For many families, a home feels within reach only when monthly payments stay manageable. Tata Capital’s Affordable Home Loan trims interest costs and stretches tenure, letting the EMI sit comfortably alongside everyday expenses.

Tata Capital Affordable Home Loan Highlights

Here are the core figures—interest rate, loan amount, and tenure—so you can quickly judge whether this loan fits your budget.

| Aspect | Highlights |

|---|---|

| Interest Rates | 10.10% p.a. |

| Loan Amount | ₹2 Lakh Onwards |

| Tenure | Up to 30 Years |

Suggested Read: West Bengal’s Housing for All Initiative

Tata Capital Affordable Home Loan Interest Rates

Knowing the starting rate lets you estimate your EMI and decide if the loan aligns with your financial plans.

| Aspect | Interest Rates |

|---|---|

| Tata Capital Affordable Home Loan | 10.10% p.a. onwards |

Tata Capital Affordable Home Loan Eligibility Criteria

Confirm that you meet these conditions first, because only eligible borrowers can enjoy the scheme’s subsidy benefits.

| Eligibility Criteria | What it means for the applicant |

|---|---|

| No existing pucca house | You (or any family member) must not already own a permanent (pucca) residential property anywhere in India. |

| Single loan per married couple | For a married couple, only one subsidised loan can be taken—either in one spouse’s name or jointly. |

| No prior housing subsidy | You must not have previously received central or state assistance under any government housing scheme. |

Suggested Read: India’s Affordable Housing Schemes

Tata Capital Affordable Home Loan Processing Fees

Understand the processing fees upfront, as they affect your out-of-pocket cost before the loan is even disbursed.

| Fees Category | Charges Applicable |

|---|---|

| Salaried | Starting @ 0.10% of Loan Amount + GST |

| Self Employed | Starting @ 0.20% of Loan Amount + GST |

Suggested Read: Best Cities for Affordable Housing in India

Tata Capital Affordable Home Loan Other Charges

Review every potential fee—from late-payment penalties to foreclosure costs—so that no hidden charges catch you off guard.

| Categories | Salaried | Self Employed |

|---|---|---|

| Foreclosure Charges | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds |

| Delayed EMI Payments | 2.00% P.M. (24.00% P.A.) on the defaulted amount | 2.00% P.M. (24.00% P.A.) on the defaulted amount |

| Cheque Dishonour Charges/ Rejection of NACH/ECS Mandate | Rs 700/- per instrument per process | Rs 700/- per instrument per process |

Suggested Read: DDA Sasta Ghar Scheme

Tata Capital Affordable Home Loan Documents Required

Gather these documents in advance, because complete paperwork speeds up approval and funding.

General Documents

General documents form the foundation of your Tata Capital home loan application. These essential papers verify your identity, employment status, and residential address, ensuring that all applicants meet the basic eligibility criteria set by Tata Capital.

| Document Category | Accepted Documents |

|---|---|

| A. Age Proof | – Life Insurance Policy – PAN Card – Passport – Birth Certificate – Driving License – School Leaving Certificate |

| B. Photo Identity Proof | – Aadhaar Card – Voter ID – PAN Card – Driving License – Passport |

| C. Address Proof | – Bank Statements – Property Tax Receipt – Voter ID – Utility Bills – Property Registration Documents |

Income Proof

Income proof documents are important for assessing your ability to repay the home loan.

| Applicant Type | Employment / Business Proof | Income Proof |

|---|---|---|

| Salaried | – Appointment Letter – Yearly Increment Letter | – Salary Slips (last 3 months) – Salary Bank Account Statements (last 12 months) – Certified true copy of Form 16 |

| Self-Employed | – Business Profile on letterhead – Business Registration Certificate | – Income Tax Returns (last 2 years) – P&L Projection Statement (last 2 years) – Operative Current Account Statement (last 12 months) – CC/OD Bank Statements (last 12 months, if applicable) |

| NRIs | – Appointment Letter or Previous Employment History | – Pay Slips (last 6 months) – Overseas Salary Account Statements – NRE/NRO Bank Statements (last 12 months) |

Property Documents

Property documents establish the legitimacy and value of the property you intend to purchase. These papers ensure that the investment is secure and compliant with all regulatory standards.

| Property Documents |

|---|

| Permission for construction (where applicable) |

| Registered Agreement for Sale (only for Maharashtra)/Allotment Letter/Stamped Agreement for Sale |

| Occupancy Certificate (in case of ready to move property) |

| Share Certificate (only for Maharashtra), Maintenance Bill, Electricity Bill, Property Tax Receipt |

| Approved Plan copy (Xerox Blueprint) & Registered Development Agreement of the builder, Conveyance Deed (For New Property) |

| Payment Receipts or bank A/C statement showing all the payments made to Builder/Seller |

Suggested Read: Karnataka’s Gruha Jyothi Initiative

How to Apply for Tata Capital Affordable Home Loan?

You can finish the entire process online: fill out the application, upload your documents, and wait for the e-sanction to arrive.

Step-by-step online application process for Tata Capital Home Loans:

- Visit the Tata Capital official website.

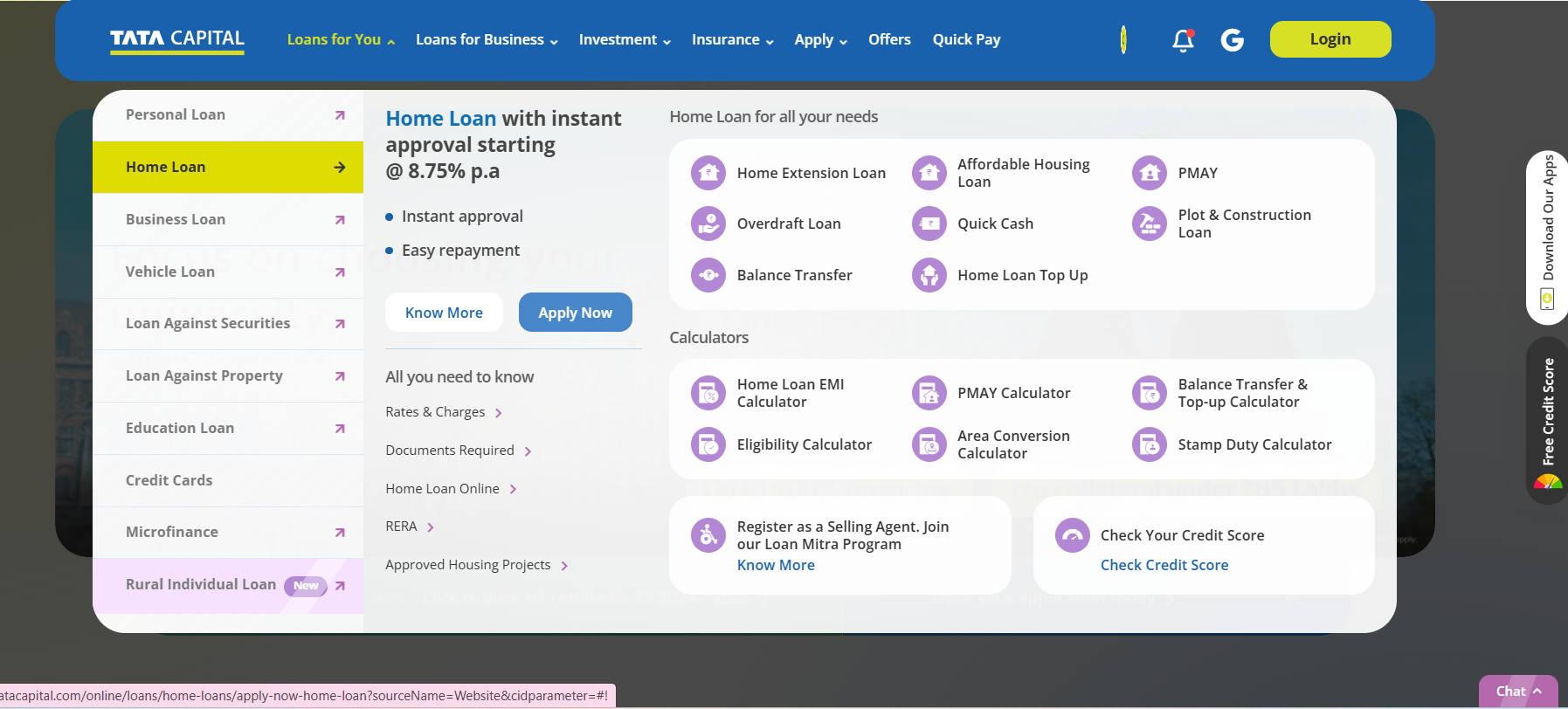

- Navigate to the “Loans for You” tab. From the dropdown menu, select “Affordable Home Loan > Apply Now” to begin your application.

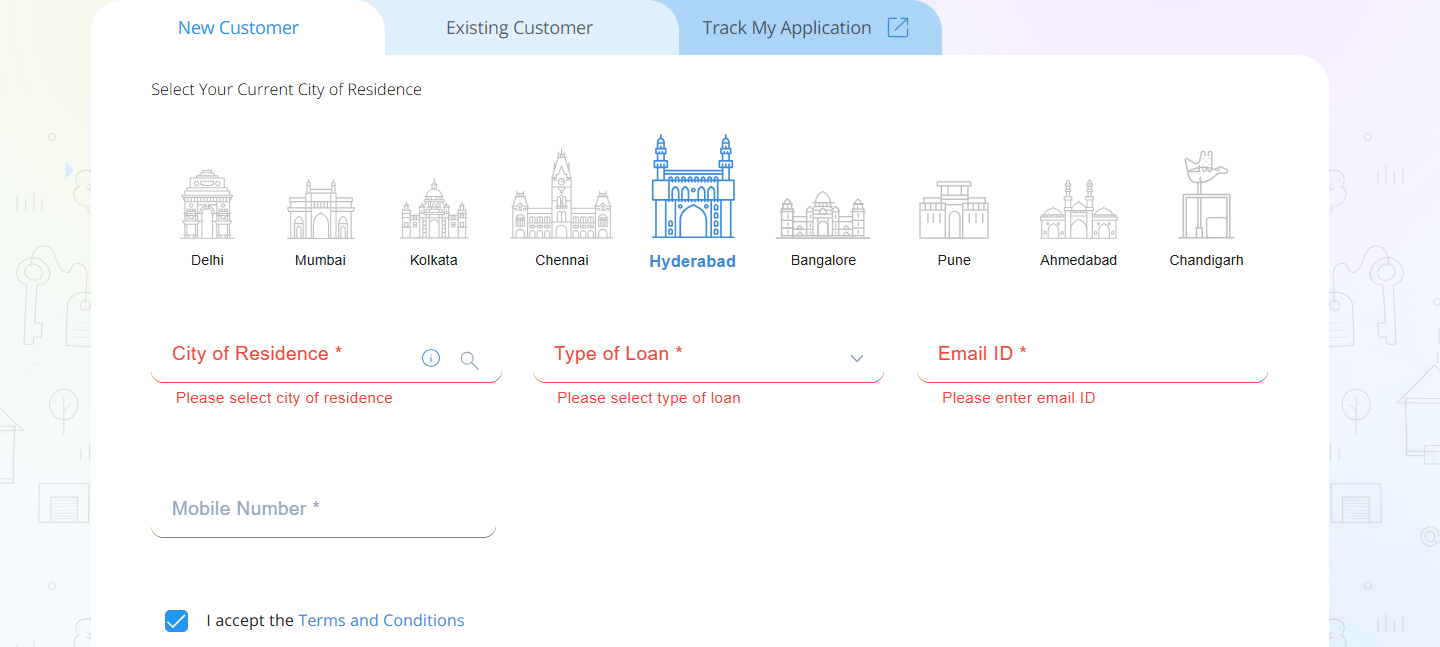

- Fill in the required details in the online home loan application form. Once done, enter the OTP to proceed.

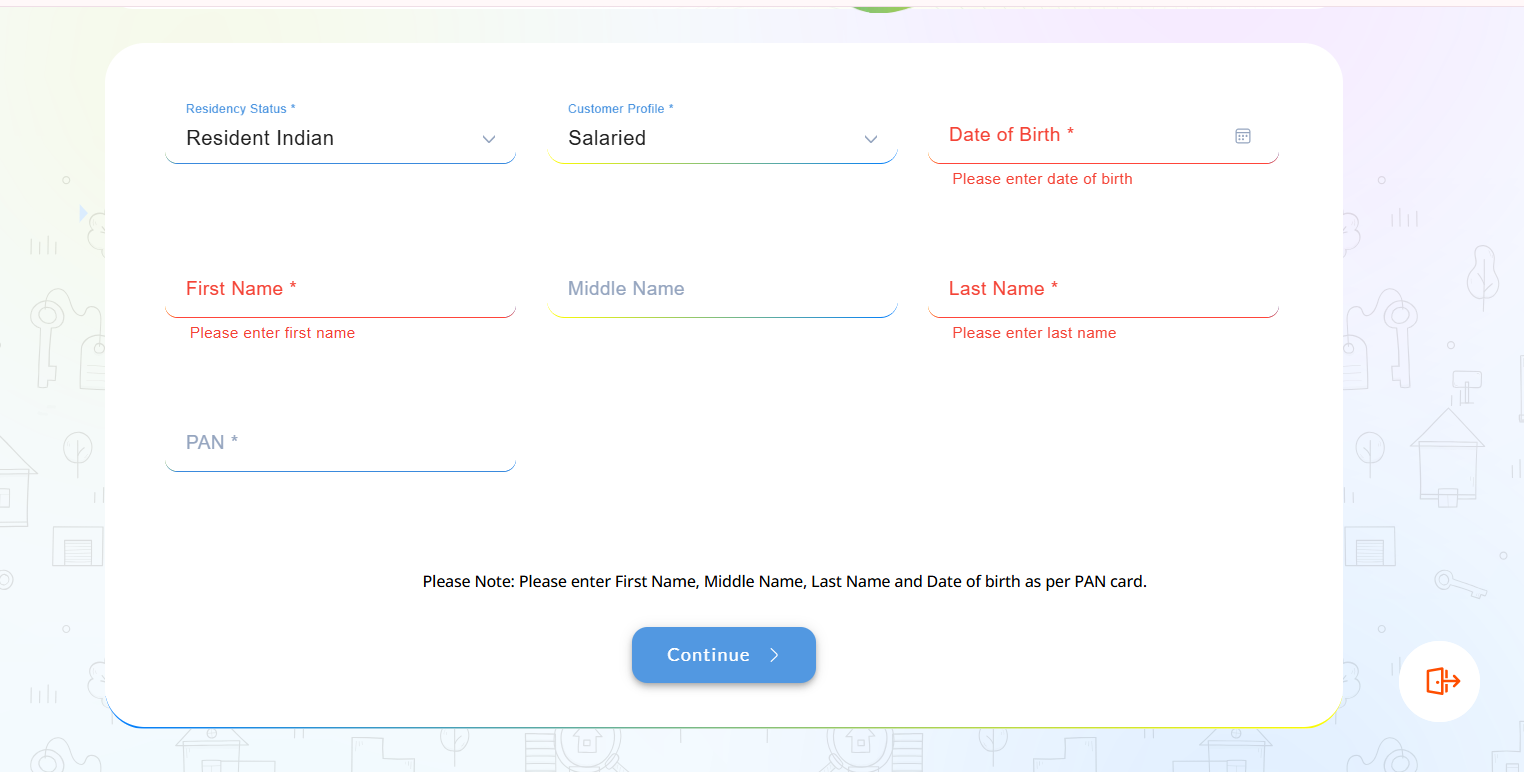

- Provide your basic information and click “Continue” to move to the next step.

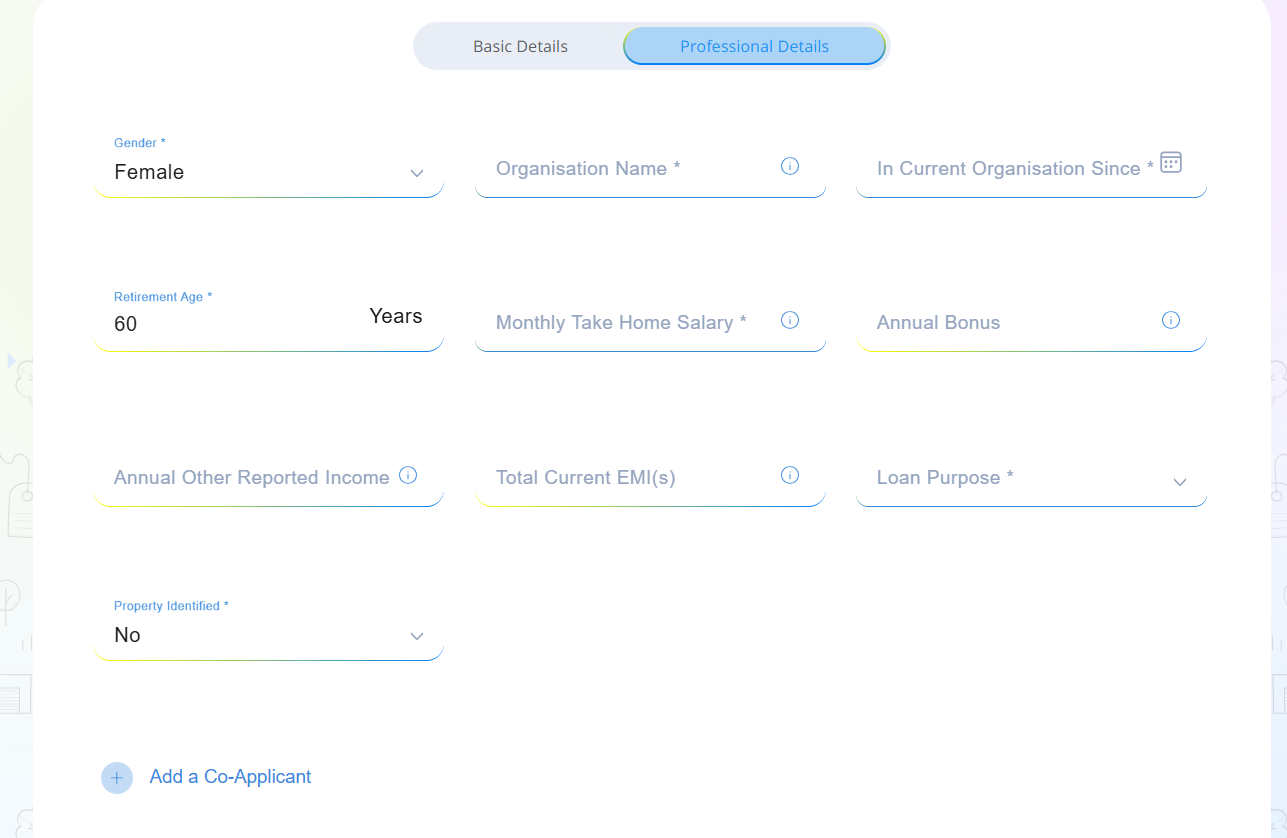

- Fill in your professional details and, if applicable, add your co-applicant information.

- Upload all the necessary financial documents for verification.

- If you qualify, you will receive an e-sanction for your loan.

Suggested Read: Gen Z’s Early Entry into Real Estate Market

Compare Top Banks Home Loan Interest Rates

Placing different lenders’ rates side by side helps you pick the option that keeps your EMIs light and manageable.

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 8.50% p.a. onwards | 8.5% p.a. onwards | 8.50% p.a. onwards |

| HDFC Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| LIC Bank | 8.50% – 10.35% p.a. | 8.50% – 10.55% p.a. | 8.50% – 10.75% p.a. |

| ICICI Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Kotak Mahindra Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Punjab National Bank | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. |

| Bank Of Baroda | 8.40% – 10.65% p.a. | 8.40% – 10.65% p.a. | 8.40% – 10.90% p.a. |

| Bajaj Housing Finance | 8.50% p.a. onwards | 8.50% p.a. onwards | 8.50% p.a. onwards |

| Axis Bank | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. |

| Bank of India | 8.40% p.a onwards | 8.40% p.a onwards | 8.40% p.a onwards |

| TATA Capital | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Interest rates start from 10.10% per annum. Eligible borrowers under the Pradhan Mantri Awas Yojana (PMAY) scheme can avail further subsidies, potentially reducing rates to as low as 4%.

You can borrow from ₹2 lakhs onwards, with a maximum tenure of up to 30 years, allowing for flexible repayment options.

The loan is designed for individuals from low- and middle-income groups. Eligibility criteria include a minimum monthly income of ₹30,000 for salaried individuals and at least 3 years of business continuity for self-employed applicants.

Yes, Tata Capital’s Affordable Housing Loan is aligned with the PMAY scheme, offering eligible borrowers interest subsidies, thereby reducing the overall loan burden.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan