Building your dream home doesn’t have to feel impossible. With LIC Housing Finance’s Construction Loan, you can buy the land and fund the construction without any hassle. LIC understands how important this milestone is, and their loans come with simple terms, competitive rates, and the flexibility you need to get started with ease.

LIC Housing Finance Home Construction Loan Highlights

| Aspects | Highlights |

|---|---|

| Interest Rates | 8.65% p.a. onwards |

| Tenure | 90% of the property value |

| Maximum Loan Amount | Salaried: 30 years Self Employed: 25 years |

Suggested Read: Plot Loan vs. Home Loan

LIC Housing Finance Home Construction Loan Interest Rates 2025

| CIBIL score bracket | Salaried applicants | Self-employed applicants |

|---|---|---|

| ≥ 800 | — | — |

| 775 – 799 | — | — |

| 750 – 774 | 8.65 % p.a. – 8.80 % p.a. | 8.90 % p.a. – 9.05 % p.a. |

| 725 – 749 | — | — |

| 700 – 724 | 8.90 % p.a. – 9.05 % p.a. | 9.15 % p.a. – 9.30 % p.a. |

| 600 – 699 | 9.55 % p.a. – 9.90 % p.a. | 9.65 % p.a. – 10.00 % p.a. |

| < 600 | 10.00 % p.a. – 10.40 % p.a. | 10.10 % p.a. – 10.50 % p.a. |

| 150 ≤ CIBIL ≤ 200 | 8.75 % p.a. onwards | 8.85 % p.a. |

| 100 ≤ CIBIL ≤ 150 | 9.25 % p.a. onwards | 9.35 % p.a. |

| Sure Fixed Scheme | 10.00 % p.a. – 10.25 % p.a. | — |

Suggested Read: Can NRIs Buy Agricultural Land in India?

LIC Housing Finance Home Construction Loan Eligibility Criteria

| Eligibility Parameter | Salaried Applicants | Self-Employed Applicants |

|---|---|---|

| Age at the time of application | 21 – 60 years | 21 – 70 years |

| Minimum regular income | ₹25,000 per month (or higher, depending on city tier) | ₹25,000 per month (stable business cash flow) |

| Work experience / business vintage | At least 2 years in current job | Business should be operational & profitable for at least 2 years |

| Credit (CIBIL) score | 700+ | 700+ |

Suggested Read: Loan Against Agricultural Land in India

LIC Housing Finance Home Construction Loan Processing Fees

| Loan Slab | Processing Fee |

|---|---|

| Up to ₹ 1 Crore | 0.25% of loan amount Maximum: ₹ 15,000 + GST |

| ₹1 crore – ₹2 crore | Rs 20,000 + GST |

| ₹2 crore- ₹5 crore | Rs 25,000 + GST |

| ₹5 crore – ₹15 crore | Rs 50,000 + GST |

Suggested Read: Can You Build a House on Agricultural Land in India?

LIC Housing Finance Home Construction Loan Other Fees and Charges

| Service | Charges |

|---|---|

| Prepayment Charges | Floating and fixed rates: NIL if paid through own funds 2% on prepaid loan amount if paid through other sources |

| Penal Charges | Up to 12 months: 1.50% per month Beyond 12 months: 1.75% per month |

| Document retrieval charges | Rs 2,500 |

| Providing document list | Rs 500 |

| Photocopies of title documents | Rs 1,000 |

| Cheque bounce charges | Rs 350 |

| ECS/NACH dishonor charges | Rs 200 |

Suggested Read: 1 Acre Land Prices in India 2025

LIC Housing Finance Home Construction Loan Documents Required

Make your application process smooth by having the right documents ready, from identity proof to income statements.

General Documents

| Document Category | Accepted Documents |

|---|---|

| A. Age Proof | – Life Insurance Policy – PAN Card – Passport – Birth Certificate – Driving Licence – School Leaving Certificate |

| B. Photo Identity Proof | – Aadhaar Card – Voter ID – PAN Card – Driving License – Passport |

| C. Address Proof | – Bank Statements – Property Tax Receipt – Voter ID – Utility Bills – Property Registration Documents |

Income Proof

| Applicant Type | Employment/ Business Proof | Income Proof |

|---|---|---|

| Salaried | – Appointment Letter – Yearly Increment Letter | – Salary Slips (last 3 months) – Salary Bank Account Statements (last 12 months) – Certified true copy of Form 16 |

| Self-Employed | – Business Profile on letterhead – Business Registration Certificate | – Income Tax Returns (last 2 years) – P&L Projection Statement (last 2 years) – Operative Current Account Statement (last 12 months) – CC/OD Bank Statements (last 12 months, if applicable) |

| NRIs | – Appointment Letter or Previous Employment History | – Pay Slips (last 6 months) – Overseas Salary Account Statements – NRE/NRO Bank Statements (last 12 months) |

Property Documents

| Property Documents |

|---|

| Permission for construction (where applicable) |

| Registered Agreement for Sale (only for Maharashtra)/Allotment Letter/Stamped Agreement for Sale |

| Occupancy Certificate (in case of ready to move property) |

| Share Certificate (only for Maharashtra), Maintenance Bill, Electricity Bill, Property Tax Receipt |

| Approved Plan copy (Xerox Blueprint) & Registered Development Agreement of the builder, Conveyance Deed (For New Property) |

| Payment Receipts or bank A/C statement showing all the payments made to Builder/Seller |

Balance Transfer Documents

| Balance Transfer Documents |

|---|

| KYC Documents |

| Home Loan Statements from Previous Bank |

| Bank Account Statement |

Suggested Read: Fixed vs. Floating Interest Rates

How to Apply for LIC Housing Finance Home Construction Loan?

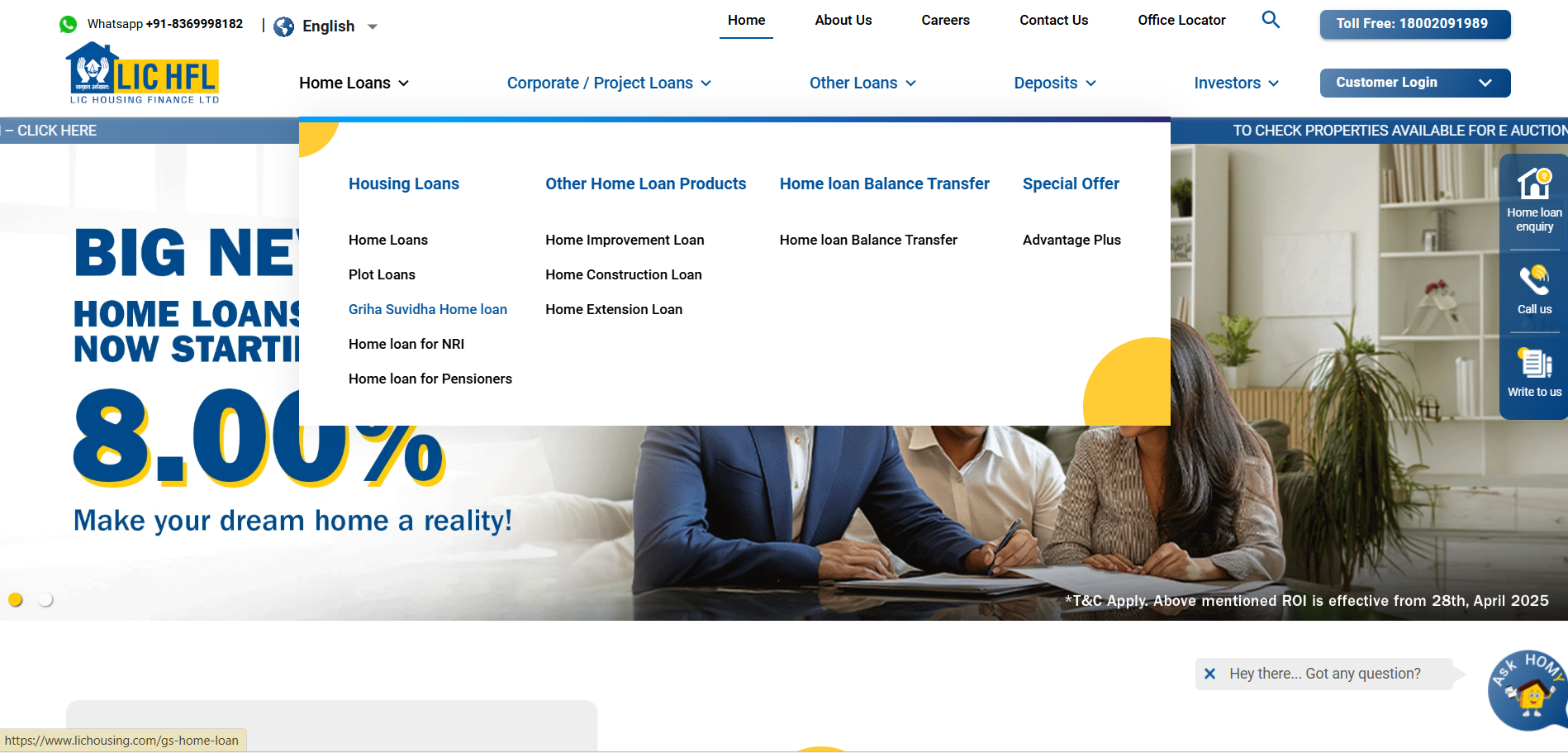

- Go to the official LIC Housing Finance website.

- Navigate to Home Loans > Home Construction Loan . Click Apply Now.

- Enter your name, mobile number, property location, and preferred office area, then click on “Get Started.”

- Complete the application form with accurate personal, financial, and property details .

- Upload all required supporting documents .

- Review all information and documents carefully, then submit the application.

- Upon successful submission, you will receive an acknowledgment or reference number .

Suggested Read: Impact of CIBIL Score on Home Loan Application

Compare Top Banks Home Construction Loan Interest Rates

Take a look at interest rates from different banks to ensure you’re getting the best deal for your plot and construction loan.

| Bank/ NBFCs | Interest Rates |

|---|---|

| SBI | 8.00% p.a. onwards |

| ICICI | 9.25% p.a. onwards |

| LIC Housing Finance | 8.20% p.a. onwards |

| IDFC First | 8.85% p.a. onwards |

| PNB Housing Finance | 9.75% p.a. onwards |

| HDFC Bank | 8.50% p.a. onwards |

Conclusion

Buying a plot and building your dream home is an exciting adventure, but managing the finances doesn’t have to be overwhelming. At Credit Dharma, we understand the importance of creating a space that truly reflects your lifestyle. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Typically, Plot + Construction Loans are provided for non-agricultural residential plots. Lenders usually require the land to be within municipal or local development authority limits. Agricultural land is generally not eligible for this type of loan.

EMIs typically commence after the construction is complete and the full loan amount is disbursed. However, some lenders may allow interest-only payments during the construction phase.

Yes, you can avail tax deductions under Section 80C for principal repayment and under Section 24(b) for interest paid. These benefits apply once the construction is complete and possession is taken.

Absolutely! If you own a plot and wish to construct a house, you can apply for a Construction Loan to fund the building process. Some lenders may even offer a top-up loan on your existing home loan for this purpose.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan