Planning to build your dream home or renovate your existing space? We’re here to make that journey simpler for you. With ICICI Bank Home Construction Loans, you can raise funds to buy a plot and build your house on it, or even construct on land you already own.

With a goal is to support your vision by providing a loan solution that’s flexible, easy to manage, and designed around your unique needs. Whether you’re a first-time builder or upgrading your current property, ICICI Bank’s Home Construction Loan is the financial partner you can trust to make your home a reality.

ICICI Bank Home Construction Loan Highlights

Here’s a quick overview of the key features—interest rates, loan amounts, and fees—so you can decide if the home loan is the right choice for you.

| Category | Highlights |

|---|---|

| Interest Rates | 9.25% p.a. onwards |

| Maximum Loan Amount | ₹5 Crore |

| Maximum Tenure | 30 years |

| Processing Fees | Up to 2% of the loan amount |

Suggested Read: ICICI Bank Home Loan Interest Rates 2025

ICICI Bank Home Construction Loan Interest Rates

Check out the interest rates for home loan in 2025 to get an idea of your potential EMI and costs.

| Loan Amount | Salaried Customers | Self-Employed Customers |

|---|---|---|

| Up to ₹35 lakhs | 9.25% – 9.65% | 9.40% – 9.80% |

| ₹35 lakhs to ₹75 lakhs | 9.50% – 9.80% | 9.65% – 9.95% |

| Above ₹75 lakhs | 9.60% – 9.90% | 9.75% – 10.05% |

Suggested Read: ICICI Bank Home Loan Customer Care

ICICI Bank Home Construction Loan Eligibility Criteria

Find out the basic eligibility requirements, such as age, income, and existing home loan status, before applying for a home loan.

| Criterion | Details |

|---|---|

| Profession | – Both salaried and self-employed individuals can apply for a Home Loan |

| Income | – Salaried: Minimum monthly salary of ₹25,000 – Self-Employed: Minimum monthly income of ₹30,000 |

| Age | – Between 21 and 70 years |

| Loan Amount | – No upper limit; loan sanction depends on eligibility – You can apply online for loans up to ₹5 crore |

| Nationality | – Must be an Indian citizen |

Suggested Read: ICICI Bank Home Loan Balance Transfer

ICICI Bank Home Construction Loan Processing Fees

Understand the processing fees involved so you can factor them into your overall cost when opting for a home loan.

| Product | Processing Fees |

|---|---|

| Step Up Home Loan | 2% of the loan |

Suggested Read: ICICI Bank Home Loan Moratorium

ICICI Bank Home Construction Loan Other Fees and Charges

Be aware of any extra charges, such as prepayment penalties or overdue fees, that may apply to your home loan.

| Charge Type | Details |

|---|---|

| Loan Processing Charges | Up to 2% of loan amount (non-refundable) |

| Administrative Charges | 0.25% of loan amount or ₹5,000 (whichever is lower, non-refundable) |

| Commitment Charges (Overdraft) | 0.5% on shortfall if <30% utilization (quarterly avg.) – Not for salaried customers |

| Part Prepayment Fees | Nil |

| Prepayment Charges (Fixed Rate) | 2% on home loans, 4% on non-home loans (exceptions: PSL, small/micro, loans ≤ ₹50L) |

| Prepayment Charges (Floating Rate) | Nil for home loans, 2%-4% for others (based on purpose/borrower type) |

| Conversion Charges | ₹3,000 for floating-to-fixed 2% for fixed-to-floating 0.5% for overdraft |

| Cheque/ECS Dishonor Charges | ₹500 per instance |

| Cheque/Repayment Swap Charges | ₹500 |

| Penal Charges (Delay/Default) | 5% p.a. on overdue sum + taxes |

| Amortisation Schedule | ₹200 (physical copy) |

| Statement of Account | ₹200 (physical copy) |

| Prepayment Statement | ₹200 (physical copy) |

| Duplicate NOC/No Dues | ₹250 |

| Revalidation of NOC | ₹250 |

| Non-submission of Documents | ₹5,000 per month (from due date till submission) |

| Non-collection of Property Docs (post 60 days) | ₹1,000 per month |

| Construction Delay (Land Loan) | 1% p.a. on principal or ₹50,000 (whichever is lower) after 4 years from 1st disbursal |

| Overdraft Renewal Fees | ₹5,000 (not applicable for Money Saver & Insta OD) |

| Loan/Property Document Retrieval | ₹500 |

| Cash EMI Payment at Branch | ₹100 |

| Information Utility (Corporate Cases) | ₹300 |

| CERSAI Charges | ₹50 (loan ≤₹5L) ₹100 (loan >₹5L) |

| Auction, Legal, SARFAESI, Enforcement, Ads, Professional, Repossession, Security | At actuals |

| Non-maintenance of Payment Mode | ₹800 |

Suggested Read: ICICI Bank Home Loan Overdraft

ICICI Bank Home Construction Loan Documents Required

Ensure you have all the necessary documents ready, from identity proof to income statements, to make the home loan application process smooth.

Identity Proof

| Criterion | Details |

|---|---|

| Identity & Address Proof | Aadhaar/Passport/Driving License/Voter ID/NREGA Card/Letter from NPR containing name & address |

| Date of Birth Proof | Passport/Driving License/Voter ID/NREGA Card/Letter from NPR containing name & address |

Income Proof

| Category | Documents Required |

|---|---|

| Salaried Individuals | Latest Form 16 Latest 1-month Salary Slip Last 6 months’ Bank Statements |

| Self-Employed Individuals | Last 6 months’ Bank Statements (all operative accounts) Last 2 years CA Certified/Audited ITRs with Computation of Income P&L Statement Balance Sheet GST Returns for the last 1 year |

Suggested Read: ICICI Bank Home Loan Statement Download

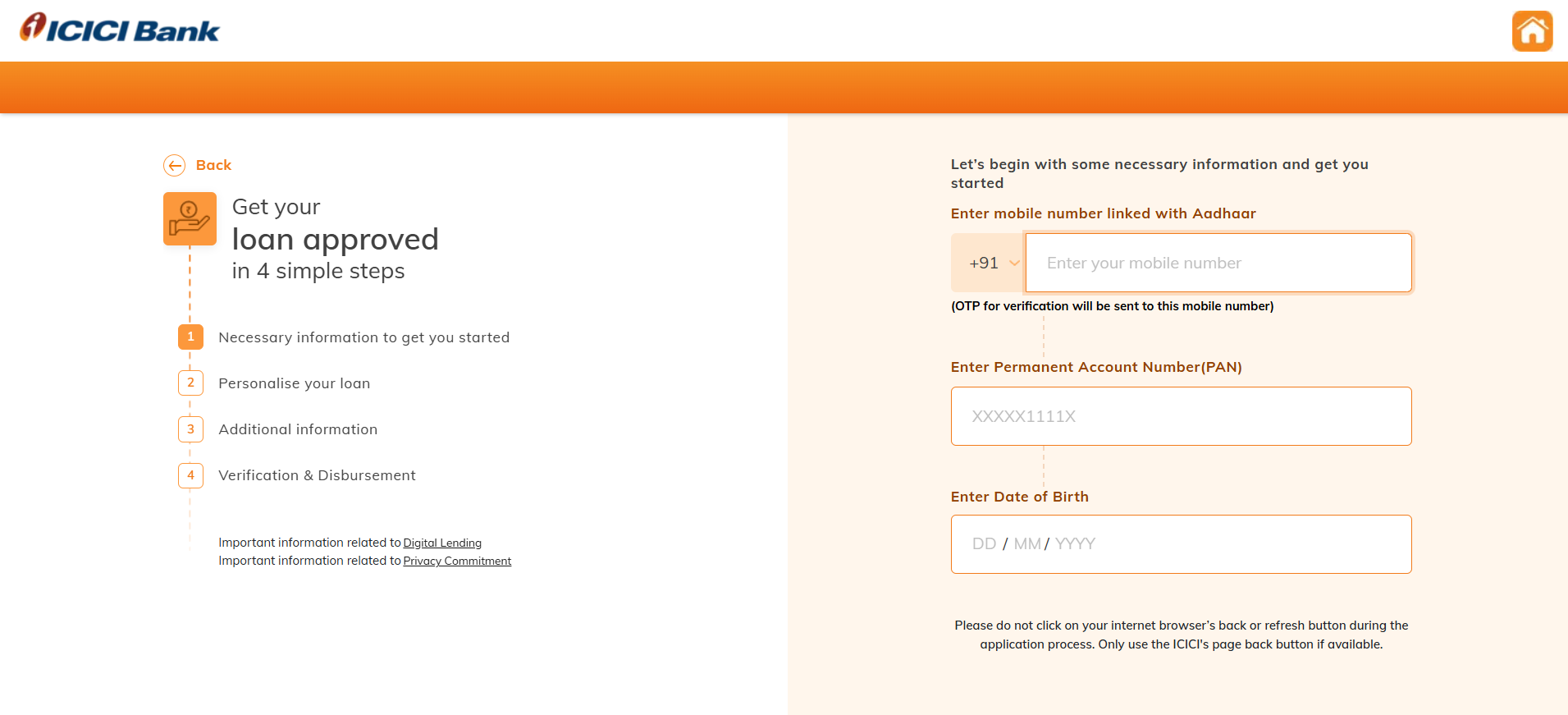

How to Apply for ICICI Bank Home Construction Loan?

The application process is easy—simply fill in your details, upload the required documents, and get started on your loan.

- Visit the official ICICI Bank website.

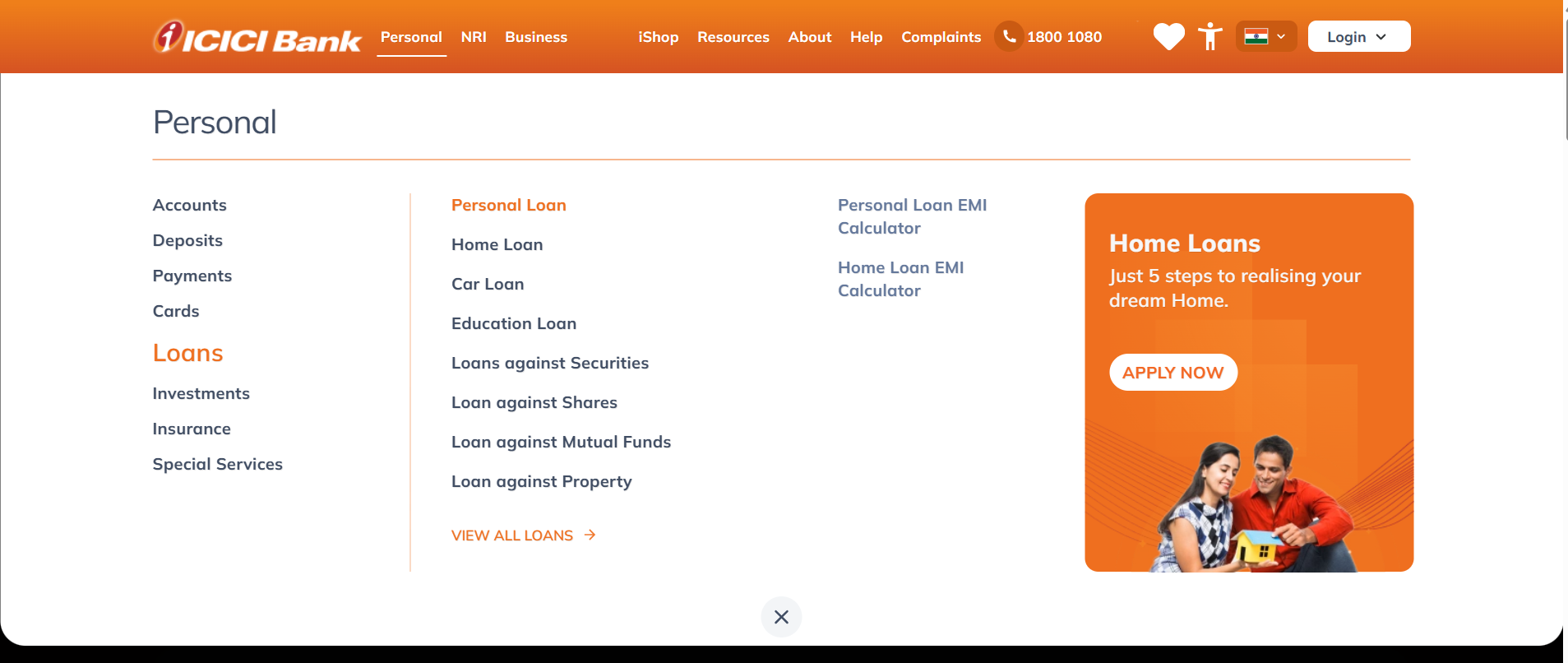

- From the top dashboard, click on Personal. Select Loans > Home Loan.

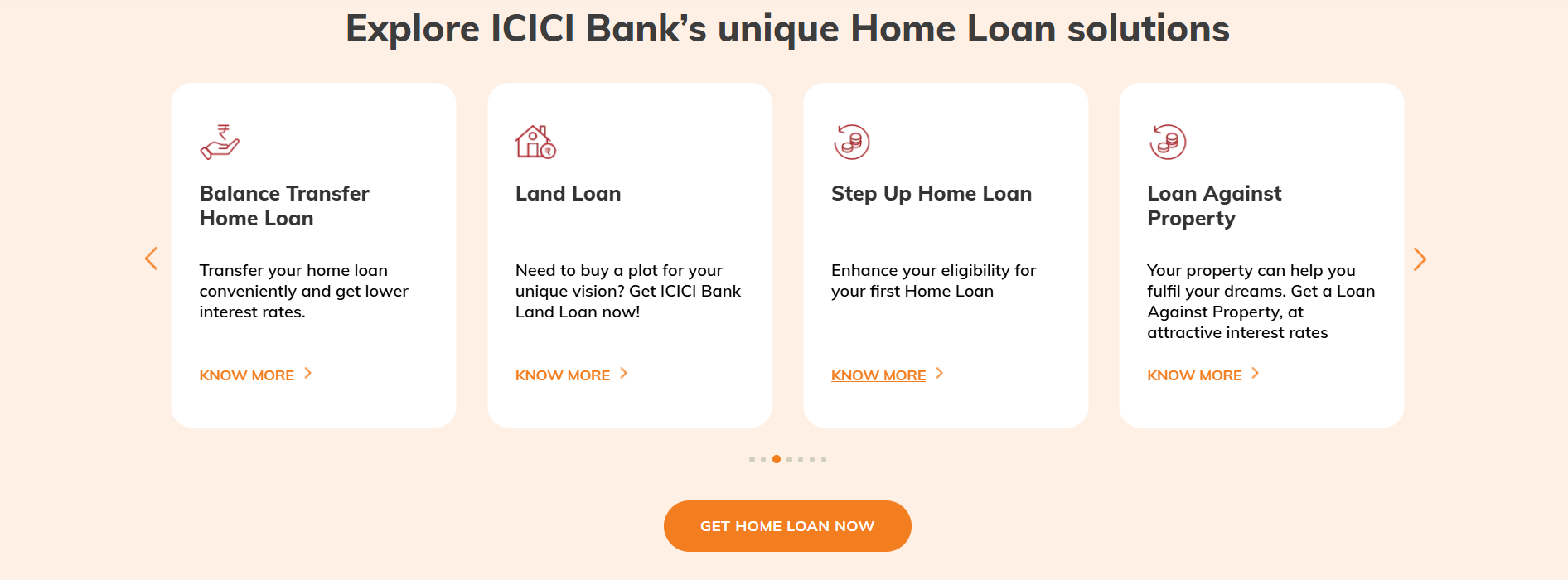

- Scroll down and click Apply Now under Home Construction Loan.

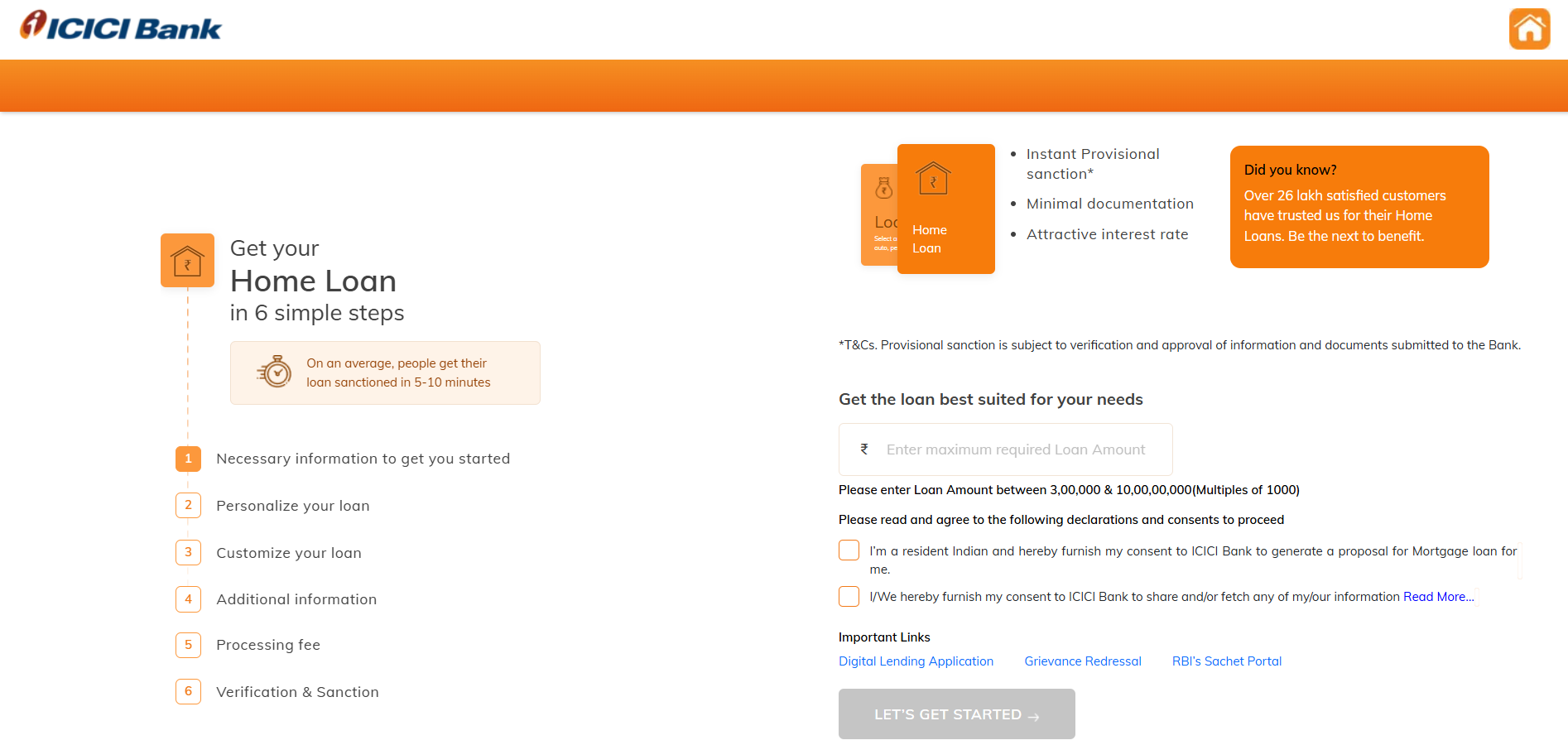

- Enter the required loan amount and accept the Terms and Conditions.

- Enter your mobile number, PAN, and date of birth.

- Enter your Aadhaar Card details. Complete the OTP verification by entering the OTP sent to your registered mobile number.

- Enter your official name as per records. Provide your employment details, including:

Type of work (Salaried/Self-employed)

Organization name

Official email ID - Enter your place of birth, purpose of the loan, religion, and category (General/SC/ST/OBC/Other).

- Complete the eNACH process and verify with OTP.

- A video KYC will be scheduled as part of the verification process.

- Once all the steps are completed, the provisionally approved loan amount will be displayed on the screen.

Compare Top Banks Home Construction Loan Interest Rates

Explore home loan offers from different banks to find the best deal that fits your needs.

| Bank/ NBFCs | Interest Rates |

|---|---|

| SBI | 8.00% p.a. onwards |

| ICICI | 9.25% p.a. onwards |

| LIC Housing Finance | 8.20% p.a. onwards |

| IDFC First | 8.85% p.a. onwards |

| PNB Housing Finance | 9.75% p.a. onwards |

| HDFC Bank | 8.50% p.a. onwards |

Conclusion

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer

Frequently Asked Questions

Yes! You can take a Land Loan to purchase a plot even if you don’t have approved construction plans yet. Once the land is purchased, you can obtain the necessary approvals and estimates for your construction project.

No, Land Loans do not qualify for income tax benefits. Tax deductions are available only on Home Loans that are used for the construction or purchase of a house.

Yes, there is! You’ll need to complete the construction of the property within 2 years from the date the Land Loan is disbursed.

No, Land Loans are strictly for residential self-use. However, if you’re a self-employed customer looking to purchase or build on a commercial or industrial plot, ICICI Bank offers a separate loan product tailored for that purpose.

No, Land Loans are meant for individuals constructing one residential unit for personal use. Builders or developers constructing multiple units for sale are not eligible for a Land Loan.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan