Building your dream home doesn’t have to feel impossible. With Tata Capital’s Plot and Construction Loan, you can buy the land and fund the construction without any hassle. Tata Capital understands how important this milestone is, and their loans come with simple terms, competitive rates, and the flexibility you need to get started with ease.

Tata Capital Plot and Construction Loan Highlights

Get a quick overview of the key details like loan amount, interest rates, and processing fees to decide if this loan meets your needs.

| Categories | Highlights |

|---|---|

| Interest Rates | 8.75% p.a. onwards |

| Loan Amount | ₹5 Lakh to ₹5 Crore |

| Tenure | 30 Years |

| Processing Fees | Up to 3% of the Loan Amount + GST |

Suggested Read: Plot Loan vs. Home Loan

Tata Capital Plot and Construction Loan Interest Rates 2025

Check out the 2025 interest rates for Tata Capital’s plot and construction loans to better plan your repayment and EMIs.

| Aspects | Details |

|---|---|

| Salaried | 8.75% p.a. onwards |

| Self Employed | 8.85% p.a. onwards |

Suggested Read: Tata Capital Home Loan Interest Rates 2025

Tata Capital Plot and Construction Loan Eligibility Criteria

See if you meet the basic eligibility requirements like age, income, and property details before applying for the loan.

| Eligibility Criteria | Details |

|---|---|

| Age Requirement | Applicant should be between 24 to 65 years (at the time of loan completion). |

| Salaried Employees | Minimum monthly salary: ₹30,000 required. |

| Self-Employed Applicants | At least 3 years of experience in the same business. |

| NRIs | Minimum work experience: 3 years |

Suggested Read: How to Check Tata Capital Plot Loan Application Status?

Tata Capital Plot and Construction Loan Documents Required

Make your application process smooth by having the right documents ready, from identity proof to income statements.

Tata Capital Home Loan: General Documents

General documents form the foundation of your Tata Capital home loan application. These essential papers verify your identity, employment status, and residential address, ensuring that all applicants meet the basic eligibility criteria set by Tata Capital.

| Document Category | Accepted Documents |

|---|---|

| A. Age Proof | – Life Insurance Policy – PAN Card – Passport – Birth Certificate – Driving Licence – School Leaving Certificate |

| B. Photo Identity Proof | – Aadhaar Card – Voter ID – PAN Card – Driving License – Passport |

| C. Address Proof | – Bank Statements – Property Tax Receipt – Voter ID – Utility Bills – Property Registration Documents |

Tata Capital Home Loan: Income Proof

Income proof documents are important for assessing your ability to repay the home loan.

| Applicant Type | Employment/ Business Proof | Income Proof |

|---|---|---|

| Salaried | – Appointment Letter – Yearly Increment Letter | – Salary Slips (last 3 months) – Salary Bank Account Statements (last 12 months) – Certified true copy of Form 16 |

| Self-Employed | – Business Profile on letterhead – Business Registration Certificate | – Income Tax Returns (last 2 years) – P&L Projection Statement (last 2 years) – Operative Current Account Statement (last 12 months) – CC/OD Bank Statements (last 12 months, if applicable) |

| NRIs | – Appointment Letter or Previous Employment History | – Pay Slips (last 6 months) – Overseas Salary Account Statements – NRE/NRO Bank Statements (last 12 months) |

Tata Capital Home Loan: Property Documents

Property documents establish the legitimacy and value of the property you intend to purchase. These papers ensure that the investment is secure and compliant with all regulatory standards.

| Property Documents |

|---|

| Permission for construction (where applicable) |

| Registered Agreement for Sale (only for Maharashtra)/Allotment Letter/Stamped Agreement for Sale |

| Occupancy Certificate (in case of ready to move property) |

| Share Certificate (only for Maharashtra), Maintenance Bill, Electricity Bill, Property Tax Receipt |

| Approved Plan copy (Xerox Blueprint) & Registered Development Agreement of the builder, Conveyance Deed (For New Property) |

| Payment Receipts or bank A/C statement showing all the payments made to Builder/Seller |

Tata Capital Balance Transfer Documents

Transferring your existing home loan to Tata Capital can help you take advantage of better interest rates and favorable terms. To facilitate a smooth balance transfer process, you need to provide specific documents that verify your current loan details and financial standing.

| Balance Transfer Documents |

|---|

| KYC Documents |

| Home Loan Statements from Previous Bank |

| Bank Account Statement |

Suggested Read: Can NRIs Buy Agricultural Land in India?

Tata Capital Plot and Construction Loan Processing Fees

Know the processing fees upfront, so you’re not caught off guard by any additional costs.

| Fees Type | Charges |

|---|---|

| Processing Fees | 3% of the Loan Amount + GST |

Suggested Read: Loan Against Agricultural Land in India

Tata Capital Plot and Construction Loan Other Charges

Stay informed about any extra charges, such as late-payment fees or statutory costs, that could affect your loan repayment.

| Categories | Salaried | Self Employed |

|---|---|---|

| Foreclosure Charges | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds |

| Delayed EMI Payments | 2.00% P.M. (24.00% P.A.) on the defaulted amount | 2.00% P.M. (24.00% P.A.) on the defaulted amount |

| Cheque Dishonour Charges/ Rejection of NACH/ECS Mandate | Rs 700/- per instrument per process | Rs 700/- per instrument per process |

Suggested Read: Can You Build a House on Agricultural Land in India?

How to Apply to Tata Capital Plot and Construction Loan?

The application process is simple and fast—fill in your details online, upload your documents, and get started on your dream project.

- Visit the Tata Capital official website.

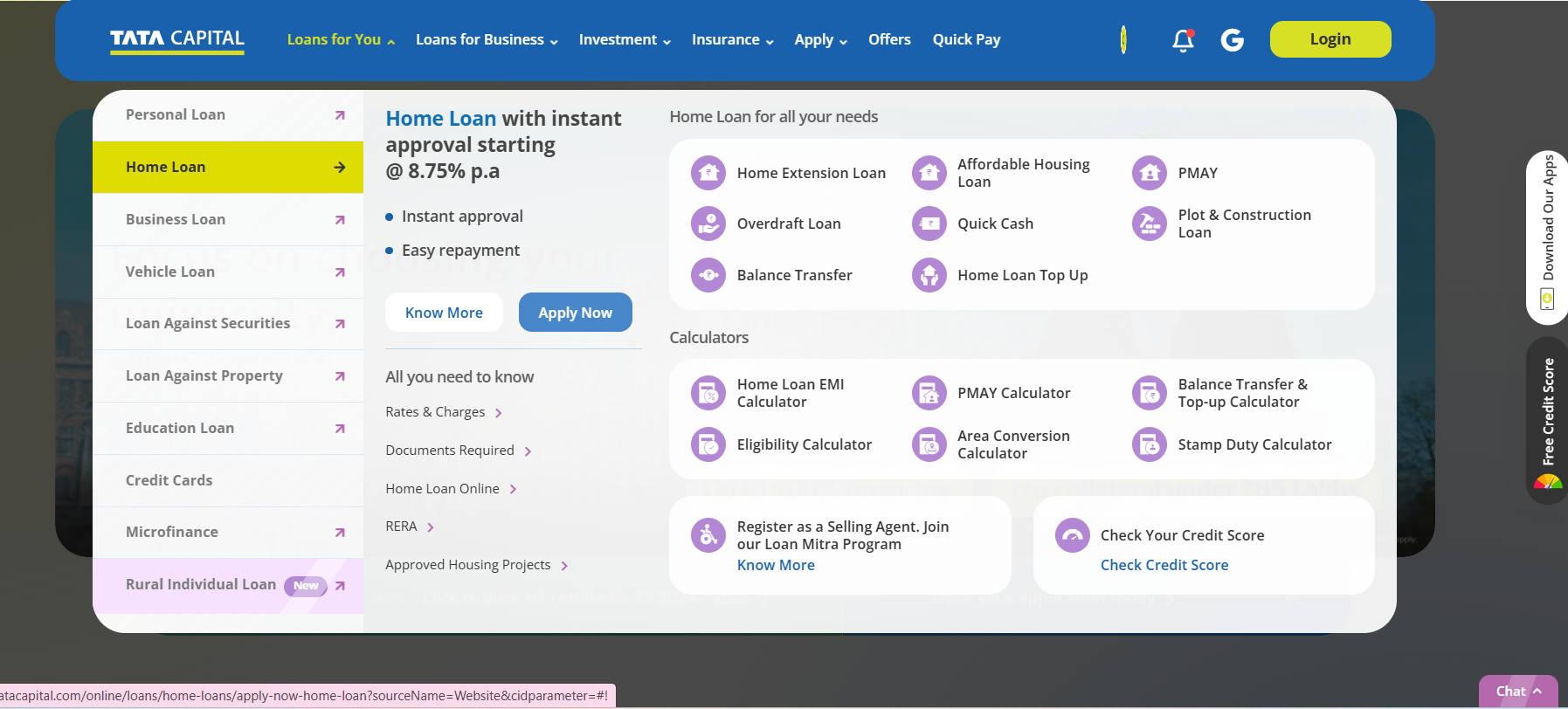

- Navigate to the “Loans for You” tab. From the dropdown menu, select “Plot & Construction > Apply Now” to begin your application.

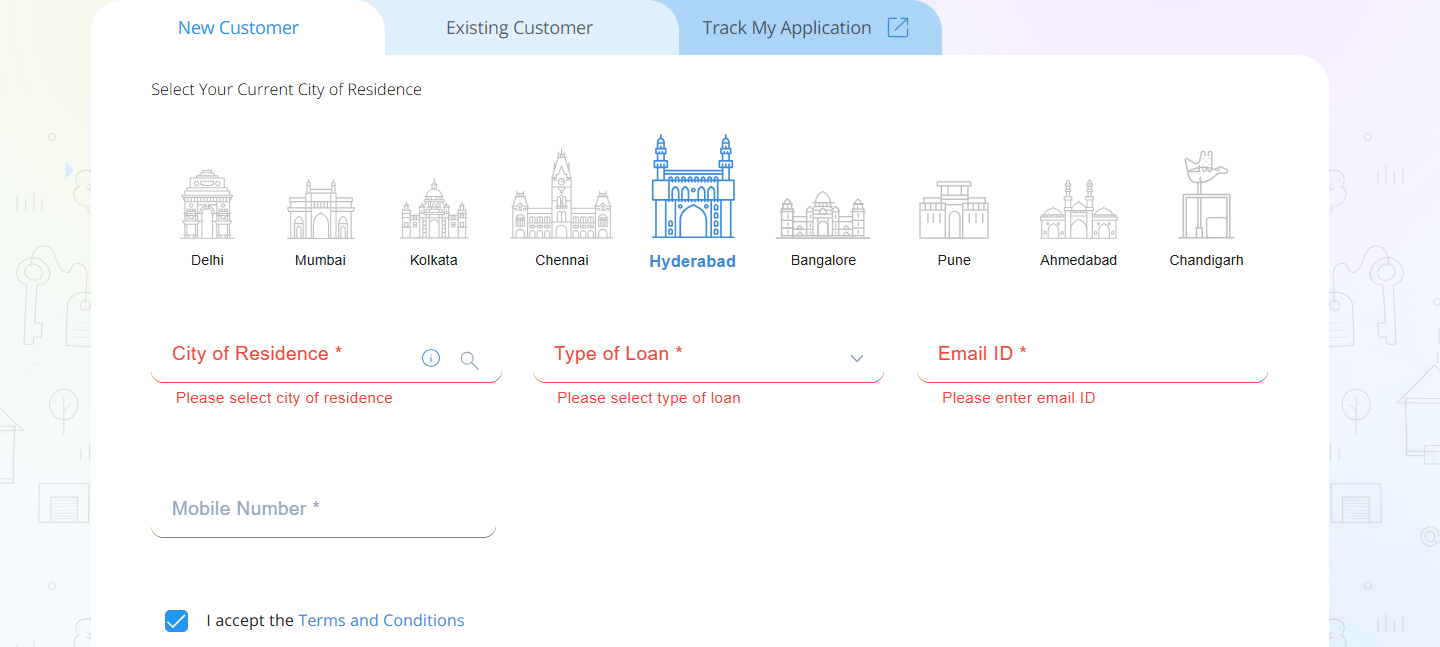

- Fill in the required details in the online home loan application form. Once done, enter the OTP to proceed.

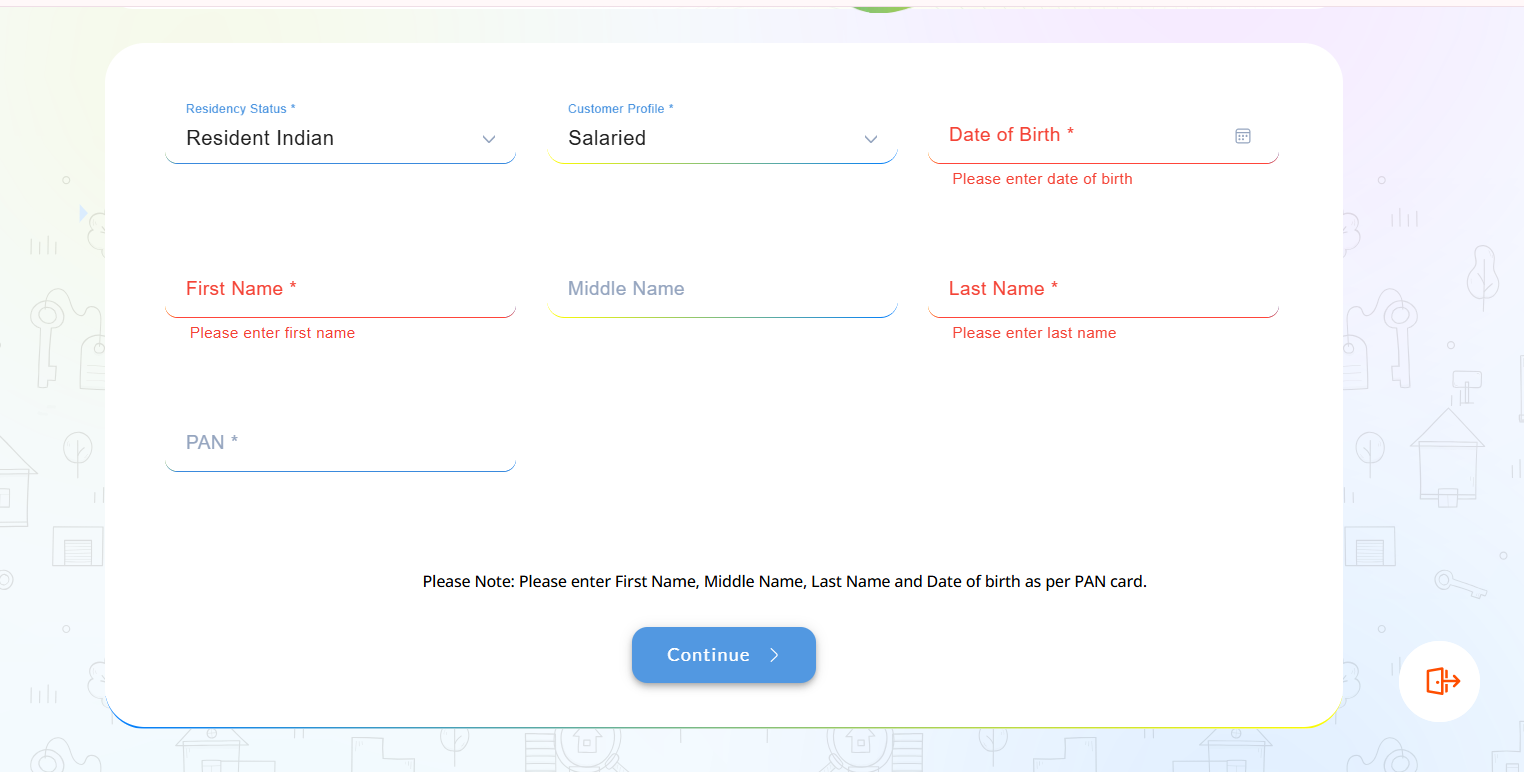

- Provide your basic information and click “Continue” to move to the next step.

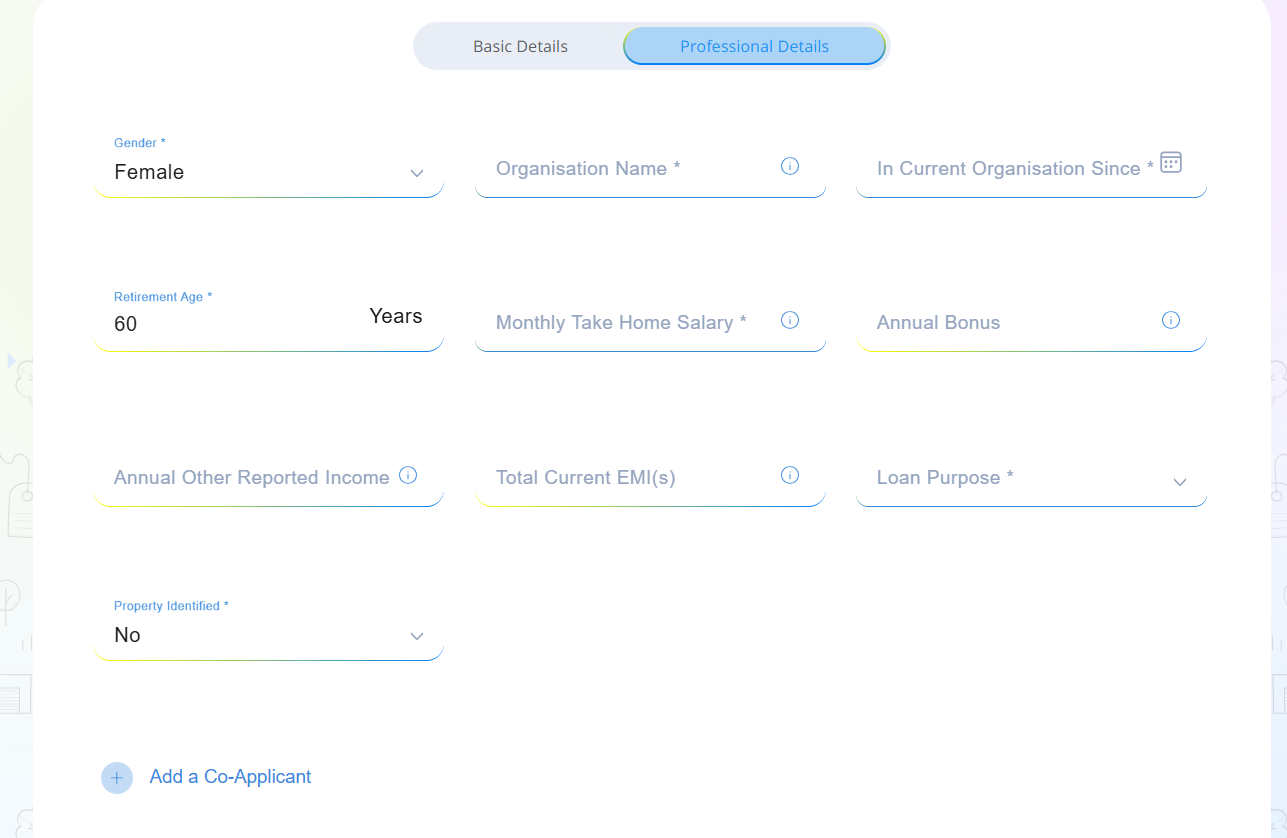

- Fill in your professional details and, if applicable, add your co-applicant information.

- Upload all the necessary financial documents for verification.

- If you qualify, you will receive an e-sanction for your loan.

Suggested Read: 1 Acre Land Prices in India 2025

Compare Top Banks Plot and Construction Loan Interest Rates

Take a look at interest rates from different banks to ensure you’re getting the best deal for your plot and construction loan.

| Bank/ NBFCs | Interest Rates |

|---|---|

| SBI | 8.00% p.a. onwards |

| ICICI | 9.25% p.a. onwards |

| LIC Housing Finance | 8.20% p.a. onwards |

| IDFC First | 8.85% p.a. onwards |

| PNB Housing Finance | 9.75% p.a. onwards |

| HDFC Bank | 8.50% p.a. onwards |

Conclusion

Buying a plot and building your dream home is an exciting adventure, but managing the finances doesn’t have to be overwhelming. At Credit Dharma, we understand the importance of creating a space that truly reflects your lifestyle. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Eligible borrowers can avail a loan amount ranging from ₹5 lakh to ₹5 crore, depending on factors like income, property value, and creditworthiness.

Tata Capital offers competitive interest rates starting from 8.75% per annum for both salaried and self-employed individuals.

Tata Capital does not charge any prepayment penalties for full or partial prepayments made from the borrower’s own funds, offering flexibility to reduce loan tenure or outstanding balance.

The LTV ratio is up to 75% of the plot’s market value for the plot purchase portion and up to 90% of the construction cost for the construction portion, subject to eligibility.

Yes, borrowers can avail tax deductions under Section 80C for principal repayment and under Section 24(b) for interest paid on the loan, subject to prevailing tax laws.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan