When life calls for a little extra, LIC Housing Finance Home Loan Top-Up is here to help. Whether you want to build an extension, or upgrade your interiors, top-up loan offer the perfect solution. With an easy application process and minimal additional paperwork, you can quickly access the funds you need.

LIC Housing Finance Home Loan Top Up Highlights

Here’s a quick overview of the key features—interest rates, loan amounts, and fees—so you can decide if the home loan top-up is the right choice for you.

| Aspects | Highlights |

|---|---|

| Interest Rates | 9.70% p.a. onwards |

| Loan Amount | Contact the Bank |

| Loan Tenure | Remaining tenure of the existing home loan |

Suggested Read: LIC Home Loan Interest Rates 2025

LIC Housing Finance Home Loan Top Up Interest Rates 2025

Check out the interest rates for home loan top-ups in 2025 to get an idea of your potential EMI and costs.

| CIBIL Score | Interest Rates |

|---|---|

| >= 750 | 9.70% p.a. onwards |

| 750 – 700 | 10.30% p.a. onwards |

| 700 – 600 | 11.55% p.a. onwards |

Read More: How to Improve Your CIBIL Score?

LIC Housing Finance Home Loan Top Up Eligibility Criteria

Find out the basic eligibility requirements, such as age, income, and existing home loan status, before applying for a top-up loan.

| Customer Segment | Quick Definition |

|---|---|

| Seasoned LIC HFL borrowers | Existing borrowers with zero payment defaults |

| Balance-transfer applicants | New borrowers shifting an existing home loan to LIC HFL |

| Salaried professionals | Govt./PSU/private-sector employees |

| Self-employed individuals | Business owners, freelancers, partners, proprietors |

| Resident Indians | Applicants living in India |

| NRIs / PIOs | Overseas Indians meeting LIC HFL’s NRI policy |

Suggested Read: LIC Home Loan Customer Care

LIC Housing Finance Home Loan Top Up Processing Fees

Understand the processing fees involved so you can factor them into your overall cost when opting for a home loan top-up.

| Loan Slab | Processing Fee |

|---|---|

| Up to ₹ 1 Crore | 0.25% of loan amount Maximum: ₹ 15,000 + GST |

| ₹1 crore – ₹2 crore | Rs 20,000 + GST |

| ₹2 crore- ₹5 crore | Rs 25,000 + GST |

| ₹5 crore – ₹15 crore | Rs 50,000 + GST |

Suggested Read: How Long Does Home Loan Disbursement Take After Approval?

LIC Housing Finance Home Loan Top Up Other Fees and Charges

Be aware of any extra charges, such as prepayment penalties or overdue fees, that may apply to your home loan top-up.

| Service | Charges |

|---|---|

| Prepayment Charges | Floating and fixed rates: NIL if paid through own funds 2% on prepaid loan amount if paid through other sources |

| Penal Charges | Up to 12 months: 1.50% per month Beyond 12 months: 1.75% per month |

| Document retrieval charges | Rs 2,500 |

| Providing document list | Rs 500 |

| Photocopies of title documents | Rs 1,000 |

| Cheque bounce charges | Rs 350 |

| ECS/NACH dishonor charges | Rs 200 |

Also Read: Property Documents for Home Loans: NRI vs Indians

LIC Housing Finance Home Loan Top Up Documents Required

Ensure you have all the necessary documents ready, from identity proof to income statements, to make the top-up application process smooth.

Documents Applicable to All Applicants:

| Document | Details |

|---|---|

| Employer Identity Card | Provided by employer for identity verification. |

| Completed Loan Application | Must be filled and submitted for loan processing. |

| 3 Passport Size Photographs | Required for official records. |

| Proof of Identity | Voter’s ID card, Passport, Driving License, IT PAN card (photocopies). |

| Proof of Residence | Recent Telephone Bill, Electricity Bill, Property Tax Receipt, Passport, Voter’s ID card (photocopies). |

| Proof of Business Address | Required for non-salaried individuals. |

| Statement of Bank Account/Pass Book | Last six months’ statement or passbook for financial verification. |

| Signature Identification | From current bankers for identity verification. |

| Personal Assets and Liabilities Statement | Financial statement to assess financial stability. |

Documents for Guarantor (Where Applicable):

| Document |

|---|

| Personal Assets and Liabilities Statement |

| 2 Passport Size Photographs |

| Proof of Identification |

| Proof of Residence |

| Proof of Business Address |

| Signature Identification |

Also Read: Property Documents for Home Loans: NRI vs Indians

Additional Documents for Salaried Individuals:

| Document | Details |

|---|---|

| Original Salary Certificate | Issued by employer to confirm salary details. |

| TDS Certificate on Form 16 or IT Returns | For the last two financial years. |

Additional Documents for Professionals/Self-Employed/Other IT Assesses:

| Document |

|---|

| Acknowledged Copies of 3 Years I.T. Returns/Assessment Orders |

| Photocopies of Challans for Advance Income Tax Payment |

Suggested Read: LIC Housing Finance Home Loan Repayment Options

How to Apply to LIC Housing Finance Home Loan Top Up?

The application process is easy—simply fill in your details, upload the required documents, and get started on your loan top-up.

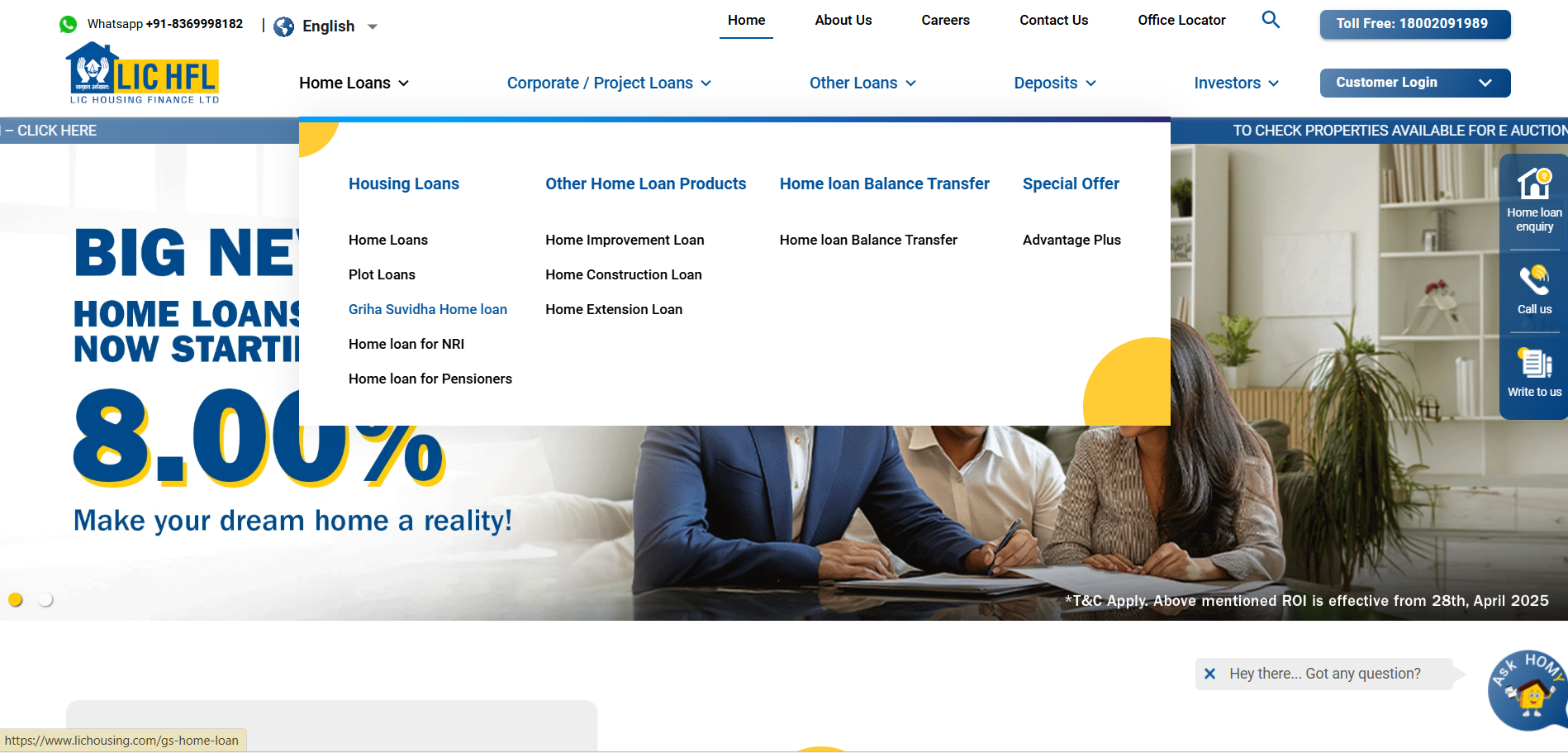

- Go to the official LIC Housing Finance website.

- Navigate to Home Loans > Home Loan Top Up . Click on “Apply Now”

- Enter your name, mobile number, property location, and preferred office area, then click on “Get Started.”

- Complete the application form with accurate personal, financial, and property details .

- Upload all required supporting documents .

- Review all information and documents carefully, then submit the application.

- Upon successful submission, you will receive an acknowledgment or reference number .

Suggested Read: LIC Home Loan Balance Transfer

Compare Top Banks Home Loan Top Up Interest Rates

Explore home loan top-up offers from different banks to find the best deal that fits your needs.

| Bank | Interest Rate (p.a.) |

|---|---|

| State Bank of India | 8.00% onwards |

| HDFC Bank | 8.70% – 9.55% |

| ICICI Bank | 8.75% onwards |

| Axis Bank | 8.75% – 12.80% |

| Kotak Mahindra Bank | 8.65% onwards |

| Punjab National Bank | 8.50% onwards |

| Bank of Baroda | 8.40% onwards |

Conclusion

Accessing extra funds for your home shouldn’t feel stressful. At Credit Dharma, we understand the need to unlock your property’s value to meet new financial goals. Whether it’s for renovations, education, or other priorities, our team offers expert guidance and customized solutions to simplify your home loan top-up process, ensuring a smooth and efficient experience.

From eligibility checks to final disbursal, we provide end-to-end assistance. Enjoy clear, honest communication at every stage, with no hidden charges or unexpected hurdles.

Frequently Asked Questions

Existing home loan borrowers with a good repayment track record and a satisfactory credit score are typically eligible for a top-up loan.

Funds from a top-up loan can be used for personal or professional needs, such as home renovation, education, medical expenses, or debt consolidation.

The loan amount varies based on the lender’s policies, your repayment capacity, and the value of the property. Some lenders offer up to 100% of the existing home loan amount.

The tenure for a top-up loan is usually aligned with the remaining tenure of your existing home loan, up to a maximum of 20 years.

Yes, a top-up loan is secured against your property and typically offers lower interest rates and longer tenures compared to unsecured personal loans.

Transferring a top-up loan to another lender is possible through a balance transfer, subject to the new lender’s policies.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan