Life doesn’t wait. Neither should your finances. Whether it’s a startup idea, a home makeover, or an urgent bill, Bajaj Housing Finance’s Loan Against Property has your back. Up to ₹5 Crore at 9.40% p.a., repayable over 17 years. Your property stays yours—no strings attached. Quick, hassle-free, and zero asset loss.

Bajaj Housing Finance Loan Against Property Highlights

| Category | Details |

|---|---|

| Rate of Interest | 9.40% p.a. onwards |

| Loan Amount | Up to ₹5 Crore |

| Tenure | 17 Years |

| Processing Fees | Up to 4% of loan amount + GST |

Bajaj Housing Finance Loan Against Property Interest Rates 2025

In 2025, your property isn’t just a home—it’s your financial leverage. Bajaj Housing Finance offers interest rates starting at 9.40% p.a. , letting you unlock your dreams, emergencies, or growth.

Salaried and Self Employed Professional Borrowers

| Loan Type | Effective ROI (p.a.) |

|---|---|

| Loan Against Property | 9.40%* to 18.00%* |

| Loan Against Property Balance Transfer | 9.40%* to 18.00%* |

Self Employed Non-Professional Borrowers

| Loan Type | Effective ROI (p.a.) |

|---|---|

| Loan Against Property | 9.40%* to 18.00%* |

| Loan Against Property Balance Transfer | 9.40%* to 18.00%* |

Calculate: Your LAP EMIs if you take a loan from Bajaj Housing Finance.

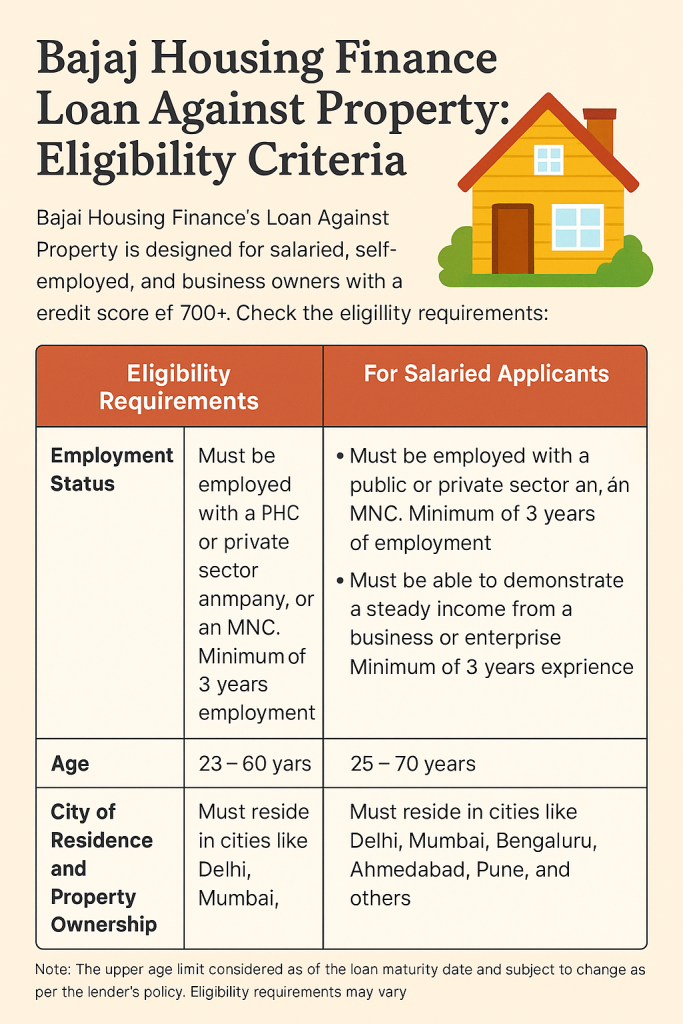

Bajaj Housing Finance Loan Against Property: Eligibility Criteria

Bajaj Housing Finance’s Loan Against Property is designed for salaried, self-employed, and business owners with a credit score of 700+. Check the eligibility requirements:

| Eligibility Requirements | For Salaried Applicants | For Self-Employed Applicants |

|---|---|---|

| Employment Status | Must be employed with a public or private sector company, or an MNC.Minimum of 3 years of experience. | Must be able to demonstrate a steady income from a business or enterprise.Minimum of 3 years of operation. |

| Age | 23 – 60 years | 23 – 70 years |

| City of Residence and Property Ownership | Must reside in cities like Delhi, Mumbai, Bengaluru, Ahmedabad, Pune, and others. | Must reside in cities like Delhi, Mumbai, Bengaluru, Ahmedabad, Pune, and others. |

The upper age limit is considered as of the loan maturity date and is subject to change based on property profile.

Eligibility requirements may vary and include additional criteria.

Bajaj Housing Finance Loan Against Property: Processing Fees

| Fees Category | Charges Applicable |

|---|---|

| Processing Fees | Up to 4% of loan amount + GST |

Bajaj Housing Finance Loan Against Property: Other Fees and Charges

| Nature of Fee/ Charge | Payable At | Amount |

|---|---|---|

| Expenses to cover costs | On incurring expenses | As applicable |

| Statutory Charges | Once | Applicable as per state laws |

| Switch to Lower Rate | On Rate revision | Up to 2% of principal outstanding + GST as applicable |

| Switch in Interest Computation (e.g., From BHFL FRR to Repo Rate and vice-versa) | On Interest Computation change | Up to 2% of principal outstanding + GST as applicable |

| Mortgage Origination Fees (MOF) – for secured loans | At Application | Up to Rs. 10,000 + GST as applicable |

| Cheque Swap charges | At request | As per expenses incurred |

| Security Swap charges | At request | As per expenses incurred |

| Fees on account of External / Legal / Technical Opinion | On incurring expenses | As per expenses incurred |

| Reappraisal of loan after 6 months from sanction | At re-application | Mortgage Origination Fees as applicable |

| Hard Copy of Statement of Account | Per request | Up to Rs. 500 per request + GST as applicable |

| Conversion of existing loan to new product (Term loan/ Flexi Term loan/ Flexi Hybrid loan) | On Conversion | Up to 2% of principal outstanding + GST as applicable |

| Conversion charges for switching from Fixed rate loan to Floating rate loan | On Conversion | For Term Loans: Up to 3% + GST as applicable on principal outstanding and undisbursed amount (if any) |

| Conversion charges for switching from Floating rate loan to Fixed rate loan | On Conversion | For Term Loans: Up to 1% + GST as applicable on principal outstanding and undisbursed amount (if any) |

| Flexi Annual Maintenance Charge – Flexi Hybrid Loan | Annual Charge | Up to 1% of the Sanctioned amount during Flexi Interest Only Loan Repayment Tenure + GST |

| Flexi Annual Maintenance Charge – Flexi Term Loan | Annual Charge | Up to 1% of the available Flexi Loan Limit + GST as applicable |

| CERSAI Charges (for Secured Loans) | At application | As per charges levied by CERSAI + GST as applicable |

| Fees for Photocopy of Title Documents (for secured loans) | At request | Minimum fee of Rs. 500/- for up to 30 pages, Rs. 3/- for each additional page + GST as applicable |

| Document Retrieval Charges on Closed Loans (Re-vaulting Charges) | At request | A charge of Rs. 1000 (including GST) if original documents are not collected within 15 days after loan closure |

| Penal Charges | As per terms | Bounce Charges for EMI bounce; Late Payment Charges calculated daily for each unpaid EMI |

Pre-Payment Charges

| Floating Rate Loans | Term Loan | Flexi Term Loan | Flexi Hybrid Loan |

|---|---|---|---|

| Part Prepayment Charges | Nil | Nil | Nil |

| Full Prepayment Charges | Nil | Nil | Nil |

| Fixed Rate Loans | Term Loan | Flexi Term Loan | Flexi Hybrid Loan |

|---|---|---|---|

| Part Prepayment Charges | 2% on Part Payment | Nil | Nil |

| Full Prepayment Charges | 4% on Principal Outstanding | 4% on the available Flexi Loan Limit | 4% on Sanctioned Amount during Flexi Interest Only Loan Repayment Tenure 4% on the available Flexi Loan Limit during Flexi Term Loan Tenure |

Bajaj Housing Finance Loan Against Property Documents Required

| Category | For Salaried Applicants | For Self-Employed Applicants |

|---|---|---|

| Proof of Identity and Address | Aadhaar Card, Voter ID, Passport, Driving License, Utility Bills, or any other government-approved photo identity/address proof | Identity and address proof are the same for both self-employed and salaried applicants |

| Mandatory Documents | PAN Card or Form 60 | PAN Card or Form 60 |

| Proof of Employment | Identity card issued by the employer | Document of business ownership, such as partnership agreement, and registration certificate |

| Proof of Income | Latest salary slips, bank account statement for the last 3 months, Income Tax Returns | Latest salary slips, bank account statement for the last 3 months, Income Tax Returns |

| Property Documents | Copy of documents of the property to be mortgaged, Title documents as required by the legal team | Same as for salaried applicants |

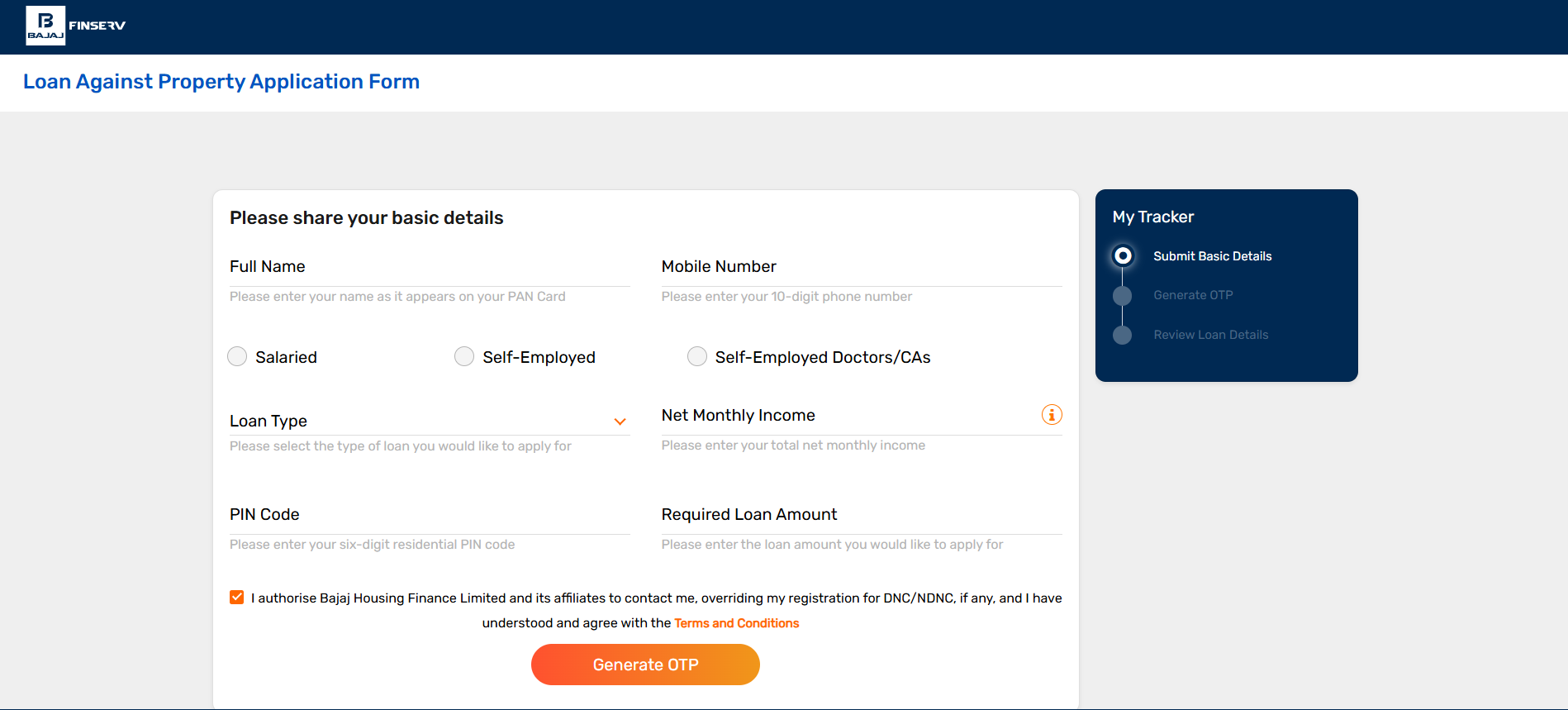

How to Apply for Bajaj Housing Finance Loan Against Property?

Time needed: 2 minutes

Step-by-step application process for a home loan from Bajaj Housing Finance:

- Access the Application Form

Visit the Bajaj Housing Finance Loan Against Property application page and fill in personal details (name, contact number, employment type).

- Specify Loan Details

Select the loan type and enter your net income to tailor offers based on your financial profile.

- Enter Loan Amount & PIN

Input the desired loan amount and your PIN code.

- Verify OTP & Complete Details

After receiving the OTP, proceed to submit financial statements and property-related information.

- Submit Application

Click “Submit” to finalize your application.

Next Steps: A Bajaj representative will contact you within 24 hours to assist with document submission and verification.

Compare Top Banks Loan Against Property Interest Rates

Comparing loan against property interest rates from leading banks helps you identify affordable financing options. Get a clearer view of each lender’s terms and choose the best home loan that matches your budget and financial goals.

| Banks/ NBFCs | Rate of Interest | Maximum Loan Amount |

|---|---|---|

| SBI | 10.60% p.a. – 11.30% p.a. | Rs. 7.5 Crore |

| HDFC | 9.50% p.a. – 11.00% p.a. | 65% of the market value of the property |

| IDFC | 9.25% p.a. onwards | 50% – 70% of the market value of the property |

| Tata Capital | 14.25% p.a. onwards | Depending on the market value of the property |

| Axis Bank | 10.50% p.a. – 10.90% p.a. | Rs. 5 Crore |

| Kotak Mahindra Bank | 9.50% p.a. onwards | Rs. 5 Crore |

| Bank of India | 10.10% p.a. Per lakh | Rs. 5 Crore |

| LIC Housing Finance | 9.70% p.a. – 11.55% p.a. | Rs. 2 lakhs onwards |

| PNB Housing Finance | 9.24% p.a. – 12.75% p.a. | 70% of the market value of the property |

| ICICI Bank | 10.85% p.a. – 12.50% p.a. | 75% of the market value of the property |

Conclusion

Taking a loan against property is a big step. Putting your property as collateral can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

As of April 2025, headline rates start at 9.40 % p.a. for both salaried and self‑employed applicants, with the final quote tied to your credit score, income, and property type.

Eligible borrowers can access up to ₹5 crore—or more—subject to roughly 70‑75 % of the property’s market value and their repayment capacity.

You may stretch EMIs for up to 17 years, or pick a shorter term if you want to save on total interest.

Bajaj levies a one‑time processing fee of up to 4 % of the sanctioned amount, plus GST. Other charges—bounce fees, statement fees, legal evaluation—apply only if triggered.

. Salaried applicants aged 23‑60 years and self‑employed applicants aged 23‑70 years (at loan maturity) with stable income and clean credit can apply.

You can pledge residential or commercial property—even opt for lease‑rental discounting—so long as the title is clear and the valuation stacks up.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan