As your family grows, so does your need for space. If you’re looking to add more room to your existing home, LIC Housing Finance’s Home Extension Loan provides the perfect solution. It offers you the financial flexibility to extend your home and create the extra room you need—without the stress of upfront costs or draining your savings.

LIC Housing Finance Home Extension Loan Highlights

This quick snapshot shows the core numbers—rate, loan share, and tenure—so you can gauge affordability at a glance.

| Aspects | Highlights |

|---|---|

| Interest Rates | 8.65% p.a. onwards |

| Tenure | 90% of the property value |

| Maximum Loan Amount | Salaried: 30 years Self Employed: 25 years |

Suggested Read: What is Home Loan Moratorium?

LIC Housing Finance Home Extension Loan Interest Rates 2025

Knowing the starting rate lets you estimate your EMI and decide whether the loan matches your cash-flow comfort.

| CIBIL Score bracket | Salaried – Indicative Rate | Self-Employed – Indicative Rate |

|---|---|---|

| ≥ 800 | — | — |

| 775 – 799 | — | — |

| 750 – 774 | 8.65 % p.a. – 8.80 % p.a. | 8.90 % p.a. – 9.05 % p.a. |

| 725 – 749 | — | — |

| 700 – 724 | 8.90 % p.a. – 9.05 % p.a. | 9.15 % p.a. – 9.30 % p.a. |

| 600 – 699 | 9.55 % p.a. – 9.90 % p.a. | 9.65 % p.a. – 10.00 % p.a. |

| < 600 | 10.00 % p.a. – 10.40 % p.a. | 10.10 % p.a. – 10.50 % p.a. |

| 150 ≤ CIBIL ≤ 200 | 8.75 % p.a. onwards | 8.85 % p.a. |

| 100 ≤ CIBIL ≤ 150 | 9.25 % p.a. onwards | 9.35 % p.a. |

| Sure Fixed Scheme | 10.00 % p.a. – 10.25 % p.a. | — |

Suggested Read: Top 10 Home Renovation Loans

LIC Housing Finance Home Extension Loan Eligibility Criteria

Check these basic conditions first; meeting them is the key to unlocking your NRI borrowing power.

| Eligibility Parameter | Salaried Applicants | Self-Employed Applicants |

|---|---|---|

| Age at the time of application | 21 – 60 years | 21 – 70 years |

| Minimum regular income | ₹25,000 per month (or higher, depending on city tier) | ₹25,000 per month (stable business cash flow) |

| Work experience / business vintage | At least 2 years in current job | Business should be operational & profitable for at least 2 years |

| Credit (CIBIL) score | 700+ | 700+ |

Suggested Read: How to Reduce Home Insurance Premiums Legally?

LIC Housing Finance Home Extension Loan Processing Fees

Understanding the one-time processing fee helps you budget for the costs that appear before the loan even starts.

| Loan Slab | Processing Fee |

|---|---|

| Up to ₹ 1 Crore | 0.25% of loan amount Maximum: ₹ 15,000 + GST |

| ₹1 crore – ₹2 crore | Rs 20,000 + GST |

| ₹2 crore- ₹5 crore | Rs 25,000 + GST |

| ₹5 crore – ₹15 crore | Rs 50,000 + GST |

Suggested Read: Is Rental Real Estate Income Still a Good Investment in 2025?

LIC Housing Finance Home Extension Loan Other Fees and Charges

Review the penalty and service fees now, so no surprise bills pop up later in your repayment journey.

| Service | Charges |

|---|---|

| Prepayment Charges | Floating and fixed rates: NIL if paid through own funds 2% on prepaid loan amount if paid through other sources |

| Penal Charges | Up to 12 months: 1.50% per month Beyond 12 months: 1.75% per month |

| Document retrieval charges | Rs 2,500 |

| Providing document list | Rs 500 |

| Photocopies of title documents | Rs 1,000 |

| Cheque bounce charges | Rs 350 |

| ECS/NACH dishonor charges | Rs 200 |

Suggested Read: Small Bathrooom Renovation Ideas

LIC Housing Finance Home Extension Loan Documents Required

When applying for a home loan with the LIC, you will need to provide specific documents that verify your identity, income, and property details. Below is a detailed list:

General Documents

| Category | Documents Required |

|---|---|

| Proof of Identity | PAN Card/ Driver’s License / Voter ID / Passport / Aadhar Card |

| Proof of Address | Driver’s License / Ration Card / Voter ID / Passport / Aadhar Card / Registered Rent Agreement |

Proof of Income

| Salaried | Self Employed |

|---|---|

| Last 6 months’ Salary Slips | Last 3 Years ITR with Computation of Income |

| 1 Year ITR/Form 16 | Profit & Loss Account |

| 6 months bank account statement (salary account or individual account). | Balance Sheet |

| Capital Account Statement | |

| Bank account statement for the last 12 months (for individual or business). | |

| Business proof |

NRI/ PIO

| Category | Documents |

|---|---|

| Passport & Visa | Passport with VISA printed on it |

| Work Authorization | Work Permit |

| Identity Proof | Copy of PAN, ID card issued by employer |

| Proof of Address | Proof of address in India Proof of address in the foreign country Proof of address from employer with contact details |

| Income Proof | Latest salary slip in original Annual income tax return filed as per applicable rules for the last 2 years |

Suggested Read: How to Remove Vastu Dosh in Your Home?

How to Apply for LIC Housing Finance Home Extension Loan?

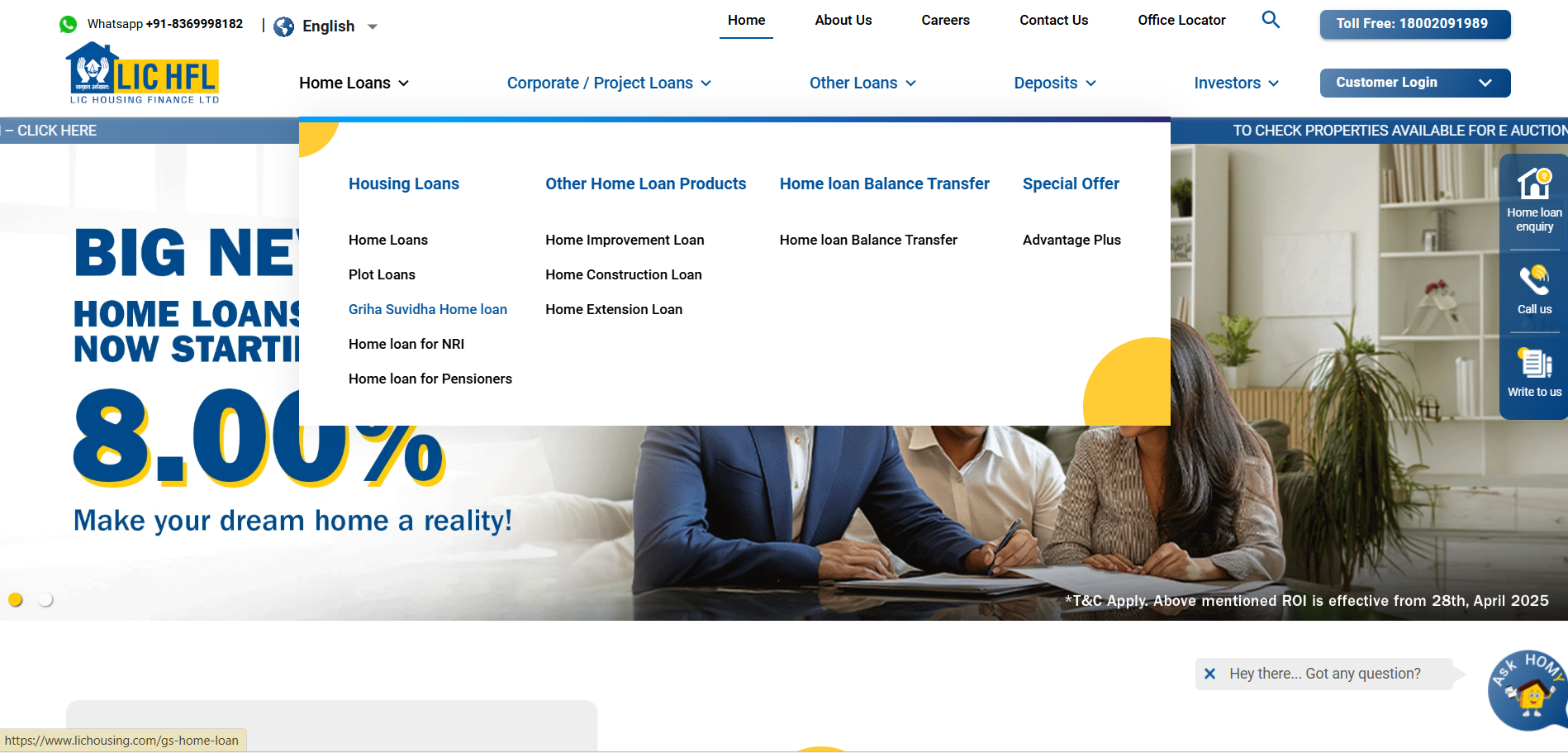

- Go to the official LIC Housing Finance website.

- Navigate to Home Loans > Home Extension Loan . Click Apply Now.

- Enter your name, mobile number, property location, and preferred office area, then click on “Get Started.”

- Complete the application form with accurate personal, financial, and property details .

- Upload all required supporting documents .

- Review all information and documents carefully, then submit the application.

- Upon successful submission, you will receive an acknowledgment or reference number .

Suggested Read: 10+ Positive Vastu Colours

Compare Top Banks Home Loan Interest Rates 2025

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 8.50% p.a. onwards | 8.5% p.a. onwards | 8.50% p.a. onwards |

| HDFC Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| LIC Bank | 8.50% – 10.35% p.a. | 8.50% – 10.55% p.a. | 8.50% – 10.75% p.a. |

| ICICI Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Kotak Mahindra Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Punjab National Bank | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. |

| Bank Of Baroda | 8.40% – 10.65% p.a. | 8.40% – 10.65% p.a. | 8.40% – 10.90% p.a. |

| Bajaj Housing Finance | 8.50% p.a. onwards | 8.50% p.a. onwards | 8.50% p.a. onwards |

| Axis Bank | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. |

| Bank of India | 8.40% p.a onwards | 8.40% p.a onwards | 8.40% p.a onwards |

| TATA Capital | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. At Credit Dharma, we make this possible by offering lowest guaranteed interest rates that keep your monthly payments manageable, allowing you to enjoy more of what truly matters.

But that is not it. We offer:

- Guaranteed up to 100% funding

- Receive lifetime assistance and expert guidance long after your loan is approved.

- Enjoy a fully digital process with minimal paperwork

- Get your loan approved within just 1-2 weeks.

Frequently Asked Questions

Yes. Most banks & HFCs offer home-extension loans specifically for enlarging an existing property (extra room, floor, study, balcony, etc.). No plot purchase needed.

An extension loan funds structural additions that increase built-up area; a renovation loan covers repairs/improvements; a top-up loan is a generic surplus amount on your current mortgage. Choose the product that secures the lowest rate with the least paperwork.

No. You typically get 75–90 % of the architect’s estimate (or contractor quote). The rest is your margin money.

Absolutely. You must submit municipal approvals & revised building plans showing the proposed extension. Without these, disbursement won’t happen.

Yes—most major lenders allow NRIs/PIOs to apply, but tenors are shorter (max 15–20 years) and you’ll need a local power-of-attorney holder for documentation.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan