Life doesn’t wait. Neither should your finances. Whether it’s a startup idea, a home makeover, or an urgent bill, Tata Capital’s Loan Against Property has your back. Up to ₹10 Crore at 9.00% p.a., repayable over 20 years. Your property stays yours—no strings attached. Quick, hassle-free, and zero asset loss.

Tata Capital Loan Against Property Highlights

Thinking about leveraging your property? This snapshot gives you the key numbers in one glance.

| Category | Details |

|---|---|

| Rate of Interest | 9.00% p.a. onwards |

| Loan Amount | Up to ₹10 Crore |

| Tenure | 20 Years |

| Processing Fees | 1% to 3% of the loan amount + GST |

Suggested Read: How to Get a Loan Against Airbnb Property?

Tata Capital Loan Against Property Interest Rates 2025

The right interest rate can make a big difference in how affordable your loan is. Here’s a break down of Tata Capital’s interest rates for Loan Against Property and help you understand how they fit into your financial goals.

| Categories | Interest Rate |

|---|---|

| Floating Rate | 9% p.a. – 17% p.a. |

| Fixed Rate | 13% p.a. – 17% p.a. |

Suggested Read: Home Loan vs. Loan Against Property

Tata Capital Loan Against Property: Eligibility Criteria

From minimum income requirements to property valuation—here’s what Tata Capital looks for before approving your Loan Against Property.

| Aspects | Salaried | Self Employed (Professionals) | Self Employed (Individuals) |

|---|---|---|---|

| Age | 23 – 65 Years | 23 – 70 Years | 23 – 70 Years |

| Work Background | MNC/ Public/ Large Pvt./ State Govt./ Central Govt./ PSU | Doctors, Architects, Chartered Accountants | Traders, Retailers, and Wholesalers |

| Income | NA | Rs 2,50,000 | Rs 2,50,000 |

| Minimum Work Experience | 3 Years | 3 Years | 3 Years |

Suggested Read: Loan Against Agricultural Land

Tata Capital Loan Against Property: Processing Fees

If you’re considering a Loan Against Property (LAP) from Tata Capital, here’s what you need to know about processing fees:

| Loan Type | Processing Fees |

|---|---|

| Residential and Commercial Properties | 1% to 3% of the Loan Amount + GST |

| Other Properties | 1.25% to 3% of the Loan Amount + GST |

| SaRaL/ Mint Loan | 1.25% to 3% of the Loan Amount + GST |

Suggested Read: Can You Get a Loan Against Property Without Property Documents?

Tata Capital Loan Against Property: Other Fees and Charges

Small extras like cheque penalties or statements can add up; stay aware of every rupee.

| Category | Charges |

|---|---|

| Default in payment | 3% per month on overdue amount |

| Dishonour of cheque/payment instruments | ₹600 for every dishonoured cheque/payment instrument |

| Mandate Rejection Service Charge | ₹450 + GST |

| Annual Maintenance Charges (Dropline) | ₹10,000 |

| LOD Statement Charges | ₹1000 per request |

| Statement of Accounts | ₹250 + GST (hard copy) for branch walk-in, free online |

| Foreclosure Report | Nil |

| Payment Instrument Swapping Charges | ₹550 + GST per instance |

| Duplicate Repayment Schedule | ₹550 + GST per instance |

| Duplicate NOC | ₹550 + GST |

Suggested Read: LAP Tax Benefits

Tata Capital Loan Against Property: Documents Required

Having the right papers ready speeds up approval—here’s what you’ll need.

For Salaried Employees

A few payslips, ID proofs, and property documents usually do the trick.

| Category | Documents |

|---|---|

| Photograph | Recent Passport-Sized Photograph |

| Photo Identity Proof | Voter ID, Passport, Driving License, or Aadhaar Card |

| PAN/Tax Document | PAN Card or Form 60 (if applicable) |

| Address Proof | Voter ID, Passport, Driving License, or Aadhaar Card |

| Signature Verification | Signature Verification Document |

| Income Proof | Form 16 for the last 2 years, Bank statements for the last 12 months |

| Salary Proof | Copy of your salary slips for the last three months |

For Self Employed Individuals/ Professionals

Tax returns and business statements tell your financial story to the lender.

| Category | Documents |

|---|---|

| Photograph | Recent Passport-Sized Photograph |

| Photo Identity Proof | Voter ID, Passport, Driving License, or Aadhaar Card |

| PAN/Tax Document | PAN Card or Form 60 (if applicable) |

| Address Proof | Voter ID, Passport, Driving License, or Aadhaar Card |

| Signature Verification | Signature Verification Document |

| Income Proof | Income Tax Return, Profit and Loss, Balance Sheet, Bank statements for the last 12 months |

Suggested Read: Can You Claim HRA without Rent Agreement?

How to Apply for Tata Capital Loan Against Property?

The online journey is quick—fill the form, upload documents, and await e-sanction.

- Visit the Tata Capital official website.

- Navigate to the “Loans for You” tab. From the dropdown menu, select “Home Loan > Apply Now” to begin your application.

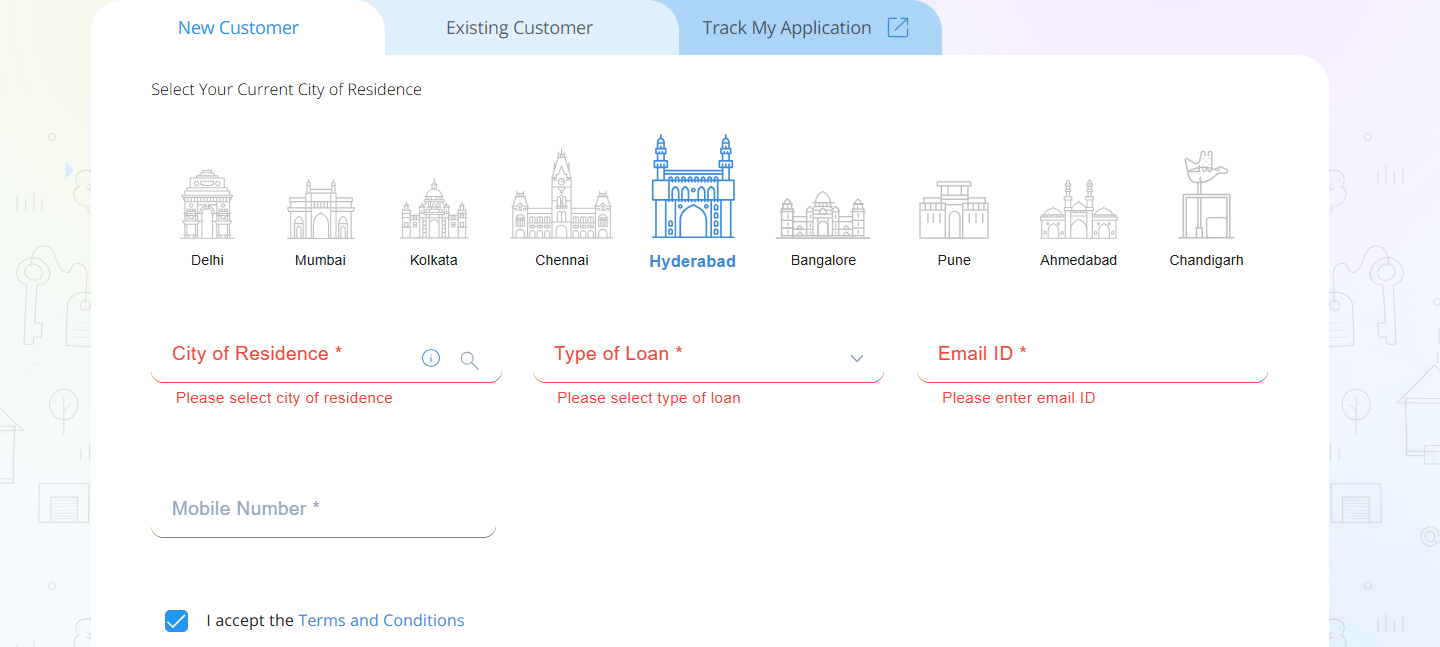

- Fill in the required details in the online home loan application form. Once done, enter the OTP to proceed.

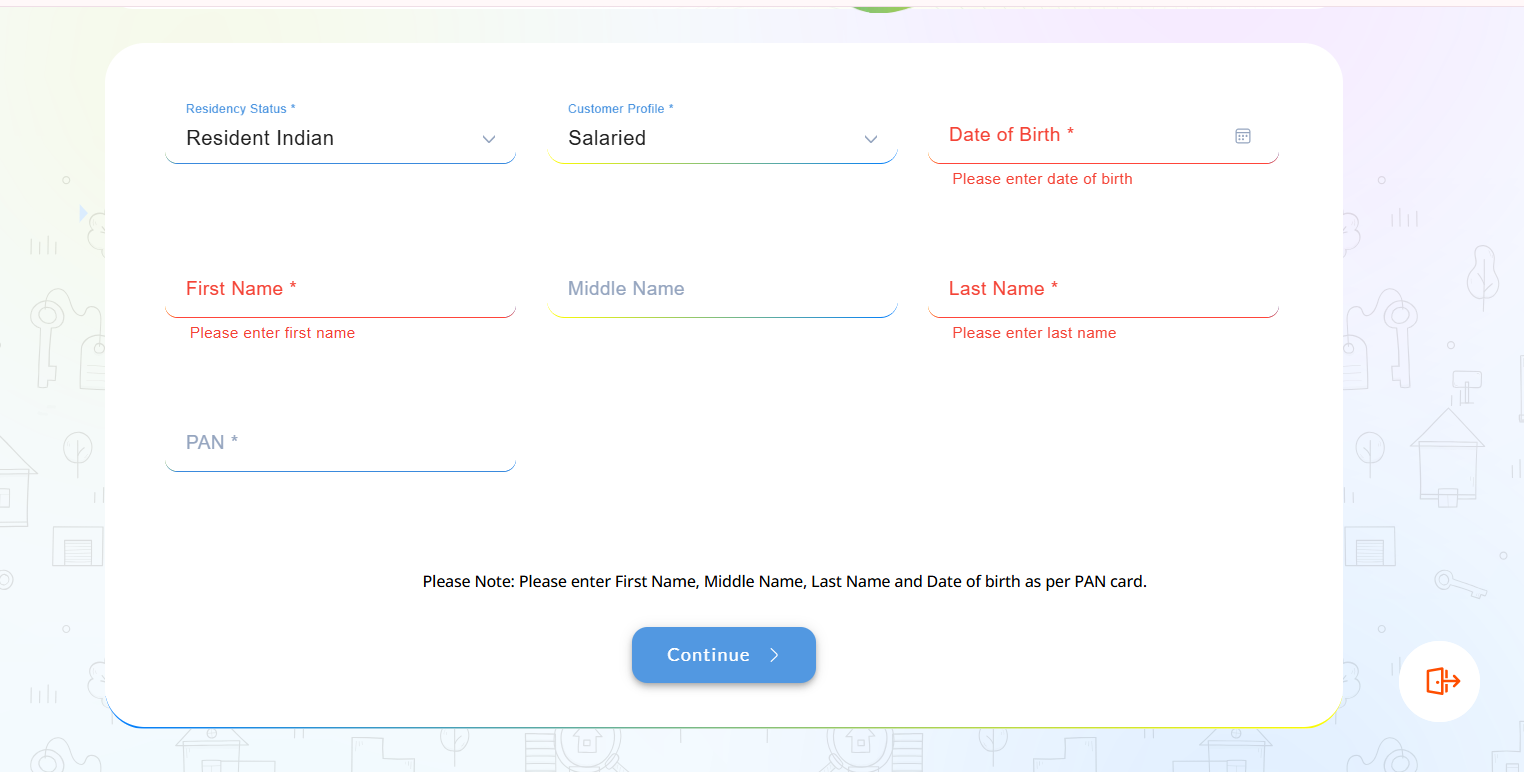

- Provide your basic information and click “Continue” to move to the next step.

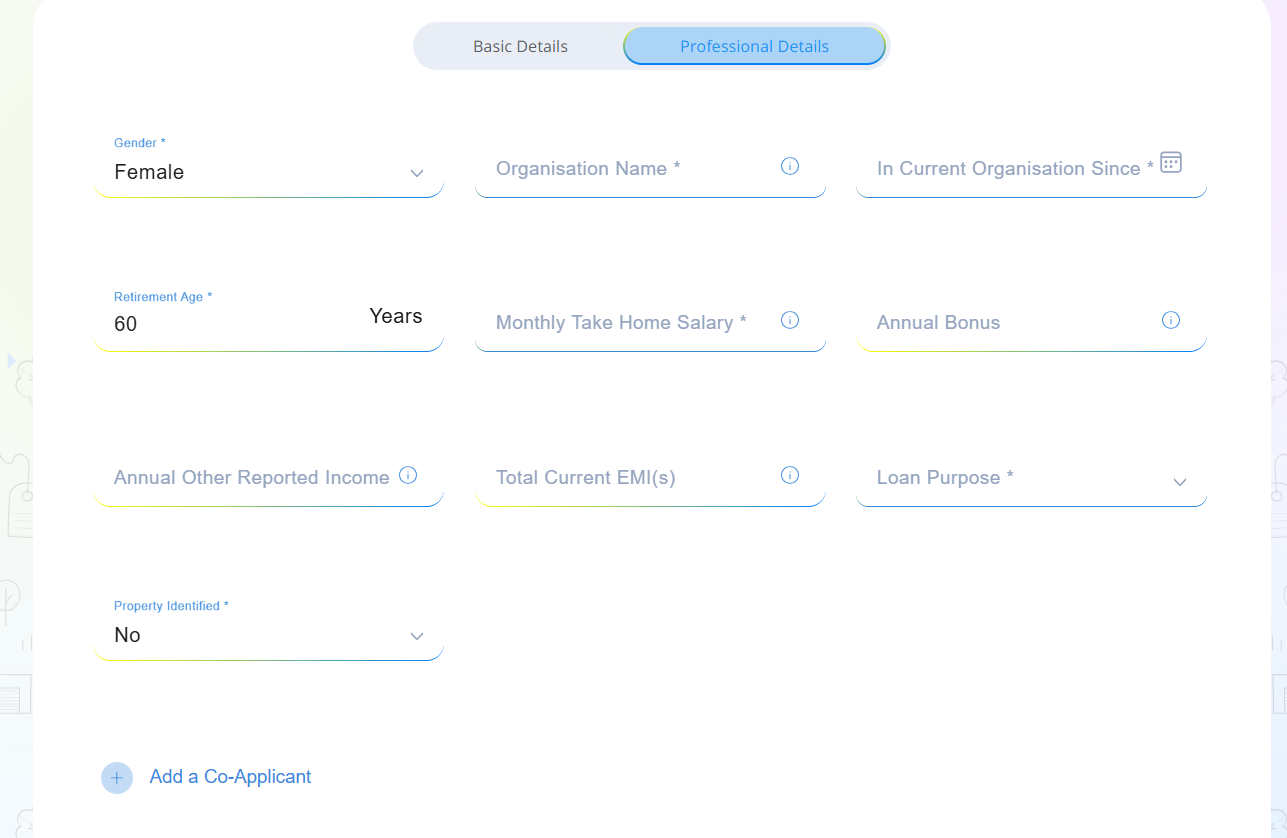

- Fill in your professional details and, if applicable, add your co-applicant information.

- Upload all the necessary financial documents for verification.

- If you qualify, you will receive an e-sanction for your loan.

Suggested Read: Mutual Funds vs. Rental Income

Compare Top Banks Loan Against Property Interest Rates

Comparing loan against property interest rates from leading banks helps you identify affordable financing options. Get a clearer view of each lender’s terms and choose the best home loan that matches your budget and financial goals.

| Banks/ NBFCs | Rate of Interest | Maximum Loan Amount |

|---|---|---|

| SBI | 10.60% p.a. – 11.30% p.a. | Rs. 7.5 Crore |

| HDFC | 9.50% p.a. – 11.00% p.a. | 65% of the market value of the property |

| IDFC | 9.25% p.a. onwards | 50% – 70% of the market value of the property |

| Tata Capital | 14.25% p.a. onwards | Depending on the market value of the property |

| Axis Bank | 10.50% p.a. – 10.90% p.a. | Rs. 5 Crore |

| Kotak Mahindra Bank | 9.50% p.a. onwards | Rs. 5 Crore |

| Bank of India | 10.10% p.a. Per lakh | Rs. 5 Crore |

| LIC Housing Finance | 9.70% p.a. – 11.55% p.a. | Rs. 2 lakhs onwards |

| PNB Housing Finance | 9.24% p.a. – 12.75% p.a. | 70% of the market value of the property |

| ICICI Bank | 10.85% p.a. – 12.50% p.a. | 75% of the market value of the property |

Suggested Read: Why is 11 Month Rent Agreement the Standard?

Conclusion

Taking a loan against property is a big step. Putting your property as collateral can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Tata Capital offers competitive interest rates starting from 9% per annum for floating rates and between 13%–17% for fixed rates.

You can avail a loan amount of up to ₹10 crore, depending on your property’s market value and your eligibility.

The loan tenure can extend up to 20 years (240 months), offering flexible repayment options tailored to your needs.

Tata Capital accepts residential, commercial, industrial properties, and land/plots as collateral, provided they are self-owned and free from legal disputes.

No, insurance is not mandatory. However, it’s recommended to safeguard against unforeseen circumstances.

Yes. For floating rate loans used for non-business purposes, there are no prepayment charges. For business purposes, charges may apply: 6% within 12 months and 4% after 12 months of disbursement.

The loan amount is primarily based on the property’s market value, with lenders typically offering between 50% and 75% of this value.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan