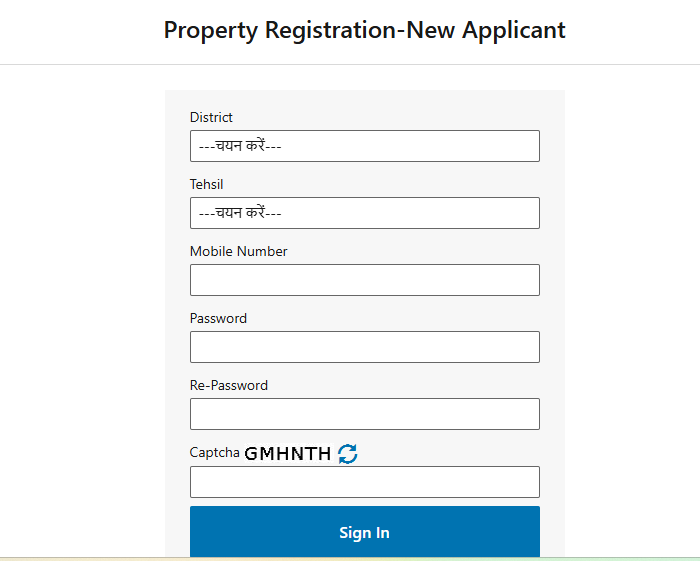

- Select the ‘New Application’ option to create an application number.

- Register with your credentials and log in as a registered user. Provide all required details for the property, including information about the buyer, seller, and witnesses.

- The system calculates the stamp duty and registration charges automatically.

- Pay the stamp duty online.

- Save the generated receipt number for future reference.

- Schedule an appointment for property registration at the sub-registrar’s office.

Suggested Read: DLF Share Price

How to Register Your Property in Uttar Pradesh?

- Visit the SRO: After paying stamp duty online, the buyer, seller, and two witnesses must go to the Sub-Registrar’s Office (SRO).

- Initial Verification: An operator at the SRO checks your online application details, and captures your thumb impressions and photograph.

- Final Verification: The sub-registrar reviews the application and cross-checks it against your original documents to finalize the registration.

How to Pay Stamp Duty and Registration Charges in Uttar Pradesh Offline?

Stamp Duty Exemption in Uttar Pradesh

Uttar Pradesh has digitised the stamp duty exemption process for industrial land purchases by integrating it with the Nivesh Mitra Portal. This initiative makes the process paperless, contactless, and more transparent.

PLEDGE Scheme for Private Industrial Parks

In addition to the broader incentives, the state government is promoting entrepreneurship through the Promoting Leadership and Enterprise for Development of Growth Engine (PLEDGE) scheme. The scheme offers significant stamp duty rebates for private industrial park development:

- Eastern Uttar Pradesh & Bundelkhand: 100% stamp duty rebate

- Central Region: 75% stamp duty rebate

- Gautam Buddha Nagar: 50% stamp duty rebate

- Women Entrepreneurs: 100% exemption for investments in or leases of industrial land within parks developed under PLEDGE

Impact and Objectives

- Boost industrialisation

- Attract domestic and foreign investments

- Support women-led enterprises

Stamp Duty and Registration Charges for Women in Uttar Pradesh

- Women in Uttar Pradesh receive a reduced stamp duty rate only for properties below a specific price threshold.

- For properties costing up to ₹10 lakh, women pay 6% stamp duty (as opposed to 7% for men).

- For properties costing above ₹10 lakh, men and women both pay the same stamp duty rate.

How to Withdraw Stamp Duty in Uttar Pradesh?

| Step | Action |

|---|---|

| 1. Access the IGRSUP Portal | Go to https://igrsup.gov.in/. |

| 2. User Registration | – New Users: Register with required details. – Existing Users: Log in using your credentials. |

| 3. Initiate Refund Application | Select “Stamp Refund” from the portal’s services to open the refund application page. |

| 4. Complete the Form | Provide: – Personal details (name, contact) – Transaction specifics (date, amount, property info) – Reason for refund request |

| 5. Upload Documents | – E-stamp certificate or challan (proof of payment) – Identification proof (Aadhaar, PAN) – Any other relevant supporting documents |

| 6. Submit Application | – Review all details and attachments – Submit the application – Note the reference number for tracking |

| 7. Review & Refund Processing | – The Stamp & Registration Department reviews the application – If approved, refund is processed as per departmental guidelines |

Non-Payment of Stamp Duty in UP: Risks, Penalties, and Legal Impact

Stamp duty and registration fees are mandatory for property transactions exceeding ₹100 under the Indian Stamp Act, 1899, and the Registration Act, 1908. Non-payment can lead to serious legal and financial repercussions.

Key Consequences:

| Consequence | Impact |

|---|---|

| Legal Invalidity | The property transaction remains legally unrecognized, making the buyer’s ownership invalid. |

| Inadmissibility in Court | Documents without proper stamp duty cannot be presented as evidence in legal proceedings. |

| Penalties | A fine of 2% per month on the deficient amount applies, up to a maximum penalty of 200%. |

Stamp Duty and Registration Charges in Uttar Pradesh: Tax Benefits

- Section 80C Benefit – Tax exemptions on stamp duty and registration fees can be claimed under Section 80C of the Income Tax Act, 1961.

- Maximum Deduction – Individuals and joint owners can avail deductions up to ₹1,50,000.

- Applicable Only on New Properties – Tax benefits apply only to new property purchases and not on resale properties.

- Joint Ownership Advantage – Each co-owner can claim a deduction separately, subject to the ₹1,50,000 limit per person.

Stamp Duty and Registration Charges For All States

| State | Stamp Duty -Male | Stamp Duty -Female | Registration Charges |

|---|---|---|---|

| Andhra Pradesh | 5% | 5% | 1% |

| Arunachal Pradesh | 6% | 6% | 1% |

| Assam | 6% | 5% | 8.50% |

| Bihar | 6.30% | 5.70% | 1% |

| Chhattisgarh | 5% | 4% | 1% |

| Goa | 3.5% – 5% | 3.5% – 5% | 1% |

| Gujarat | 4.90% | 4.90% | 1% |

| Haryana | 7% | 5% | 1% |

| Himachal Pradesh | 5% | 5% | 1% |

| Jharkhand | 4% | 4% | 1% |

| Karnataka | 2% – 5% | 2% – 5 | 1% |

| Kerala | 8% | 8% | 2% |

| Madhya Pradesh | 7.50% | 7.50% | 1% |

| Maharashtra | 6% | 5% | 1% |

| Manipur | 7% | 7% | 3% |

| Meghalaya | 9.90% | 9.90% | 1% |

| Mizoram | 9% | 9% | 1% |

| Nagaland | 8.25% | 8.25% | 1% |

| Odisha | 5% | 4% | 1% |

| Punjab | 4.75% | 2.75% | 1% |

| Rajasthan | 6% | 5% | 1% |

| Sikkim | 5% | 5% | 1% |

| Tamil Nadu | 4% | 4% | 2% |

| Telangana | 5% | 5% | 1% |

| Tripura | 5% | 5% | 1% |

| Uttarakhand | 5% | 3.75% | 1% |

| Uttar Pradesh | 7% | 5% | 1% |

| West Bengal | 6% – 7% | 6% – 7% | 1% |

| Delhi | 6% | 4% | 1% |

| Daman & Diu | 6% | 4% | 0.50% |

| Jammu and Kashmir | 7% | 3% | 1.20% |

Get a Home Loan

with Highest Eligibility

& Best Rates

Secure Your Home Purchase with Credit Dharma

In Uttar Pradesh, understanding and complying with stamp duty and registration charges is vital to ensure a smooth property transaction. If you’re looking for a home loan in UP, Credit Dharma is here to help. With expert guidance and competitive financing options, we can simplify your journey to home ownership.

Frequently Asked Questions

The buyer of the property is typically responsible for paying stamp duty, although specifics can vary based on local laws and agreements.

Stamp duty is usually calculated as a percentage of the property’s purchase price or the market value, whichever is higher.

If you don’t pay stamp duty on documents that need it, you could face serious issues. Courts won’t allow these documents as evidence, making disputes hard to resolve. Plus, authorities might hold them until you pay the duty and any extra fines, which can be quite hefty.

All real estate transactions require stamp duty, except when properties are transferred through a Will.

Yes, stamp duty rates and regulations vary significantly across different states and territories, reflecting local real estate market conditions and government policies.

The current stamp duty rates in Uttar Pradesh are 7% for female owners and 5% for male owners.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan