If you’ve been planning to purchase a plot and build your dream home, SBI’s Combo Home Loan for Plot Purchase Plus Construction offers the perfect solution. This one loan covers both the cost of purchasing your land and the construction of your home, providing a hassle-free way to fund your entire project. With easy processing and flexible terms, you can bring your vision to life without the financial burden of handling multiple loans.

SBI Combo Home Loan for Plot Purchase + Construction Highlights

Dreaming of your own home? SBI’s Combo Home Loan makes it easy to buy land and build your dream house—all in one loan! With low interest rates and flexible terms, this is the perfect solution to get you started.

| Categories | Highlights |

|---|---|

| Interest Rate | 8.00% p.a. onwards |

| Loan Tenure | 30 Years |

| Loan Amount | Contact the Bank |

| Processing Fees | 0.35% of the loan amount + GST, (₹2,000 – ₹10,000) |

Suggested Read: Fixed vs. Floating Interest Rates

SBI Combo Home Loan for Plot Purchase + Construction Interest Rates 2025

Start your home journey with SBI’s Combo Home Loan at just 8.00% p.a. in 2025. A great rate to turn your dream plot into a reality—affordable and easy to manage.

| Product | Interest Rates |

|---|---|

| SBI Combo Home Loan for Plot Purchase + Construction | 8.00% p.a. onwards |

Suggested Read: Plot vs. Flat vs. Bunglow

SBI Combo Home Loan for Plot Purchase + Construction Eligibility Criteria

Planning to buy land and build? If you’re between 18 and 70 years old, you’re eligible! Whether you’re an Indian or NRI, this loan is designed for you.

| Category | Requirements |

|---|---|

| Age | 18 – 70 Years |

| Nationality | Indian Resident/ NRIs |

SBI Combo Home Loan for Plot Purchase + Construction Processing Fees

Minimal fees, maximum ease! SBI charges just 0.35% of the loan amount (₹2,000 – ₹10,000) for processing, so you can focus on what matters most—building your home.

| Processing Fees |

|---|

| 0.35% of the loan amount + GST |

| Minimum: ₹2,000 | Maximum: ₹10,000 |

Suggested Read: Home Construction Loan Interest Rates 2025

SBI Combo Home Loan for Plot Purchase + Construction Other Fees and Charges

No surprises here! SBI’s Combo Home Loan has clear, transparent charges, from safe custody fees to penalties for missed payments—everything you need to know upfront.

| Charges/Reason | Details |

|---|---|

| CERSAI Registration Charges | ₹100 + GST |

| Fee for Switching to Current Card Rate | ₹5,000 + GST |

| Safe Custody Charges | ₹1,000 + GST per quarter or part thereof for delayed collection of original title deeds (beyond 60 days). |

| Conversion Charges for Switching Loan | Switching loan from MCLR/Base Rate/SBAR to EBLR is allowed at ₹1,000 per account + GST. |

| Penalty for Failed/Non-Payment of EMI | ₹250 + GST per EMI missed |

| Penalty for Cheque Returned (Insufficient Funds) | ₹500 + GST |

| Penalty for Failed SI/NACH | ₹250 + GST per failed SI/NACH transaction |

Suggested Read: Impact of CIBIL Score on Home Loan Application

SBI Combo Home Loan for Plot Purchase + Construction Documents Required

Applying for SBI’s Combo Home Loan for Plot Purchase + Construction is quick and simple. Just make sure you have the necessary documents, like proof of income and identity, to get started on your home loan journey.

General Documents

| Document | Notes |

|---|---|

| Employer Identity Card | Official ID issued by employer |

| Completed Loan Application Form | Duly filled, attach 3 passport‑size photographs |

Proof of Identity (submit any one)

| Acceptable ID |

|---|

| PAN Card |

| Passport |

| Driver’s License |

| Voter ID Card |

Proof of Residence (submit any one)

| Acceptable Document |

|---|

| Recent Telephone Bill |

| Electricity Bill |

| Water Bill |

| Piped Gas Bill |

| Passport |

| Driving License |

| Aadhaar Card |

Must Read: Best Property Valuation Practices

Property Papers

| Document | When / Where applicable |

|---|---|

| Permission for Construction | New builds where approval is required |

| Registered Agreement for Sale / Allotment Letter / Stamped Agreement for Sale | Registered Agreement for Sale—Maharashtra only |

| Occupancy Certificate | Ready‑to‑move properties |

| Share Certificate | Maharashtra housing societies |

| Maintenance, Electricity & Property Tax Bills | Latest copies |

| Approved Plan Copy (Blueprint) | Xerox blueprint of sanctioned plan |

| Registered Development Agreement of Builder | New property projects |

| Conveyance Deed | New property projects |

| Payment Receipts / Bank Statements | Evidence of all payments to builder/seller |

Account Statements

| Statement | Period to Submit |

|---|---|

| Bank Account Statements (all accounts) | Last 6 months |

| Existing Loan Account Statement | Last 1 year |

Income Proof – Salaried Applicants / Co‑applicants / Guarantors

| Document | Period |

|---|---|

| Salary Slips / Salary Certificate | Last 3 months |

| Form 16 | Last 2 years |

| IT Returns (acknowledged) | Last 2 financial years |

Must Read: How to Get a Home Loan With Out Income Proof?

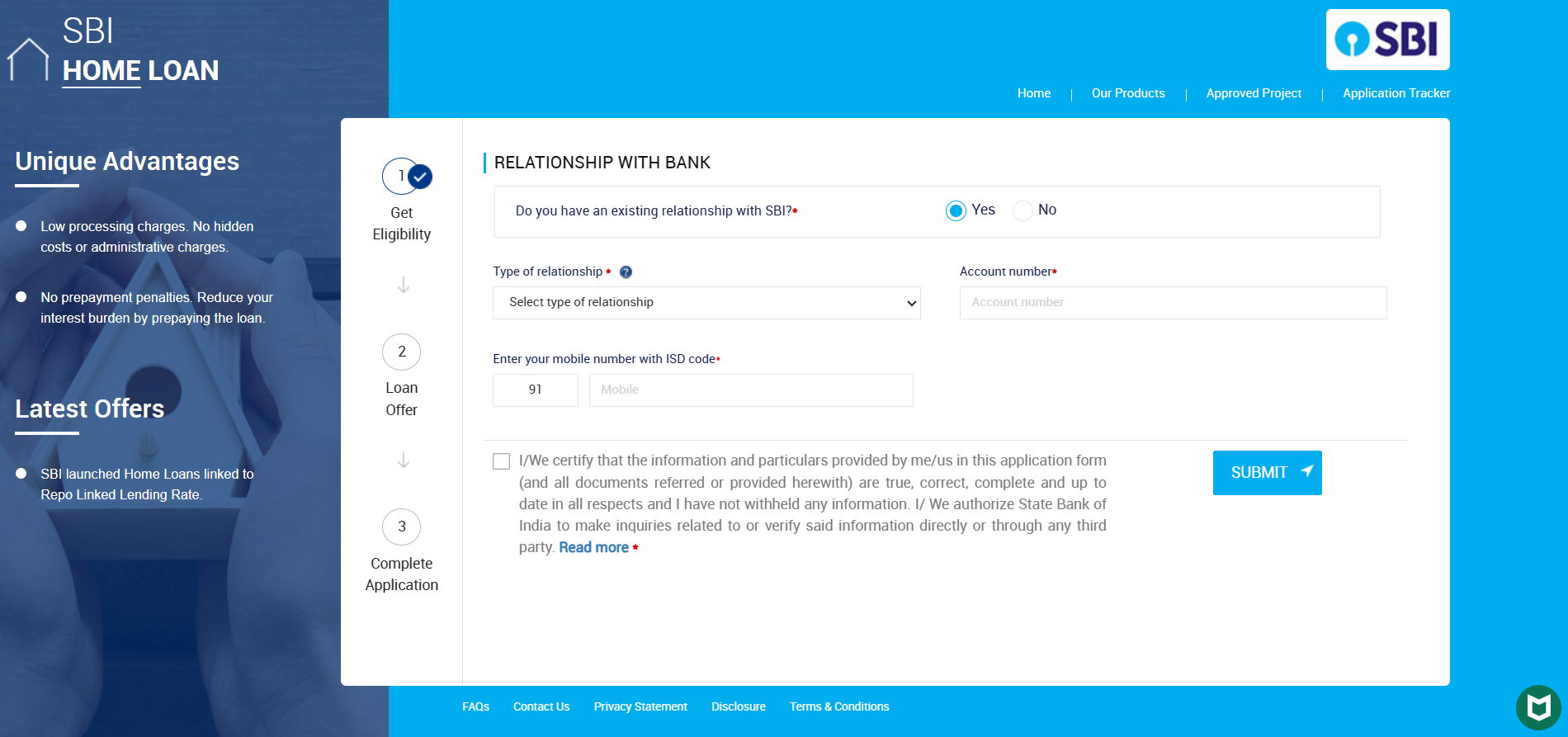

How to Apply for SBI Combo Home Loan for Plot Purchase + Construction?

Applying is a breeze! Fill out a simple form, submit your documents, and SBI will handle the rest. Soon, you’ll be on your way to purchasing land and building your home.

- Visit the official SBI Home Loan Application Form.

Form A – Personal Details: Fill in your personal details such as name, date of birth, PAN, contact information, KYC, and marital status.

Form B – Employment & Income: Provide your employment status and income details to assess your loan repayment ability.

Form C – Property & Loan Details: Enter specifics about the property and the loan amount, tenure, and other details.

Form D – Declaration: Read and sign the declaration to confirm your agreement.

- Submit Required Documents

After completing the application, gather the necessary documents. SBI offers a doorstep document collection service for your convenience.

- Application Processing

Once you submit all the required documents, SBI will process your application. Upon successful application approval, you will receive a loan sanction letter.

Suggested Read: Are NRIs Allowed to Buy an Agricultural Land in India?

Compare Top Banks Plot + Construction Loan Interest Rates

Looking for the best deal? Compare SBI’s 8.00% p.a. rate with top banks and NBFCs to find the perfect loan for your land and construction plans.

| Bank/ NBFCs | Interest Rates |

|---|---|

| SBI | 8.00% p.a. onwards |

| ICICI | 9.25% p.a. onwards |

| LIC Housing Finance | 8.20% p.a. onwards |

| IDFC First | 8.85% p.a. onwards |

| PNB Housing Finance | 9.75% p.a. onwards |

| HDFC Bank | 8.50% p.a. onwards |

Conclusion

Buying a plot and building your dream home is an exciting adventure, but managing the finances doesn’t have to be overwhelming. At Credit Dharma, we understand the importance of creating a space that truly reflects your lifestyle. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Typically, Plot + Construction Loans are provided for non-agricultural residential plots. Lenders usually require the land to be within municipal or local development authority limits. Agricultural land is generally not eligible for this type of loan.

EMIs typically commence after the construction is complete and the full loan amount is disbursed. However, some lenders may allow interest-only payments during the construction phase.

Yes, you can avail tax deductions under Section 80C for principal repayment and under Section 24(b) for interest paid. These benefits apply once the construction is complete and possession is taken.

Absolutely! If you own a plot and wish to construct a house, you can apply for a Construction Loan to fund the building process. Some lenders may even offer a top-up loan on your existing home loan for this purpose.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan