For many NRIs, the idea of “home” is split between two time zones: weekday routines abroad and memories of festivals back in India. Buying property becomes a way to stitch those worlds together, yet coordinating paperwork, local regulations, and large remittances can feel daunting from thousands of miles away.

ICICI Bank’s NRI Home Loan is structured to work with digital submissions and abroad-based income proofs, keeping you from chasing stamps at a local branch during precious vacation days.

ICICI Bank NRI Home Loan Highlights

Here’s a quick overview of the key features—interest rates, loan amounts, and fees—so you can decide if the home loan is the right choice for you.

| Category | Highlights |

|---|---|

| Interest Rates | 9.00% p.a. onwards |

| Maximum Loan Amount | Contact the bank |

| Maximum Tenure | 30 years |

| Processing Fees | 2% of the loan |

Suggested Read: ICICI Bank Home Loan Interest Rates 2025

ICICI Bank NRI Home Loan Interest Rates

Check out the interest rates for home loan in 2025 to get an idea of your potential EMI and costs.

| Credit Score | Salaried | Self-Employed |

|---|---|---|

| 800 | 9.00% | 9.00% |

| 750 – 800 | 9.00% | 9.10% |

Suggested Read: ICICI Bank Home Loan Customer Care

ICICI Bank NRI Home Loan Eligibility Criteria

Find out the basic eligibility requirements, such as age, income, and existing home loan status, before applying for a home loan.

| Criteria | Details |

|---|---|

| Age | Minimum: 21 years Maximum: 65 years or retirement age at loan maturity |

| Eligible Profiles | Salaried: Minimum 1 year of employment overseas Self-employed: Minimum 3 years in current business overseas |

| Tenure | Home Loan: 30 years Home Improvement Loan: 15 years Land Loan: 20 years |

| Minimum Income | Depends on country/type of employment: – Merchant Navy: USD 24,000 per annum – Gulf Cooperation Council (GCC) countries: AED 84,000 per annum – USA and others: USD 42,000 per annum |

Suggested Read: Can NRIs Buy Agricultural Land in India?

ICICI Bank NRI Home Loan Processing Fees

Understand the processing fees involved so you can factor them into your overall cost when opting for a home loan.

| Product | Processing Fees |

|---|---|

| NRI Home Loan | 2% of the loan |

Suggested Read: Rules for NRI Real Estate Investment in India

ICICI Bank NRI Home Loan Other Fees and Charges

Be aware of any extra charges, such as prepayment penalties or overdue fees, that may apply to your home loan.

| Charge Type | Details |

|---|---|

| Loan Processing Charges | Up to 2% of loan amount (non-refundable) |

| Administrative Charges | 0.25% of loan amount or ₹5,000 (whichever is lower, non-refundable) |

| Commitment Charges (Overdraft) | 0.5% on shortfall if <30% utilization (quarterly avg.) – Not for salaried customers |

| Part Prepayment Fees | Nil |

| Prepayment Charges (Fixed Rate) | 2% on home loans, 4% on non-home loans (exceptions: PSL, small/micro, loans ≤ ₹50L) |

| Prepayment Charges (Floating Rate) | Nil for home loans, 2%-4% for others (based on purpose/borrower type) |

| Conversion Charges | ₹3,000 for floating-to-fixed 2% for fixed-to-floating 0.5% for overdraft |

| Cheque/ECS Dishonor Charges | ₹500 per instance |

| Cheque/Repayment Swap Charges | ₹500 |

| Penal Charges (Delay/Default) | 5% p.a. on overdue sum + taxes |

| Amortisation Schedule | ₹200 (physical copy) |

| Statement of Account | ₹200 (physical copy) |

| Prepayment Statement | ₹200 (physical copy) |

| Duplicate NOC/No Dues | ₹250 |

| Revalidation of NOC | ₹250 |

| Non-submission of Documents | ₹5,000 per month (from due date till submission) |

| Non-collection of Property Docs (post 60 days) | ₹1,000 per month |

| Construction Delay (Land Loan) | 1% p.a. on principal or ₹50,000 (whichever is lower) after 4 years from 1st disbursal |

| Overdraft Renewal Fees | ₹5,000 (not applicable for Money Saver & Insta OD) |

| Loan/Property Document Retrieval | ₹500 |

| Cash EMI Payment at Branch | ₹100 |

| Information Utility (Corporate Cases) | ₹300 |

| CERSAI Charges | ₹50 (loan ≤₹5L) ₹100 (loan >₹5L) |

| Auction, Legal, SARFAESI, Enforcement, Ads, Professional, Repossession, Security | At actuals |

| Non-maintenance of Payment Mode | ₹800 |

Suggested Read: NRI CIBIL Score Requirement for Home Loans

ICICI Bank NRI Home Loan Documents Required

Ensure you have all the necessary documents ready, from identity proof to income statements, to make the home loan application process smooth.

| Document Type | Details |

|---|---|

| Application Form | – Passport-size photo |

| KYC Documents | – Passport – NRI Status Proof (Visa/Residence Permit/OCI) – Communication Address Proof (Indian or Overseas) – PAN (Mandatory for NRIs; PAN/Form 60 for OCIs) |

| Income Proof (Salaried) | – Latest Salary Slip (past 1 month) or – Salary Certificate |

| Income Proof (Self Employed) | – 2 Years Audited Profit & Loss and IT Returns – Business Incorporation Documents – Overseas Operative Bank Statements (last 6 months) – Office Address, List of Directors – Shareholding Pattern (if applicable) |

| Overseas Bank Statements | – Last 3 months (with salary credits) |

| Overseas Credit Bureau Report | – Not older than 45 days (for specific countries) |

| Balance Transfer Documents | – Last 1 year’s Bank Statement with EMI details |

Suggested Read: What to Do If You Lose Your Property Documents?

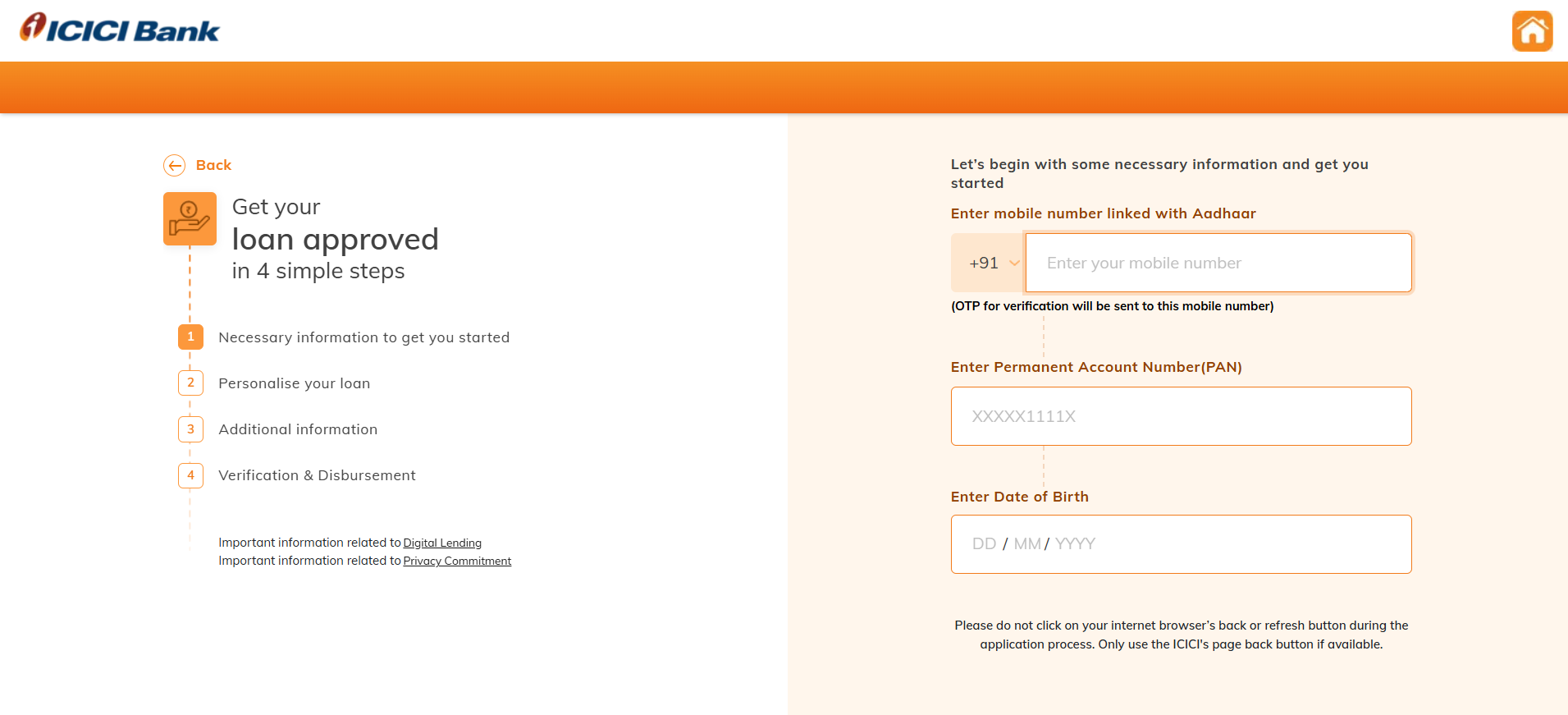

How to Apply for ICICI Bank NRI Home Loan?

The application process is easy—simply fill in your details, upload the required documents, and get started on your loan.

- Visit the official ICICI Bank website.

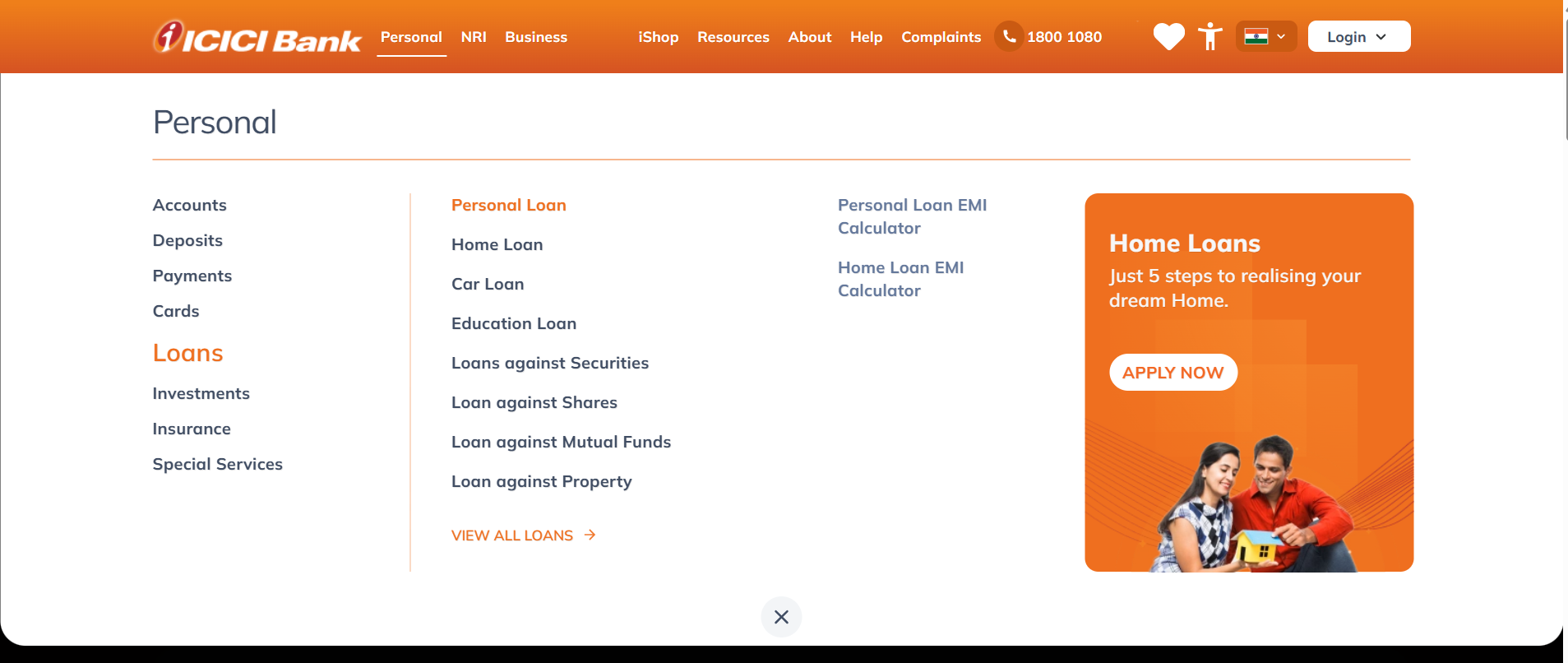

- From the top dashboard, click on Personal. Select Loans > Home Loan.

- Scroll down and click Apply Now under NRI Home Loan.

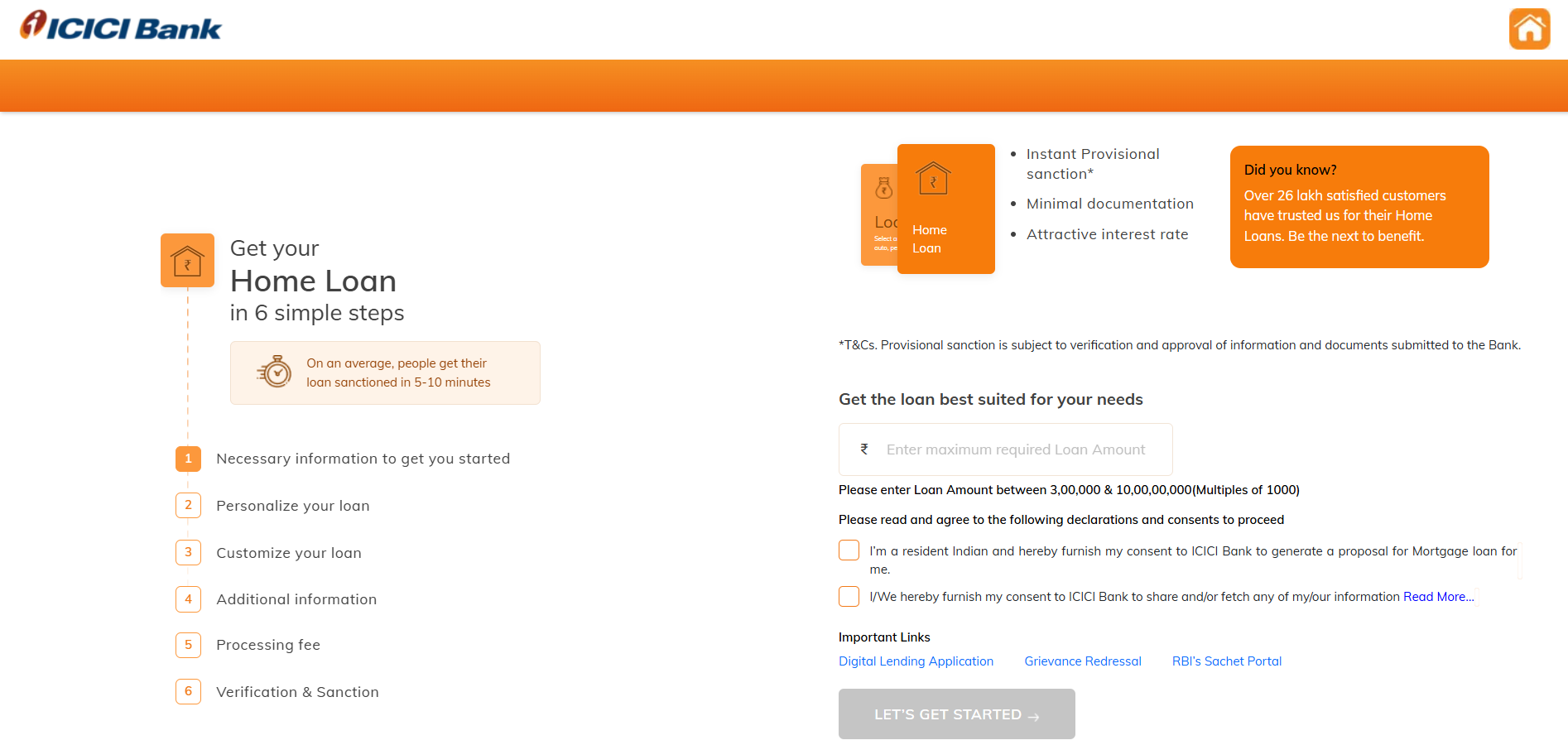

- Enter the required loan amount and accept the Terms and Conditions.

- Enter your mobile number, PAN, and date of birth.

- Enter your Aadhaar Card details. Complete the OTP verification by entering the OTP sent to your registered mobile number.

- Enter your official name as per records. Provide your employment details, including:

Type of work (Salaried/Self-employed)

Organization name

Official email ID - Enter your place of birth, purpose of the loan, religion, and category (General/SC/ST/OBC/Other).

- Complete the eNACH process and verify with OTP.

- A video KYC will be scheduled as part of the verification process.

- Once all the steps are completed, the provisionally approved loan amount will be displayed on the screen.

Suggested Read: Home Loan Prepayment vs. Investment

Compare Top Banks NRI Home Loan Interest Rates

Explore home loan offers from different banks to find the best deal that fits your needs.

| Banks/ NBFCs | Interest Rates |

|---|---|

| SBI | 8.00% p.a. onwards |

| HDFC Bank | 10.10% p.a. onwards |

| ICICI Bank | 8.75% p.a. onwards |

| LIC Housing Finance | 8.25% p.a. onwards |

| Bajaj Housing Finance | 8.25% p.a. onwards |

| Axis Bank | 10.50% p.a. onwards |

| Tata Capital | 8.75% p.a. onwards |

| Bank of India | 8.25% p.a. onwards |

| Kotak Mahindra Bank | 8.65% p.a. onwards |

Conclusion

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer

Frequently Asked Questions

Yes, NRIs are eligible for home loans from most Indian banks and financial institutions. Eligibility criteria typically include stable income, creditworthiness, and proof of NRI status. Age limits and loan terms may vary by lender.

Some banks allow NRIs to apply independently, while others may require a resident Indian co-applicant or guarantor. Policies vary, so check with your lender.

Typically, NRIs can borrow up to 80–90% of the property value (Loan-to-Value ratio). The exact amount depends on income, repayment capacity, and bank policies.

Interest rates are competitive and often similar to those for resident Indians. Rates may vary based on the bank’s policies, loan type (fixed or floating), and the borrower’s profile.

Yes, but disbursements are made in stages linked to construction milestones. The loan agreement will outline payment terms tied to project progress.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan