Securing your dream home just got easier with Union Bank of India’s reduced home loan interest rates, now starting as low as 7.80% p.a.! Whether you’re a first-time homebuyer or an existing customer, this rate cut is a golden opportunity to save big on your loan repayments. With one of the most competitive rates in the market, now is the perfect time to take action.

In this blog, we’ll break down Union Bank Of India’s new home loan interest rates, how this reduction can lower your monthly EMI, and show you exactly how much you can save with a simple example calculation. Let’s dive in!

Key Highlights of Union Bank Of India’s Home Loan Interest Rate Reduction

Whether you’re a salaried professional or a self-employed individual, these lowest interest rates can drastically lower the overall cost of your home loan.

| Key Highlights | Details |

|---|---|

| New Floating Interest Rate | Starting at 7.80% for female salaried borrowers with a CIC score of 800+ |

| Effective Benchmark Lending Rate (EBLR) | 8.75% (RBI Repo Rate 6.00% + Spread 2.75%) |

| Interest Rate for Salaried (Male) – CIC 800+ | 7.85% (EBLR – 0.90%) |

| Interest Rate for Salaried (Female) – CIC 800+ | 7.80% (EBLR – 0.95%) |

| Interest Rate for Non-Salaried (Male) – CIC 800+ | 7.95% (EBLR – 0.80%) |

| Interest Rate for Non-Salaried (Female) – CIC 800+ | 7.90% (EBLR – 0.85%) |

| Fixed Interest Rate (Up to 5 Years) | 11.40% for loans up to ₹30 lakh, 12.40% for ₹30 lakh to ₹50 lakh, 12.65% for above ₹50 lakh to ₹2 crore |

Source: Union Bank Of India Official Website

Union Bank Of India Old vs New Home Loan Interest Rates

Let’s compare the old and new interest rates to see the potential savings and benefits that come with the recent rate cut.

| Category | Old Interest Rates | New Interest Rates |

|---|---|---|

| Interest Rate for Male Salaried Borrowers (CIC 800+) | 8.50% | 7.85% |

| Interest Rate for Female Salaried Borrowers (CIC 800+) | 8.45% | 7.80% |

| Interest Rate for Non-Salaried Borrowers (Male/Female, CIC 800+) | 8.75% – 9.00% | 7.95% – 8.00% |

Check Out: Union Bank of India Home Loan EMI Calculator

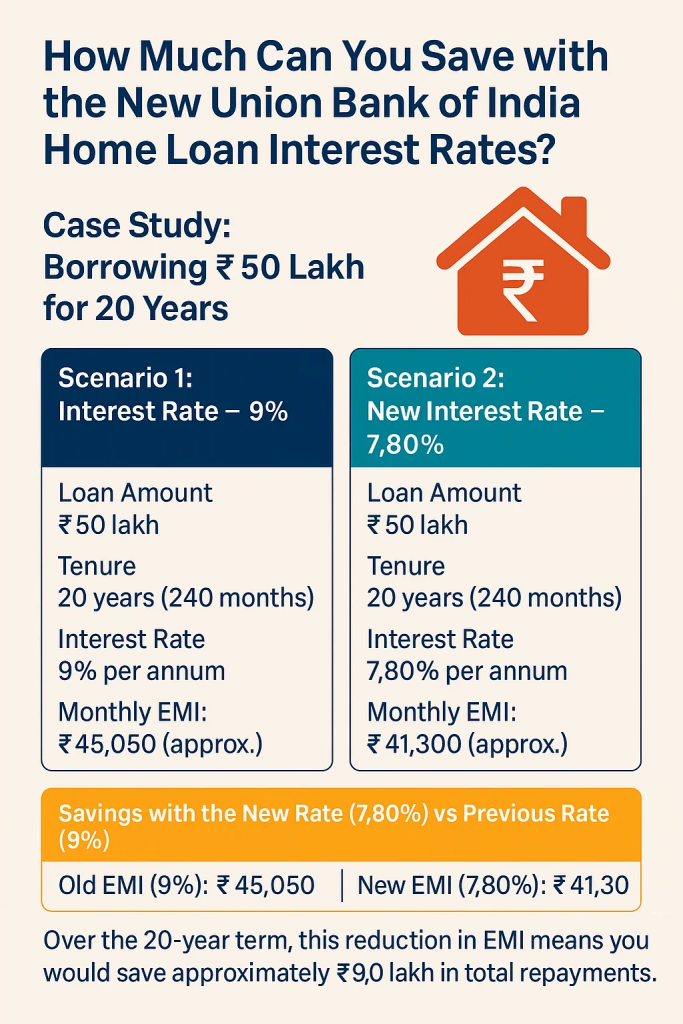

How Much Can You Save with the New Union Bank Of India Home Loan Interest Rates?

Let’s take a closer look at how much you can save with the new Union Bank Of India home loan interest rates, using a detailed case study. In this example, we’ll compare the monthly EMI and total repayment for a ₹50 lakh home loan, assuming different interest rates before and after the rate reduction.

Case Study: Borrowing ₹50 Lakh for 20 Years

Scenario 1: Previous Interest Rate – 8.50%

- Loan Amount: ₹50 lakh

- Tenure: 20 years (240 months)

- Interest Rate: 9.00% per annum

- Monthly EMI: ₹45,050 (approx.)

Total Repayment:

Over the 20-year tenure, the total repayment would be around ₹1.08 crore (₹45,050 × 240 months).

Scenario 2: New Interest Rate – 7.80%

With the recent rate cut, let’s see how the monthly EMI changes:

- Loan Amount: ₹50 lakh

- Tenure: 20 years (240 months)

- New Interest Rate: 7.80% per annum

- Monthly EMI: ₹41,300 (approx.)

Total Repayment:

At the new rate of 7.80%, the total repayment over 20 years would be around ₹99.1 lakh (₹41,300 × 240 months).

Savings with the New Rate – 7.80% p.a.

- Old EMI (9%): ₹45,050

- New EMI (7.80%): ₹41,300

- Savings per Month: ₹3,750

Over the 20-year term, this reduction in EMI means you would save approximately ₹9.0 lakh in total repayments.

By switching from the previous interest rate of 9% to the new rate of 7.80%, the borrower saves ₹3,750 every month on their EMI. This translates to a total savings of ₹9.0 lakh over the full 20-year loan term.

Check Out: Union Bank of India Home Loan Eligibility Calculator

Why Choose Union Bank Of India for Your Home Loan?

Union Bank Of India has long been known for its trustworthy financial products and customer-centric approach. Their recent interest rate reduction offers a compelling reason for homebuyers to consider them as their go-to lender. Here’s why:

- Lower EMIs: With the revised interest rates, you can save a significant

- amount on your EMIs and total repayment.

- Flexible Loan Amounts: Whether you need a small loan for a compact home or a large sum for a luxurious property, Union Bank Of India offers a wide range of loan amounts to suit your needs.

- Quick and Easy Process: The application process is straightforward, with minimal documentation and quick processing times.

- Government Employees Benefit: Government and PSU employees get additional discounts, making it even more affordable to borrow from Union Bank.

Suggested Read: Top 5 Banks for Home Loans in Bangalore

Home Loan Interest Rates by Top Banks

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 7.50% p.a. onwards | 7.50% p.a. onwards | 7.50% p.a. onwards |

| HDFC Bank | 7.50% p.a. onwards | 7.50% p.a. onwards | 7.50% p.a. onwards |

| LIC Bank | 7.50% p.a. onwards | 7.50% p.a. onwards | 7.50% p.a. onwards |

| ICICI Bank | 8.55% p.a. onwards | 8.55% p.a. onwards | 8.55% p.a. onwards |

| Kotak Mahindra Bank | 7.99% p.a. onwards | 7.99% p.a. onwards | 7.99% p.a. onwards |

| Punjab National Bank | 7.50% – 11.05% p.a. | 7.50% – 11.05% p.a. | 7.50% – 11.05% p.a. |

| Bank Of Baroda | 7.45% onwards | 7.45% onwards | 7.45% onwards |

| Bajaj Housing Finance | 7.49% p.a. onwards | 7.49% p.a. onwards | 7.49% p.a. onwards |

| Axis Bank | 7.60%-10.30% p.a. | 7.60%-10.30% p.a. | 7.60%-10.30% p.a. |

| Bank of India | 7.35% p.a onwards | 7.35% p.a onwards | 7.35% p.a onwards |

| TATA Capital | 7.70% p.a. onwards | 7.70% p.a. onwards | 7.70% p.a. onwards |

Get a Home Loan

with Highest Eligibility

& Best Rates

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Union Bank of India’s recent home loan interest rate reduction to as low as 7.80% offers an incredible opportunity for homebuyers to save significantly. With lower EMIs and potential savings of up to ₹9 lakh over 20 years, this is the perfect time to secure your dream home at a competitive rate. Whether you’re a first-time buyer or looking to refinance, don’t miss out on this chance to reduce your loan cost and make homeownership more affordable. Apply now and take advantage of these attractive rates before they change again!

Frequently Asked Questions

As of April 2025, Union Bank of India offers home loan interest rates starting from 7.80% per annum for female salaried borrowers with a CIBIL score of 800 and above. Rates vary based on credit score, employment type, and loan amount.

The bank’s home loan interest rates are linked to the External Benchmark Lending Rate (EBLR), which is based on the RBI’s repo rate. The EBLR is reset at least once every three months or as prescribed by the bank/RBI.

Yes, Union Bank of India offers a home loan balance transfer facility to help borrowers take advantage of lower interest rates and better terms.

You can apply for a home loan by:

Visiting the nearest Union Bank of India branch

Downloading the application form from the official website

Applying online through the bank’s digital platforms Ensure you have all necessary documents ready for a smooth application process.

For floating rate home loans, Union Bank of India does not charge prepayment or foreclosure fees, provided the repayment is made from verifiable sources.

Union Bank of India provides home loans up to 90% of the property’s market value, depending on the applicant’s eligibility and the property’s location.

Yes, female borrowers are eligible for a 0.05% concession on the applicable home loan interest rates.

The processing fee is 0.50% of the loan amount, subject to a maximum of ₹15,000 plus applicable GST.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan