Buying a home early in your career can feel out of reach when your salary is still on the rise. SBI’s Flexipay Home Loan changes that. This unique loan lets salaried borrowers qualify for a larger amount today, pay only the interest during an initial moratorium, and then move to easy‑on‑the‑wallet EMIs that grow gradually as your income grows.

With Flexipay, you secure your dream home now while keeping monthly payments light in the beginning. As your earning power expands, the stepped‑up EMIs kick in—matching your cash flow without forcing lifestyle cuts. It’s a smart choice for young professionals who want to own property sooner, save on rent, and build equity from day one.

SBI Flexipay Home Loan Highlights

Enjoy flexible repayment options, competitive interest rates, and quick approvals with SBI Flexipay, tailored to meet diverse home financing needs.

| Category | Highlights |

|---|---|

| Interest Rates | 8.00% p.a. onwards |

| Loan Amount | Contact the Bank |

| Tenure | 30 Years |

| Processing Fees | 0.35% of the loan amount + GST, (₹2,000 – ₹10,000) |

Suggested Read: SBI Home Loan Interest Rates 2025

SBI Flexipay Home Loan Interest Rates 2025

Tailored to suit diverse financial needs, SBI Flexipay provides flexible interest rate options, ensuring affordability and long-term savings for borrowers.

| Product | Interest Rates |

|---|---|

| SBI Flexipay Home Loan | 8.00% p.a. onwards |

Suggested Read: SBI Home Loan Customer Care

SBI Flexipay Home Loan Eligibility Criteria

Eligibility is assessed based on income stability, age, employment type, and creditworthiness, ensuring transparency and accessibility for all applicants.

| Categories | Requirement |

|---|---|

| Minimum Age | 21 Years |

| Maximum Age | To Apply: 45 Years To Repay: 70 Years |

| Nationality | Indian Resident |

Check Out: SBI Home Loan Eligibility Calculator

SBI Flexipay Home Loan Documents Required

A streamlined documentation process requires basic KYC, income proofs, property details, and financial records to expedite loan approval.

General Documents

| Document | Notes |

|---|---|

| Employer Identity Card | Official ID issued by employer |

| Completed Loan Application Form | Duly filled, attach 3 passport‑size photographs |

Must Read: Best Property Valuation Practices

Proof of Identity (submit any one)

| Acceptable ID |

|---|

| PAN Card |

| Passport |

| Driver’s License |

| Voter ID Card |

Proof of Residence (submit any one)

| Acceptable Document |

|---|

| Recent Telephone Bill |

| Electricity Bill |

| Water Bill |

| Piped Gas Bill |

| Passport |

| Driving License |

| Aadhaar Card |

Suggested Read: Minimum CIBIL Score Required for a SBI Home Loan

Property Papers

| Document | When / Where applicable |

|---|---|

| Permission for Construction | New builds where approval is required |

| Registered Agreement for Sale / Allotment Letter / Stamped Agreement for Sale | Registered Agreement for Sale—Maharashtra only |

| Occupancy Certificate | Ready‑to‑move properties |

| Share Certificate | Maharashtra housing societies |

| Maintenance, Electricity & Property Tax Bills | Latest copies |

| Approved Plan Copy (Blueprint) | Xerox blueprint of sanctioned plan |

| Registered Development Agreement of Builder | New property projects |

| Conveyance Deed | New property projects |

| Payment Receipts / Bank Statements | Evidence of all payments to builder/seller |

Account Statements

| Statement | Period to Submit |

|---|---|

| Bank Account Statements (all accounts) | Last 6 months |

| Existing Loan Account Statement | Last 1 year |

Suggested Read: SBI NRI Home Loan Eligibility Criteria

Income Proof – Salaried Applicants / Co‑applicants / Guarantors

| Document | Period |

|---|---|

| Salary Slips / Salary Certificate | Last 3 months |

| Form 16 | Last 2 years |

| IT Returns (acknowledged) | Last 2 financial years |

Must Read: How to Get a Home Loan With Out Income Proof?

SBI Flexipay Home Loan Processing Fees

Affordable processing fees with potential discounts for existing customers, ensuring minimal upfront costs for borrowers.

| Processing Fees |

|---|

| 0.35% of the loan amount + GST |

| Minimum: ₹2,000 | Maximum: ₹10,000 |

Suggested Read: How Long Does Home Loan Disbursement Take After Approval?

SBI Flexipay Home Loan Other Charges

Clear and upfront fee structures, including administrative and service charges, with no hidden costs for a hassle-free experience.

| Charges/Reason | Details |

|---|---|

| CERSAI Registration Charges | ₹100 + GST |

| Fee for Switching to Current Card Rate | ₹5,000 + GST |

| Safe Custody Charges | ₹1,000 + GST per quarter or part thereof for delayed collection of original title deeds (beyond 60 days). |

| Conversion Charges for Switching Loan | Switching loan from MCLR/Base Rate/SBAR to EBLR is allowed at ₹1,000 per account + GST. |

| Penalty for Failed/Non-Payment of EMI | ₹250 + GST per EMI missed |

| Penalty for Cheque Returned (Insufficient Funds) | ₹500 + GST |

| Penalty for Failed SI/NACH | ₹250 + GST per failed SI/NACH transaction |

Suggested Read: Home Loans Without ITR

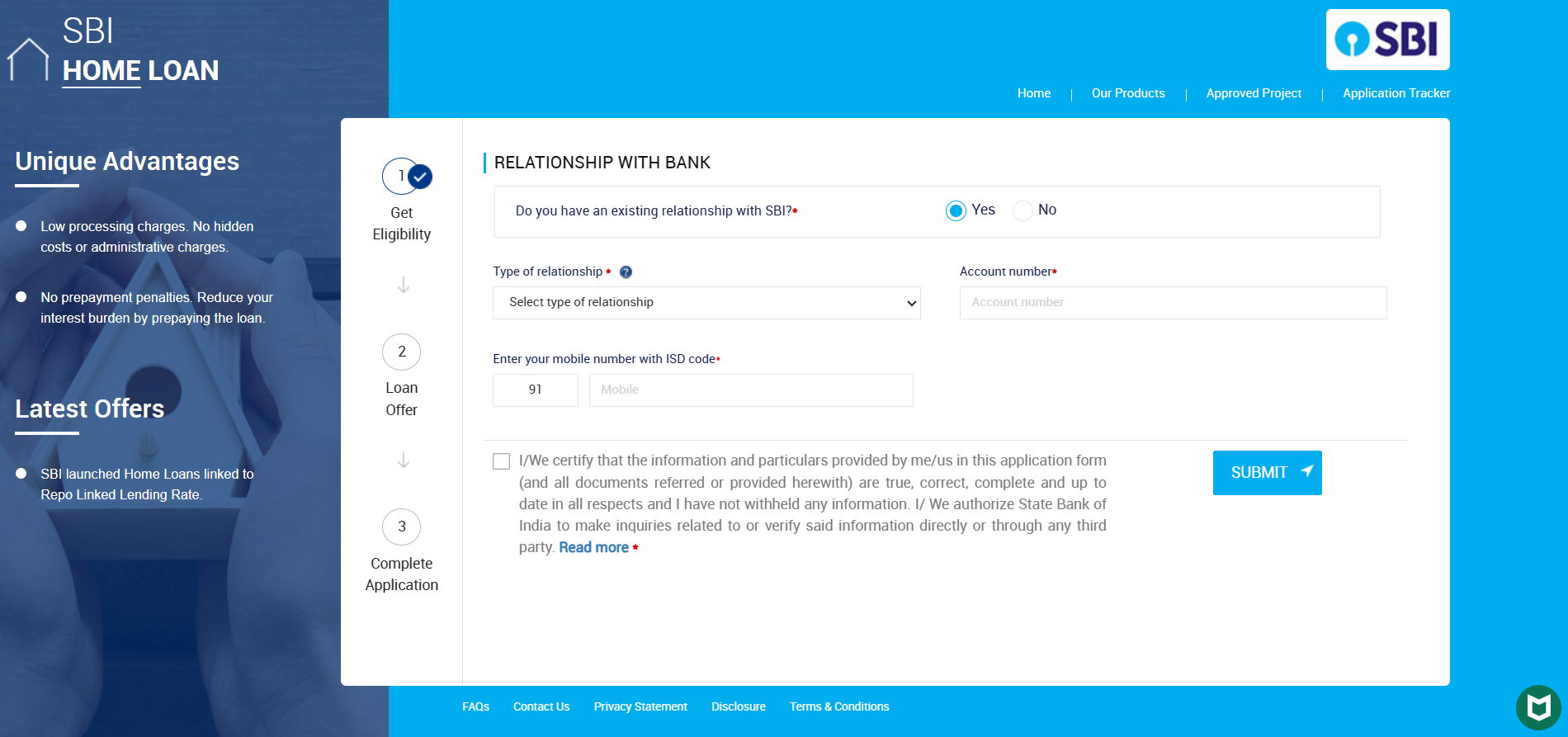

How to Apply SBI Flexipay Home Loan?

Apply seamlessly online through SBI’s portal, submit documents digitally, and track your application status in real time for a smooth journey.

- Visit the official SBI Home Loan Application Form.

Form A – Personal Details: Fill in your personal details such as name, date of birth, PAN, contact information, KYC, and marital status.

Form B – Employment & Income: Provide your employment status and income details to assess your loan repayment ability.

Form C – Property & Loan Details: Enter specifics about the property and the loan amount, tenure, and other details.

Form D – Declaration: Read and sign the declaration to confirm your agreement.

- Submit Required Documents

After completing the application, gather the necessary documents. SBI offers a doorstep document collection service for your convenience.

- Application Processing

Once you submit all the required documents, SBI will process your application. Upon successful application approval, you will receive a loan sanction letter.

Compare Top Banks Home Loan Interest Rates

Evaluate SBI Flexipay against leading banks to identify the most competitive rates, terms, and benefits aligned with your financial goals.

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 8.50% p.a. onwards | 8.5% p.a. onwards | 8.50% p.a. onwards |

| HDFC Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| LIC Bank | 8.50% – 10.35% p.a. | 8.50% – 10.55% p.a. | 8.50% – 10.75% p.a. |

| ICICI Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Kotak Mahindra Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Punjab National Bank | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. |

| Bank Of Baroda | 8.40% – 10.65% p.a. | 8.40% – 10.65% p.a. | 8.40% – 10.90% p.a. |

| Bajaj Housing Finance | 8.50% p.a. onwards | 8.50% p.a. onwards | 8.50% p.a. onwards |

| Axis Bank | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. |

| Bank of India | 8.40% p.a onwards | 8.40% p.a onwards | 8.40% p.a onwards |

| TATA Capital | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

Suggested Read: SBI Home Loan Insurance

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

The SBI Flexipay Home Loan is designed for salaried professionals, allowing them to pay only the interest during the initial moratorium period (up to 60 months). Afterward, they can opt for moderated EMIs, which gradually increase over time. This structure offers higher loan eligibility compared to standard home loans.

The minimum loan amount for the SBI Flexipay Home Loan is ₹20 lakh. This higher threshold is set to ensure that the loan structure benefits those seeking substantial financing.

Yes, there is a processing fee of 0.35% of the loan amount plus applicable GST, with a minimum of ₹2,000 and a maximum of ₹10,000. Additional charges for legal and valuation services may apply.

The moratorium period is the initial phase of the loan where only interest is paid, and principal repayment is deferred. For the Flexipay scheme, this period can range from 36 to 60 months, depending on the borrower’s preference.

After the moratorium period, the loan transitions to a full EMI structure, with payments covering both principal and interest. The EMIs are “stepped-up,” meaning they gradually increase over the remaining loan tenure.

Yes, SBI offers a home loan balance transfer facility, allowing borrowers to transfer their existing home loan to SBI Flexipay to avail of better terms and interest rates.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan