Before you finalize your property purchase, use our stamp duty and registration charges calculator to get an idea of the costs involved with buying a new house.

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

From Tirupati to Vijayawada, Credit Dharma brings you the BEST home loan offers! 100% digital process. Transparent rates!

Property Stamp Duty Charges in Andhra Pradesh 2025

Buying a home in Andhra Pradesh? Stamp duty is a key cost to factor in. For 2025, the state has revised rates to ensure fair taxation on property transactions. This one-time tax, calculated as a percentage of the property value, is crucial for legal ownership.

| Document Type | Fee Percentage |

|---|---|

| Sale Deed (in Gram Panchayath) | 5.50% |

| Sale Deed (in other areas) | 5.50% |

| Sale Agreement With Possession | 5.50% (Adjustable) |

| Sale Agreement Without Possession | 0.50% (Not adjustable) |

| Agreement of Sale cum General Power of Attorney | 6.50% (5.50% Adjustable) |

| Conveyance | 5.00% |

| Certificate of Sale | 5.00% |

| Development / Construction Agreement cum GPA | 1.00% (Not adjustable) |

| Development/Construction Agreement | 0.50% (Not adjustable) |

Suggested Read: Profitable Cities for Airbnb Investment 2025

Property Registration Charges in Andhra Pradesh 2025

After you pay the stamp duty, you must register your property with the government. In 2025, Andhra Pradesh continues to streamline this process, adding a nominal percentage for registration fees to your total cost. This legal formality recognizes your ownership and safeguards against disputes.

| Document | Registration Fees | Chargeable Value |

|---|---|---|

| Sale Deed (in Gram Panchayath) | 2.00% | Market value (or) consideration whichever is higher |

| Sale Deed (in other areas) | 0.50% | Market value (or) consideration whichever is higher |

| Sale Agreement With Possession | 0.50% (Minimum Rs.1,000 and Maximum 50,000) | Market value (or) consideration whichever is higher |

| Sale Agreement Without Possession | 0.00% | Market value (or) consideration whichever is higher |

| Agreement of Sale cum General Power of Attorney | 0.50% subject to a minimum of Rs.5,000 and maximum of Rs.1,00,000 | Market value (or) consideration whichever is higher |

| Conveyance | 0.50% | Market value (or) consideration whichever is higher |

| Certificate of Sale | 0.50% | Value equal to the amount of purchase money |

| Development / Construction Agreement cum GPA | 0.50% (Subject to a minimum of Rs.5,000 and maximum of Rs.1,00,000) | Land value or the estimated cost of the proposed construction/development of the property whichever is higher |

Suggested Read: 1 Acre Land Price in India 2025

Stamp Duty and Registration Charges on Gift Deed in Andhra Pradesh 2025

Gifting property to a loved one? Even gifts attract stamp duty and registration fees in Andhra Pradesh. For 2025, the state mandates these charges to formalize transfers, ensuring the deed holds legal weight. Rates may vary for family members, so check the latest guidelines to make the transfer smooth and valid.

| Gift Type | Stamp Duty | Registration Fees | Chargeable Value |

|---|---|---|---|

| (i) Gift in favour of Family Member | |||

| (a) Property falling in any area except Gram Panchayat | 2.00% | 0.5% subject to a minimum of ₹2,000 and maximum of ₹25,000 | Market value of the property |

| (b) Property falling in Gram Panchayat | 2.00% | 0.5% + (0.5% subject to a minimum of ₹2,000 and maximum of ₹25,000) | Market value of the property |

| (ii) Gift in favor of Person other than Family Member | |||

| (a) Property falling in any area except Gram Panchayat | 5.00% | 0.5% subject to a minimum of ₹2,000 and maximum of ₹1,00,000 | Market value of the property |

| (b) Property falling in Gram Panchayat | 5.00% | 1.5% + (0.5% subject to a minimum of ₹2,000 and maximum of ₹1,00,000) | Market value of the property |

| (iii) Gift in favour of Government/Gram Panchayat/Municipality/Municipal Corporation/UDA/IALA | 0.00% | 0.5% subject to a minimum of ₹2,000 and maximum of ₹10,000 | Market value of the property |

Suggested Read: Transfer Property Act 1882

Stamp Duty and Registration Charges on Settlement Deed in Andhra Pradesh 2025

Settling property disputes or dividing assets? A settlement deed requires stamp duty and registration in Andhra Pradesh. In 2025, these charges remain essential to legalize agreements, whether among heirs or parties resolving conflicts.

| Settlement Type | Stamp Duty | Registration Fees |

|---|---|---|

| (i) Settlement in favour of Family Member | 2.00% | 0.5% subject to a minimum of ₹2,000 and maximum of ₹25,000 |

| (ii) Settlement in favour of person other than Family Members | 3.50% | 0.5% subject to a minimum of ₹2,000 and maximum of ₹1,00,000 |

| (iii) Settlement in favor of Government/Gram Panchayat/Municipality/Municipal Corporation/UDA/IALA | 0.00% | 0.5% subject to a minimum of ₹2,000 and maximum of ₹10,000 |

Stamp Duty and Registration Charges on Mortgage Deed in Andhra Pradesh 2025

Taking a loan against your property? Andhra Pradesh’s 2025 guidelines require stamp duty and registration for mortgage deeds. These charges, based on the loan amount, validate the lender’s claim on your asset.

| Mortgage Type | Stamp Duty | Registration Fees |

|---|---|---|

| Mortgage without Possession | 0.50% | 0.10% |

| Mortgage with Possession (in Gram Panchayath) | 2.00% | 1.60% |

| Mortgage with Possession (in other areas) | 2.00% | 0.10% |

| Deposit of Title Deeds | 0.50% (Subject to a maximum of ₹50,000) | 0.10% (Subject to a maximum of ₹10,000) |

Suggested Read: Inheritance Rights on Ancestral Property

Stamp Duty and Registration Charges on Power of Attorney in Andhra Pradesh 2025

Granting someone authority over your property? A power of attorney (POA) in Andhra Pradesh needs stamp duty and registration to be legally binding.

| Document Type | Stamp Duty | Registration Fees |

|---|---|---|

| General Power of Attorney authorising family member to sell, transfer or develop immovable property | ₹1,000 | 0.5% subject to a minimum of ₹2,000 and maximum of ₹20,000 |

| General Power of Attorney authorising agent to sell, transfer or develop immovable property outsiders (Other than family) | 1.00% | 0.5% subject to minimum of ₹5,000 and maximum of ₹1,00,000 |

| General Power of Attorney purpose other than authorising sell, transfer or develop immovable property | ||

| (a) Authorising not more than five persons | ₹50 | ₹5,000 |

| (b) Authorising more than five, but not more than ten persons | ₹75 | ₹5,000 |

| Special Power of Attorney | ₹20 | ₹3,000 |

Suggested Read: TDS on Purchase of Property

Stamp Duty and Registration Charges on Exchange Deed in Andhra Pradesh 2025

| Document Type | Stamp Duty | Registration Fees |

|---|---|---|

| Exchange (in Gram Panchayath) | 5.00% | 2.00% |

| Exchange (in other areas) | 5.00% | 0.50% |

Suggested Read: How to Transfer an Unregistered Property?

Stamp Duty and Registration Charges on Partion Deed in Andhra Pradesh 2025

Dividing family land or property? A partition deed in Andhra Pradesh requires stamp duty and registration to legally split ownership. For 2025, these charges ensure each co-owner’s share is documented, preventing conflicts down the line. Plan ahead for a hassle-free division.

| Document Type | Stamp Duty | Registration Fees |

|---|---|---|

| Partition among family members | 0.50% (subject to a maximum of ₹1,00,000/-) | ₹2,000/- |

| Partition outside family | 2.50% | 0.5% subject to a minimum of ₹2,000/- and maximum of ₹1,00,000/- |

Suggested Read: AP Land Records 2025 (Meebhoomi)

Stamp Duty and Registration Charges on Lease in Andhra Pradesh 2025

| Lease Type | Stamp Duty | Registration Fees | Chargeable Value |

|---|---|---|---|

| (a) i) For less than 1 year | 0.40% | 0.20% | On total rent |

| ii) For 1-5 years | 0.50% | 0.20% | On Average Annual Rent |

| For residential properties | 0.50% | 0.20% | On Average Annual Rent |

| In other cases | 1.00% | 0.20% | On Average Annual Rent |

| iii) For 5-10 years | 1.00% | 0.20% | On Average Annual Rent |

| For residential properties | 1.00% | 0.20% | On Average Annual Rent |

| In other cases | 2.00% | 0.20% | On Average Annual Rent |

| iv) For 10-20 years | 6.00% | 0.20% | On Average Annual Rent |

| v) For 20-30 years | 15.00% | 0.20% | On Average Annual Rent |

| vi) For more than 30 years or in perpetuity | 3.00% | 0.20% | Market Value of the property |

| (b) For fine, premium or money advanced without rent | 2.00% | 0.20% | Fine, Premium or money advanced |

| (c) For fine, premium or money advanced in addition to the rent | 2.00% | 0.20% | Fine, Premium or money advanced in addition to the duty payable on the rent |

| (d) Involving improvements, to be made over to lessor at the end | 2.00% | 0.20% | Value of improvements |

Suggested Read: RERA Charges in AP 2025

Compare Stamp Duty and Registration Charges in All States

| State/UT | Stamp Duty Charges | Registration Fees |

|---|---|---|

| Andhra Pradesh | 5.00% | 1% |

| Arunachal Pradesh | Male: 6% Female: 6% | 1% |

| Assam | Male: 6% Female: 5% | 8.5% |

| Bihar | Male: 6.3% Female: 5.7% | Male: 2.1% Female: 1.9% |

| Chhattisgarh | Male: 5% Female: 4% | 4% |

| Goa | < ₹50 Lakh: 3.5% ₹50 Lakh – ₹75 Lakh: 4.5% ₹75 Lakh – ₹1 Crore: 4.5% > ₹1 Crore: 5% > ₹5 Crore: 6% | < ₹50 Lakh: 3% ₹50 Lakh – ₹75 Lakh: 3% ₹75 Lakh – ₹1 Crore: 3.5% > ₹1 Crore: 3.5% > ₹5 Crore: 3.5% |

| Gujarat | 4.9% | Male: 1% Female: NA |

| Haryana | Urban Area: Male: 7% Female: 5% Joint Ownership: 6% Rural Area: Male: 5% Female: 3% Joint: 4% | Up to ₹50,000: ₹100 ₹50,001 – ₹5 Lakhs: ₹1,000 ₹5 Lakhs – ₹10 Lakhs: ₹5,000 ₹10 Lakhs – ₹20 Lakhs: ₹10,000. |

| Himachal Pradesh | Male: 6%, Female: 4% Male + Female: 5% | Female: <= ₹80 Lakhs: 4% > ₹80 Lakhs: 8% Male/Joint: <= ₹50 Lakhs: 6% > ₹50 Lakhs: 8% |

| Jharkhand | Male: 4% Female: 4% Male + Female: 4% | 3% |

| Karnataka | > ₹45 Lakhs: 5% ₹21 Lakhs – ₹45 Lakhs: 3% < ₹20 Lakhs: 2% | 1% |

| Kerala | 8% | 2% |

| Madhya Pradesh | 7.5% | 3% |

| Maharashtra | Urban areas: Male: 6% Female: 5% Gram Panchayat: Male: 3% Female: 2% MMRDA: Male: 4% Female: 3% | 1% |

| Manipur | 7% | 3% |

| Meghalaya | 9.90% | 1% |

| Mizoram | <= ₹10,000: ₹100 ₹10,000 < Value <= ₹5,00,000: ₹200 > ₹5,00,000: ₹500 | 1% |

| Nagaland | 8.25% | Unspecified |

| Odisha | Male: 5% Female: 4% Joint ownership (Male + Female): 4% Joint (Male + Male): 5% Joint (Female + Female): 4% | 2% |

| Punjab | Female: 5% Male: 7% Joint (Male + Female): 6% Joint (Male + Male): 7% Joint (Female + Female): 5% | 1% |

| Rajasthan | Men: 6% Women: 5% | Men: 1% Women: 1% |

| Sikkim | Sikkimese origin: 5% For others: 10% | Sikkimese origin: ₹50,000 For others: ₹1,00,000 |

| Tamil Nadu | General: 7% Female (For properties valued up to ₹10 Lakhs): 3% | 4% |

| Telangana | 4% | 0.5% |

| Tripura | 5% | 1% |

| Uttar Pradesh | Female/Joint (Female + Female): 6% Male/Joint (Male + Male): 7% Joint (Female + Male): 6.5% | Female/Joint (Female + Female): 1% Male/Joint (Male + Male): 1% Joint (Female + Male): 1% |

| Uttarakhand | Male: 5% Female: 3.75% Joint (Male + Female): 4.37% Joint (Male + Male): 5% Joint (Female + Female): 3.75% | 2% |

| West Bengal | Corporation Area/ Municipal: Below ₹1 Crore: 6% Above ₹1 Crore: 7% Other Areas: Below ₹1 Crore: 5% Above ₹1 Crore: 6% | 1% |

| Andaman and Nicobar Islands | 5% | 2% |

| Chandigarh | 6% | 1% |

| Dadra and Nagar Haveli and Daman and Diu | Female: 4% Male: 6% Joint ownership (Male and Female): 5% | Female: Nil Male: 0.5% Joint (Male and Female): 0.25% |

| Delhi (National Capital Territory of Delhi) | Male: 6% Female: 4% Joint (Male + Female): 5% | 1% |

| Jammu and Kashmir | Female: 3% Male: 7% Joint (Male + Female): 7% Joint (Female + Female): 5% Joint (Male + Male): 7% | 1.20% |

| Ladakh | Female: 3% Male: 7% Joint(Male and Female): 7% Joint (Female and Female): 5% Joint (Male and Male): 7% | 1.20% |

| Lakshadweep | Female: 6% Joint(Female + Male): 7% Others: 8% | Not specified |

| Puducherry | 10% | 0.50% |

How to Calculate Stamp Duty and Registration Charges in Andhra Pradesh?

Calculating stamp duty and registration charges in Andhra Pradesh involves a clear process based on property value and fixed rates.

How to?

- Determine the Property Value: You need to first determine the market value or the government-assessed rate of the property. Use the higher value between the two to calculate the stamp duty and registration charges.

- Apply Stamp Duty Rates: In Andhra Pradesh, the stamp duty rate for a sale deed is 5.50% of the property’s market value or the agreed sale value (whichever is higher).

- Apply Registration Charges: The registration charges are 0.50% of the property’s value. This charge is applicable to most property transactions in the state.

Example Calculation

Let’s take a property worth ₹50,00,000 as an example to illustrate the calculation process.

| Component | Calculation | Amount (₹) |

|---|---|---|

| Stamp Duty | 50,00,000 × 5.5% | 2,75,000 |

| Registration Charges | 50,00,000 × 0.5% | 25,000 |

| Total | 2,75,000 + 25,000 | 3,00,000 |

Suggested Read: How to Identitfy Illegally Constructed Buildings?

How to Pay Stamp Duty in Andhra Pradesh Online?

Paying stamp duty online in Andhra Pradesh is quick and secure via the AP Stamps and Registration portal. Simply upload property details, calculate the duty (5.5% of property value), and pay via net banking/UPI. A digital stamp certificate is generated instantly for legal validity.

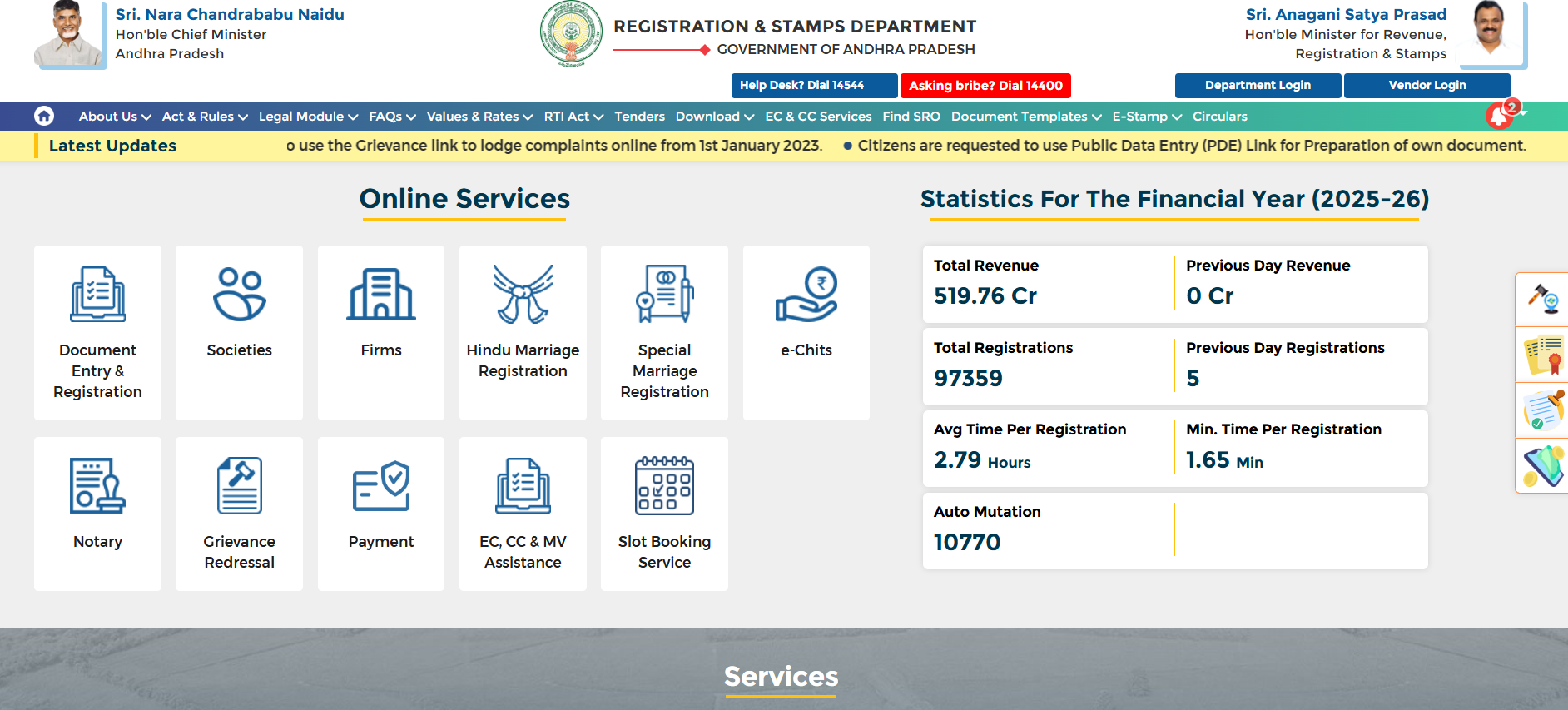

- Visit the official REGISTRATION & STAMPS DEPARTMENT GOVERNMENT OF ANDHRA PRADESH.

- Under “Online Services” click on “Payments”

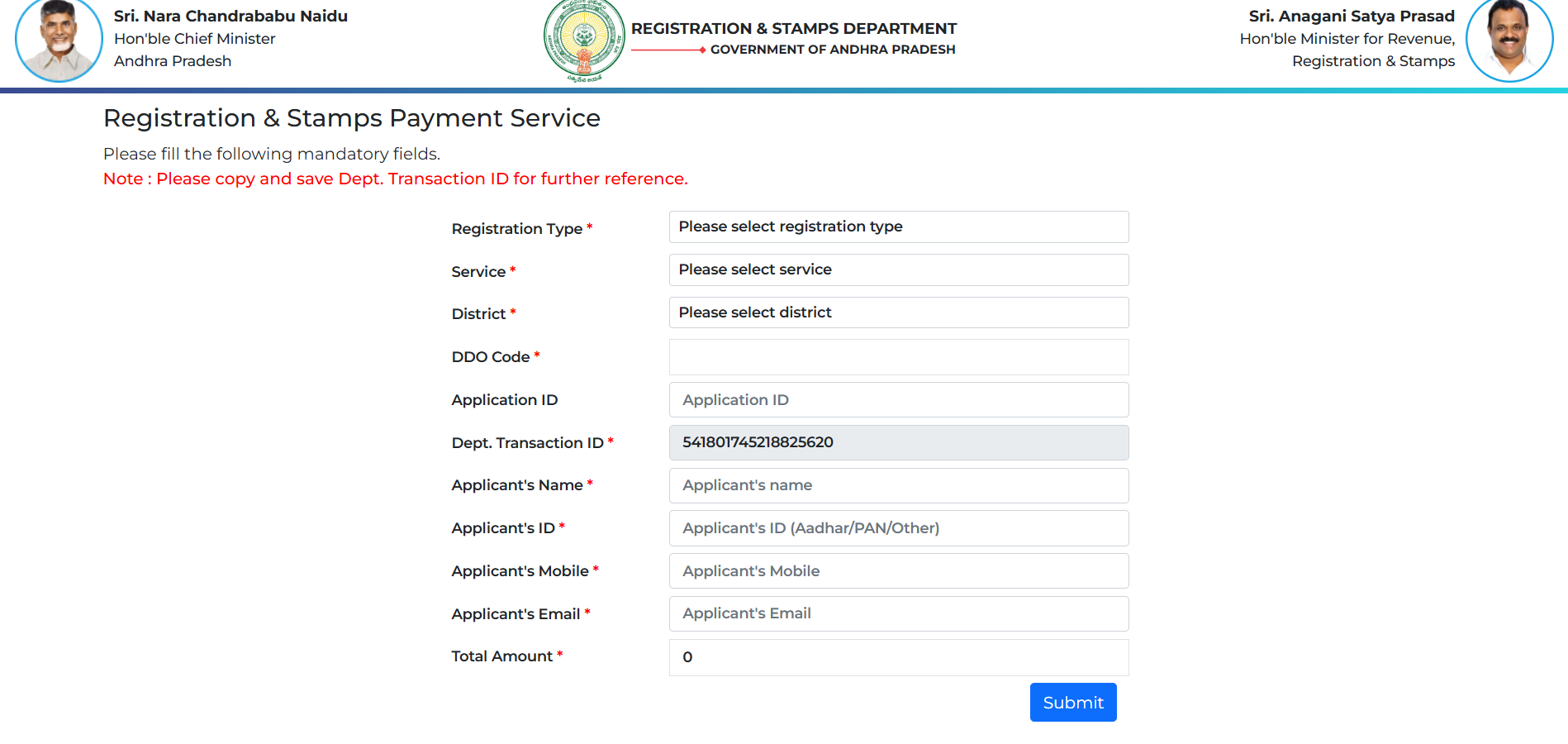

- Fill out the application form with the required details and click on Submit.

- The browser will be redirected to the payment page.

- Make the payment and save the receipt PDF for future reference.

Suggested Read: Top 5 Banks for Home Loans in India 2025

How to Pay Stamp Duty in Andhra Pradesh via SHCIL?

The Stock Holding Corporation of India Limited (SHCIL) offers a government-approved e-stamping service.

- Visit the official SHCIL website at for Andhra Pradesh stamp duty online payment.

- Click the Login button at the top right and enter your username and password.

- After logging in, enter the property details and proceed to make the payment via online banking, NEFT, or Debit/Credit Card.

- You can also download the list of SHCIL branches and Sub-registrar offices in Andhra Pradesh.

Suggested Read: Cost of Living in Hyderabad 2025

How to Register Your Property in Andhra Pradesh?

After paying stamp duty, visit the nearest Sub-Registrar Office (or use the IGRS AP portal) to register your property.

| Step | Description |

|---|---|

| 1. Check Market Rates | Verify the market rate of the property. |

| 2. Compare Rates | Compare the market rate with the circle rate. The higher value is used for stamp duty calculation. Purchase non-judicial stamps accordingly. |

| 3. Visit Sub-Registrar’s Office | Collect all necessary documents and visit the sub-registrar’s office with all parties involved. The SRO officer will generate a check slip from the Public Data Entry System. |

| 4. E-KYC and Fingerprint Collection | The officer will complete E-KYC and collect the parties’ fingerprints, which will be verified with the Aadhaar database. |

| 5. Payment of Fees | After successful Aadhaar verification, pay the stamp duty, registration fees, and any other charges. The Registrar will print and register the document with all signatures and thumb impressions. |

| 6. Document Scanning | The registered document is scanned and uploaded to a server, where the customer can access it via the portal. |

| 7. Reapply if Verification Fails | If verification is unsuccessful, make the necessary corrections and apply again. |

Suggested Read: How to Calculate Agricultural Land Area?

How to Pay Stamp Duty and Registration Charges Offline in Andhra Pradesh?

You can pay the stamp duty directly at the Sub-Registrar’s office when you register the property document.

- Prepare Documents: Ensure all required documents are ready for registration.

- Visit the Sub-Registrar’s Office: Go to the office with the documents and two witnesses.

- Fill Payment Form: Complete the payment form with transaction details.

- Make Payment: Pay the stamp duty and registration charges using cash, demand draft, or cheque.

- Obtain Receipt: Collect the receipt as proof of payment.

Suggested Read: Plot vs. Apartment vs. Villa

Stamp Duty Exemptions in Andhra Pradesh 2025

Stamp duty and registration fee exemptions are granted for land used to develop solar projects in Andhra Pradesh.

How to Claim Refund of Stamp Duty Paid in Andhra Pradesh?

Refunds for stamp duty paid can be claimed within six months of payment through a challan. A 10% deduction from the gross stamp duty will apply.

Process for Claiming Refund:

- Submit Request: The applicant must submit a request for a refund to the Sub-Registrar.

- Required Documents: Include the challan and original receipt from the specified bank.

- Verification: The Sub-Registrar will verify the validity of the challan and check that the receipt has not been used.

- Certification: After verification, the Sub-Registrar will issue a certificate.

- Refund Process: Upon receiving the certificate, the refund will be processed, deducting 10% of the total stamp duty.

Refund applications must be made to the District Collector, Sub-Collector, Deputy Collector, R.D.O., or Tahsildar as per Section 2(9) of the I.S. Act.

Suggested Read: What is Undivided Share of Land?

Types of Encumbrance Certificates (EC) for Stamp Duty and Registration in Andhra Pradesh

There are two types of Encumbrance Certificates (EC) issued for stamp duty and registration in Andhra Pradesh:

Form No. 15

- Purpose: Issued when property transactions such as mortgage, sale, and other deeds are registered with the Sub-Registrar in Andhra Pradesh.

- Details Included: Provides a record of all property transactions in the owner’s name for a specific period, including sales, gifts, mortgages, leases, releases, and partitions.

Form No. 16

- Purpose: Also known as the Non-Encumbrance Certificate (NEC), issued by the government.

- Details Included: Confirms that there are no recorded transactions or liabilities related to the property, meaning the property is free from any encumbrances.

Suggested Read: What to do if Builder Delays the Possession Date?

Tax Benefits of Paying Stamp Duty

Paying stamp duty on property transactions in India comes with several tax benefits that can help reduce the overall tax burden. Here are the key advantages:

- Stamp duty and registration charges paid for the purchase of a property are eligible for deductions under Section 80C of the Income Tax Act, 1961.

- You can deduct up to ₹1.5 lakh for stamp duty and registration charges in a financial year if you pay them for purchasing a residential property.

- This deduction applies to both self-occupied and rented properties, as long as you pay the stamp duty during the assessment year.

Suggested Read: Home Loan Insurance Tax Benefits

Factors Affecting Stamp Duty and Registration Charges in Andhra Pradesh

- Property Value: Charges are based on the market or transaction value, whichever is higher.

- Property Type: Residential, commercial, and agricultural properties have different rates.

- Location of the Property: Rates vary between urban and rural areas.

- Gender of the Owner: Female buyers may receive a reduced stamp duty rate.

- Age of the Property: Older properties may have different valuation methods affecting charges.

- Exemption or Concessions: Certain properties may qualify for reduced rates or exemptions.

- Age of the Buyer: Senior citizens may receive concessions for residential properties.

- Transfer Type: Sale, gift, or inheritance transfers attract different rates.

- Government Policies: Changes in policies can impact stamp duty rates and charges.

- Additional Charges: Includes legal documentation, verification, and service fees.

Suggested Read: How to Change Name in Land Registry or Property Documents?

Secure the Lowest Home Loan Interest Rates with Credit Dharma

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

The registration charges in Andhra Pradesh are a percentage of the property’s market or consideration value:

Gram Panchayat Sale Deed: 2.00%

Sale Deed (Other Areas): 0.50%

Sale Agreement with Possession: 0.50% (Minimum ₹1,000, Maximum ₹50,000)

Agreement of Sale cum GPA: 0.50% (Minimum ₹5,000, Maximum ₹1,00,000)

The current stamp duty rates on sale deed in Andhra Pradesh are 5.50% of the property’s market value.

Stamp Duty: 5.50% of the flat’s market value.

Registration Fee: 0.50% of the flat’s market value.

The Ready Reckoner Rate (RRR), set by the Andhra Pradesh government, determines the minimum market value of a property.

You can check the RRR on the IGRS portal.

The stamp duty is calculated based on the property’s market value, which is determined by the Ready Reckoner Rate or the actual transaction value, whichever is higher.

Draft the GPA document.

Visit the nearest Sub-Registrar office with the document and required identification.

Pay the applicable stamp duty and registration fees.

The GPA will be registered, and a certified copy will be issued.

Yes, effective February 1, 2025, the Andhra Pradesh government increased property registration charges by 0% to 20%, depending on the property’s location.

Property tax receipt

Aadhaar card

Passport-sized photographs of both buyer and seller

Original sale deed (certified copy)

Voter ID or passport

Latest property register card issued by the City Survey Department

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan