When life calls for a little extra, Tata Capital Home Loan Top-Up is here to help. Whether you want to build an extension, or upgrade your interiors, top-up loan offer the perfect solution. With an easy application process and minimal additional paperwork, you can quickly access the funds you need.

Tata Capital Home Loan Top Up Highlights

Here’s a quick overview of the key features—interest rates, loan amounts, and fees—so you can decide if the home loan top-up is the right choice for you.

| Category | Highlights |

|---|---|

| Interest Rates | 8.75% p.a. onwards |

| Tenure | Up to 30 years |

| Loan Amount | Up to ₹7.5 Crore |

| Processing Fees | 3% of the Loan Amount + GST |

Tata Capital Home Loan Top Up Interest Rates 2025

Check out the interest rates for home loan top-ups in 2025 to get an idea of your potential EMI and costs.

| Employment Type | Interest Rates |

|---|---|

| Salaried Individuals | 8.75% p.a. onwards |

| Self Employed Professionals | 8.85% p.a. onwards |

Suggested Read: Tata Capital Home Loan Interest Rates 2025

Tata Capital Home Loan Top Up Eligibility Criteria

Find out the basic eligibility requirements, such as age, income, and existing home loan status, before applying for a top-up loan.

| Eligibility Criteria | Details |

|---|---|

| Existing Customer | Must have taken a loan for a house from Tata Capital. |

| Payment History | Your home loan payment history should be free from outstanding dues or defaults on EMIs. |

| Credit Score | You should have a good credit score, preferably over 750. |

Suggested Read: Tata Capital Home Loan Customer Care

Tata Capital Home Loan Top Up Documents Required

Ensure you have all the necessary documents ready, from identity proof to income statements, to make the top-up application process smooth.

Documents Applicable to All Applicants:

| Document | Details |

|---|---|

| Employer Identity Card | Provided by employer for identity verification. |

| Completed Loan Application | Must be filled and submitted for loan processing. |

| 3 Passport Size Photographs | Required for official records. |

| Proof of Identity | Voter’s ID card, Passport, Driving License, IT PAN card (photocopies). |

| Proof of Residence | Recent Telephone Bill, Electricity Bill, Property Tax Receipt, Passport, Voter’s ID card (photocopies). |

| Proof of Business Address | Required for non-salaried individuals. |

| Statement of Bank Account/Pass Book | Last six months’ statement or passbook for financial verification. |

| Signature Identification | From current bankers for identity verification. |

| Personal Assets and Liabilities Statement | Financial statement to assess financial stability. |

Suggested Read: Tata Capital Travel and Home Insurance

Documents for Guarantor (Where Applicable):

| Document |

|---|

| Personal Assets and Liabilities Statement |

| 2 Passport Size Photographs |

| Proof of Identification |

| Proof of Residence |

| Proof of Business Address |

| Signature Identification |

Also Read: Property Documents for Home Loans: NRI vs Indians

Additional Documents for Salaried Individuals:

| Document | Details |

|---|---|

| Original Salary Certificate | Issued by employer to confirm salary details. |

| TDS Certificate on Form 16 or IT Returns | For the last two financial years. |

Suggested Read: How Long Does Home Loan Disbursement Take After Approval?

Additional Documents for Professionals/Self-Employed/Other IT Assesses:

| Document |

|---|

| Acknowledged Copies of 3 Years I.T. Returns/Assessment Orders |

| Photocopies of Challans for Advance Income Tax Payment |

Tata Capital Home Loan Top Up Processing Fees

Understand the processing fees involved so you can factor them into your overall cost when opting for a home loan top-up.

| Fees Type | Charges |

|---|---|

| Processing Fees | 3% of the Loan Amount + GST |

Suggested Read: Tata Capital Home Loan Statement Download

Tata Capital Home Loan Top Up Other Charges

Be aware of any extra charges, such as prepayment penalties or overdue fees, that may apply to your home loan top-up.

| Categories | Salaried | Self Employed |

|---|---|---|

| Foreclosure Charges | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds |

| Delayed EMI Payments | 2.00% P.M. (24.00% P.A.) on the defaulted amount | 2.00% P.M. (24.00% P.A.) on the defaulted amount |

| Cheque Dishonour Charges/ Rejection of NACH/ECS Mandate | Rs 700/- per instrument per process | Rs 700/- per instrument per process |

Suggested Read: Tata Capital Home Loan Repayment Options

How to Apply for Tata Capital Home Loan Top Up?

The application process is easy—simply fill in your details, upload the required documents, and get started on your loan top-up.

- Visit the Tata Capital official website.

- Navigate to the “Loans for You” tab. From the dropdown menu, select “Home Loan Top Up > Apply Now” to begin your application.

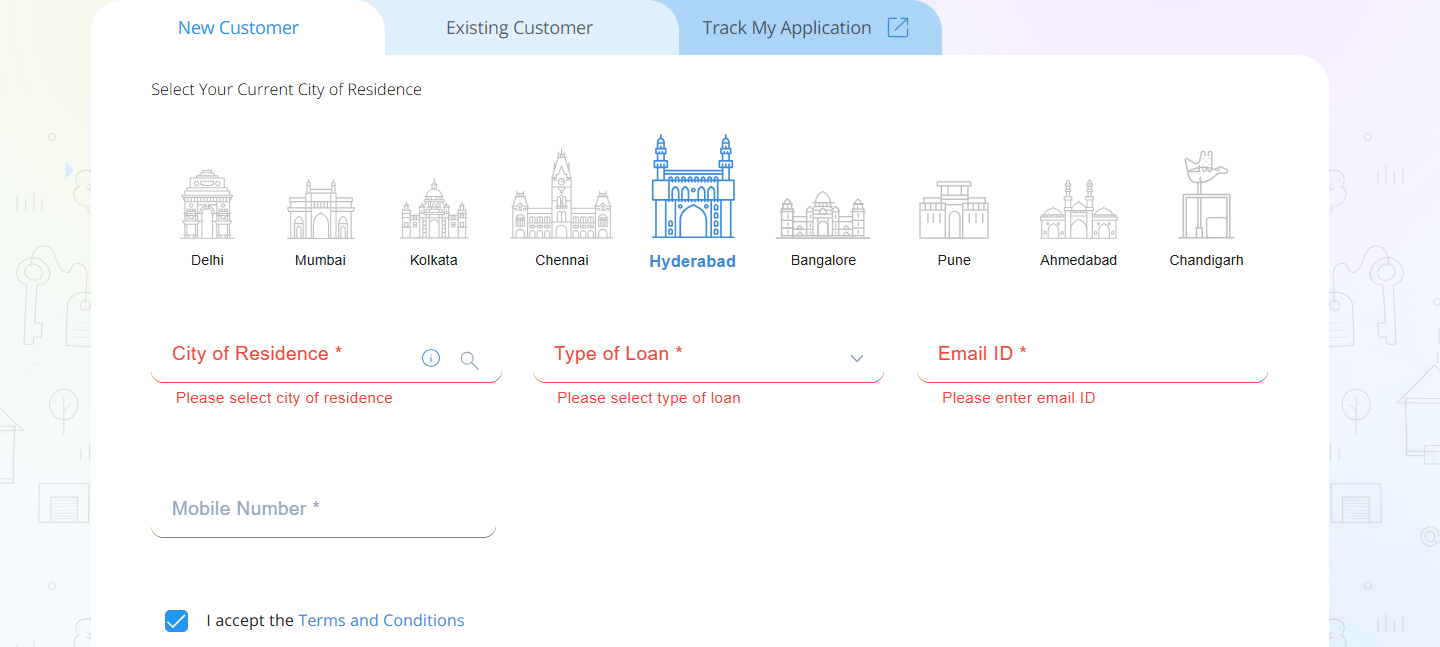

- Fill in the required details in the online home loan application form. Once done, enter the OTP to proceed.

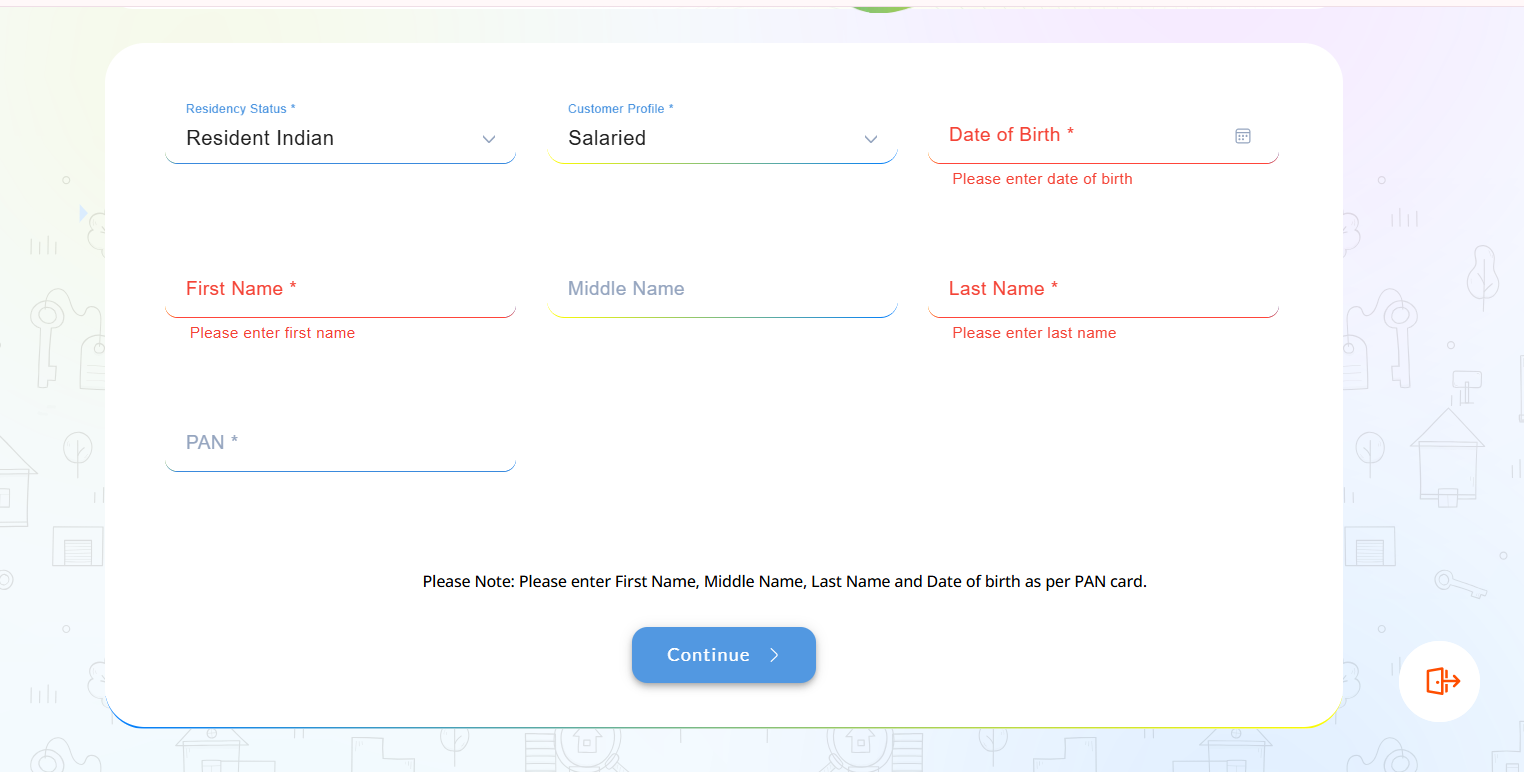

- Provide your basic information and click “Continue” to move to the next step.

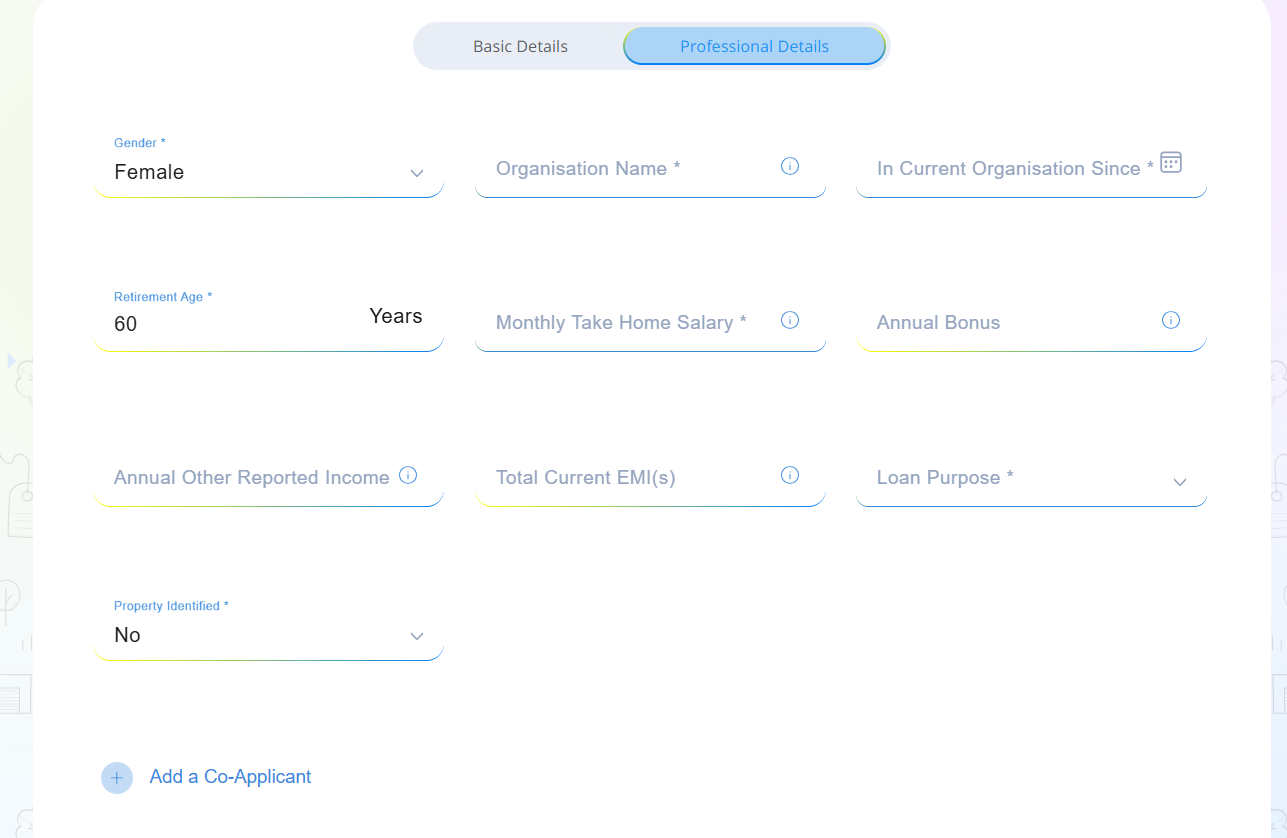

- Fill in your professional details and, if applicable, add your co-applicant information.

- Upload all the necessary financial documents for verification.

- If you qualify, you will receive an e-sanction for your loan.

Suggested Read: Check Tata Capital Home Loan Application Status

Compare Top Bank Home Loan Home Loan Top Up

Explore home loan top-up offers from different banks to find the best deal that fits your needs.

| Bank | Interest Rate (p.a.) |

|---|---|

| State Bank of India | 8.00% onwards |

| HDFC Bank | 8.70% – 9.55% |

| ICICI Bank | 8.75% onwards |

| Axis Bank | 8.75% – 12.80% |

| Kotak Mahindra Bank | 8.65% onwards |

| Punjab National Bank | 8.50% onwards |

| Bank of Baroda | 8.40% onwards |

Conclusion

Accessing extra funds for your home shouldn’t feel stressful. At Credit Dharma, we understand the need to unlock your property’s value to meet new financial goals. Whether it’s for renovations, education, or other priorities, our team offers expert guidance and customized solutions to simplify your home loan top-up process, ensuring a smooth and efficient experience.

From eligibility checks to final disbursal, we provide end-to-end assistance. Enjoy clear, honest communication at every stage, with no hidden charges or unexpected hurdles.

Frequently Asked Questions

Existing home loan borrowers with a good repayment track record and a satisfactory credit score are typically eligible for a top-up loan.

Funds from a top-up loan can be used for personal or professional needs, such as home renovation, education, medical expenses, or debt consolidation.

The loan amount varies based on the lender’s policies, your repayment capacity, and the value of the property. Some lenders offer up to 100% of the existing home loan amount.

The tenure for a top-up loan is usually aligned with the remaining tenure of your existing home loan, up to a maximum of 20 years.

Yes, a top-up loan is secured against your property and typically offers lower interest rates and longer tenures compared to unsecured personal loans.

Transferring a top-up loan to another lender is possible through a balance transfer, subject to the new lender’s policies.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan