As West Bengal evolves, so do its legal and fiscal frameworks. Every property purchase in West Bengal comes with the additional expense of stamp duty and registration charges. These charges not only give legal recognition to the transaction but also provide security and clarity for all parties involved.

This blog will walk you through the updated stamp duty and registration charges in West Bengal for 2025.

What Are Stamp Duty and Registration Charges?

Stamp Duty is a government tax you pay when buying or transferring property. It legally acknowledges the transaction and ensures the law recognizes the property transfer.

Registration Charges are fees you pay to officially register the property transaction with local authorities. This process records the transfer in public records, making your ownership legal and official.

Stamp Duty Charges in West Bengal 2025

| Location of Property | Property Worth up to Rs 1 crore | Property Worth over Rs 1 crore |

|---|---|---|

| Rural Area | 3% | 4% |

| Urban Area | 4% | 5% |

Registration Charges in West Bengal 2025

| Location of Property | Registration Charge |

|---|---|

| Rural Area | 1% |

| Urban Area | 1% |

Suggested Read: RERA Charges in West Bengal

What Are the Stamp Duty and Registration Charges in West Bengal by City?

| Location of the Property | Stamp Duty for Property Less than Rs 1 Crore | Stamp Duty for Property Above Rs 1 Crore | Registration Charges for Flat |

|---|---|---|---|

| Howrah | 4% | 5% | 1% |

| Kolkata | 4% | 5% | 1% |

| Siliguri | 4% | 5% | 1% |

| Durgapur | 4% | 5% | 1% |

| Kharagpur | 4% | 5% | 1% |

Suggested Read: How to Register Your Land in West Bengal?

Stamp Duty on Sale Deed and Other Documents in West Bengal 2025

| Instrument | Stamp Duty | Registration Fee |

|---|---|---|

| Power of Attorney: | ||

| – Market value ≤ Rs 30 lakh | Rs 5,000 | Nil |

| – Market value between Rs 30 lakh and Rs 60 lakh | Rs 7,000 | Nil |

| – Market value between Rs 60 lakh and Rs 1 crore | Rs 10,000 | Nil |

| – Market value between Rs 1 crore and Rs 1.5 crores | Rs 20,000 | Nil |

| – Market value between Rs 1.5 crores and Rs 3 crores | Rs 40,000 | Nil |

| – Market value > Rs 3 crores | Rs 75,000 | Nil |

| Partnership Deed: | ||

| – Up to Rs 500 | Rs 20 | Rs 7 |

| – Up to Rs 10,000 | Rs 50 | Rs 7 |

| – Up to Rs 50,000 | Rs 100 | Rs 7 |

| – Exceeding Rs 50,000 | Rs 150 | Rs 7 |

| Transfer of Lease: | ||

| – For government land (in favor of family members) | 0.5% of market value | Same as conveyance deed |

| – In all other cases | Same as conveyance duty on market value | Same as conveyance deed |

| Gift Deed: | ||

| – To family members | Rs 1,000* | Same as conveyance deed |

| – For others | Same as conveyance duty on market value | Same as conveyance deed |

| Sale Agreement: | ||

| – Market value ≤ Rs 30 lakh | Rs 5,000 | Rs 7 |

| – Market value between Rs 30 lakh and Rs 60 lakh | Rs 7,000 | Rs 7 |

| – Market value between Rs 60 lakh and Rs 1 crore | Rs 10,000 | Rs 7 |

| – Market value between Rs 1 crore and Rs 1.5 crores | Rs 20,000 | Rs 7 |

| – Market value between Rs 1.5 crores and Rs 3 crores | Rs 40,000 | Rs 7 |

| – Market value > Rs 3 crores | Rs 75,000 | Rs 7 |

Suggested Read: West Bengal Land Records

How to Pay Stamp Duty in West Bengal Online?

- Visit the West Bengal’s official “Directorate of Registration and Stamp Revenue“

- Under “e-Services” tab, click on “e-Payment and Refund”

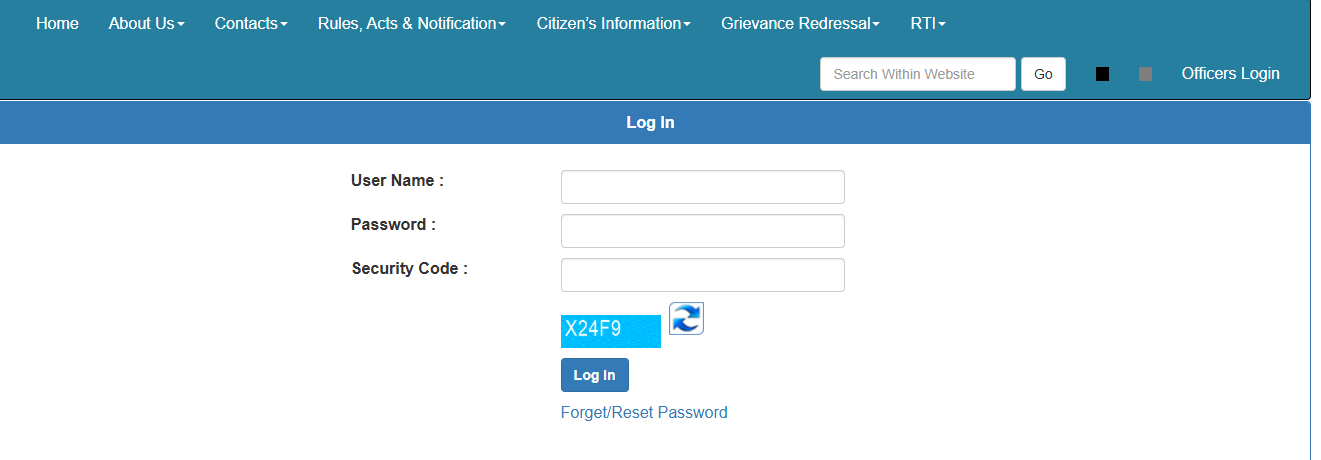

- Login/ Register using your user ID, password, and security code.

- Click on “e-Payment of Stamp Duty & Registration Fees”

- Provide the Query Number and Query Year. Click “Check Query Status” to proceed.

- You will be redirected to the West Bengal GRPS (Government Resource Planning System) Portal

- After successful payment, click on “Click Here to Download Challan”

Source of Information: West Bengal Stamp Duty Payment Official User Manual

How to Apply for a Refund of Stamp Duty and Registration Fees in West Bengal?

To get a refund on stamp duty and registration charges in West Bengal, follow these steps:

Online Process:

- Visit https://wbregistration.gov.in and go to the ‘E-Services’ tab.

- Click on ‘e-Payment and Refund’, then select ‘Application for Refund of e-Payment’ from the pop-up.

- Enter your query number, query year, and GRN number to search for payment details.

- If a refund is applicable, the amount will be credited to the bank account used for payment.

- Upload the following documents:

- E-challan (claimant’s copy)

- Copy of valuation report/query

- Original executed/partly executed document

- Proof of agreement cancellation

- Cancelled blank cheque

Offline Process:

- Submit the refund application form (Annexure A) at the registration office chosen in the e-Assessment form.

- Only the depositor can apply, and the claim must be made within three months of the online payment.

- Attach the required documents:

- E-challan (claimant’s copy)

- Copy of valuation report/query

- Original executed/partly executed document

- Proof of agreement cancellation

- Cancelled blank cheque

Suggested Read: Cost of Living in Kolkata

What Happens If You Don’t Pay Stamp Duty and Registration Charges in West Bengal?

- Penalty Amount: Ranges from 2% to 200% of the actual stamp duty and registration charges.

- Exception: No stamp duty or registration fee is applicable when property is transferred through a will.

Suggested Read: Home Loans in Kolkata

Exempted Properties from Stamp Duty in West Bengal

- Only land purchased by government departments is exempt from stamp duty and registration fees.

- All other property transactions are subject to stamp duty and registration charges as per government regulations.

Suggested Read: West Bengal Housing for All Initiative

How to File a Complaint for Stamp Duty and Registration Issues in West Bengal?

- Visit https://wbregistration.gov.in and go to the Grievance section.

- Select ‘Suggestion/Complaint Submission’ and fill in the required details:

- Name

- Address, Pin Code, State, District, City

- Mobile Number, Email ID

- Complaint or Suggestion in the provided box

- Upload supporting documents.

- Enter the captcha and click Submit.

All States Stamp Duty and Registration Charges 2025

| State | Stamp Duty -Male | Stamp Duty -Female | Registration Charges |

|---|---|---|---|

| Andhra Pradesh | 5% | 5% | 1% |

| Arunachal Pradesh | 6% | 6% | 1% |

| Assam | 6% | 5% | 8.50% |

| Bihar | 6.30% | 5.70% | 1% |

| Chhattisgarh | 5% | 4% | 1% |

| Goa | 3.5% – 5% | 3.5% – 5% | 1% |

| Gujarat | 4.90% | 4.90% | 1% |

| Haryana | 7% | 5% | 1% |

| Himachal Pradesh | 5% | 5% | 1% |

| Jharkhand | 4% | 4% | 1% |

| Karnataka | 2% – 5% | 2% – 5 | 1% |

| Kerala | 8% | 8% | 2% |

| Madhya Pradesh | 7.50% | 7.50% | 1% |

| Maharashtra | 6% | 5% | 1% |

| Manipur | 7% | 7% | 3% |

| Meghalaya | 9.90% | 9.90% | 1% |

| Mizoram | 9% | 9% | 1% |

| Nagaland | 8.25% | 8.25% | 1% |

| Odisha | 5% | 4% | 1% |

| Punjab | 4.75% | 2.75% | 1% |

| Rajasthan | 6% | 5% | 1% |

| Sikkim | 5% | 5% | 1% |

| Tamil Nadu | 4% | 4% | 2% |

| Telangana | 5% | 5% | 1% |

| Tripura | 5% | 5% | 1% |

| Uttarakhand | 5% | 3.75% | 1% |

| Uttar Pradesh | 7% | 5% | 1% |

| West Bengal | 6% – 7% | 6% – 7% | 1% |

| Delhi | 6% | 4% | 1% |

| Daman & Diu | 6% | 4% | 0.50% |

| Jammu and Kashmir | 7% | 3% | 1.20% |

Get a Home Loan

with Highest Eligibility

& Best Rates

Conclusion

In Haryana, understanding and complying with stamp duty and registration charges is vital to ensure a smooth property transaction. If you’re looking for a home loan in Haryana, Credit Dharma is here to help. With expert guidance and competitive financing options, we can simplify your journey to home ownership.

Frequently Asked Questions

No, the 2% stamp duty rebate was discontinued effective July 1, 2024.

The cost of stamp paper in West Bengal varies depending on the transaction type and value. For example, an affidavit requires a stamp duty of ₹10. Detailed rates for various documents are available on the official website.

Stamp duty rates vary across India; as of recent data, states like Kerala and Maharashtra have some of the higher rates, around 8%.

The Indian Stamp Act of 1899, along with state-specific amendments, governs stamp duties in West Bengal.

To calculate the registration cost, multiply the property’s market value by 1%, as this is the standard registration fee rate in West Bengal.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan