For self-employed professionals and business owners, owning a home may seem challenging. But with SBI’s home loan options for non-salaried individuals, it’s more possible than ever. In this article, we’ll break down the process, eligibility, and advantages of applying for an SBI home loan, making it easier for you to take that next step toward homeownership.

SBI Home Loan to Non-Salaried Highlights

SBI offers tailored home loans for non-salaried professionals (freelancers, self-employed, etc.), featuring competitive interest rates, flexible repayment terms, and quick approvals.

| Category | Highlights |

|---|---|

| Interest Rates | 8.00% p.a. onwards |

| Loan Amount | ₹50,000 – ₹50 Crore |

| Tenure | 30 Years |

| Processing Fees | 0.35% of the loan amount + GST, (₹2,000 – ₹10,000) |

Suggested Read: SBI Home Loan Interest Rates 2025

SBI Home Loan to Non-Salaried Interest Rates 2025

SBI designs interest rates to suit non-salaried borrowers, aligning with factors like creditworthiness and repayment capacity. Rates are structured to ensure affordability while accommodating variable income streams.

| Product | Interest Rates |

|---|---|

| SBI Home Loan to Non – Salaried | 8.00% p.a. onwards |

Suggested Read: Home Loan Tax Benefits

SBI Home Loan to Non-Salaried Eligibility Criteria

Eligibility focuses on income stability, credit history, and business continuity. SBI evaluates non-salaried applicants based on transparent parameters to ensure fair access to home loans.

| Criteria | Details |

|---|---|

| Resident Type | Resident Indian |

| Proprietorship Firm or Partnership Firm or Director in Company | Should be in existence for at least 3 years Must have earned Net Profit in the last two years Existing Credit Facilities should be Regular and Standard Opinion Report to be obtained from the existing Bankers Proposed House Property must be in joint names of the Proprietor and the Firm |

| Minimum Age | 18 years |

| Loan Tenure | Up to 30 years |

Suggested Read: Home Loan Eligibility – Salaried vs. Self Employed

SBI Home Loan to Non-Salaried Documents Required

Basic documentation includes identity proof, address verification, income statements, and business ownership details. SBI streamlines the process to minimize paperwork for self-employed borrowers.

| Document | Notes |

|---|---|

| Employer Identity Card | Official ID issued by employer |

| Completed Loan Application Form | Duly filled, attach 3 passport‑size photographs |

Suggested Read: Minimum CIBIL Score Required for a SBI Home Loan

Proof of Identity (submit any one)

| Acceptable ID |

|---|

| PAN Card |

| Passport |

| Driver’s License |

| Voter ID Card |

Proof of Residence (submit any one)

| Acceptable Document |

|---|

| Recent Telephone Bill |

| Electricity Bill |

| Water Bill |

| Piped Gas Bill |

| Passport |

| Driving License |

| Aadhaar Card |

Must Read: Best Property Valuation Practices

Property Papers

| Document | When / Where applicable |

|---|---|

| Permission for Construction | New builds where approval is required |

| Registered Agreement for Sale / Allotment Letter / Stamped Agreement for Sale | Registered Agreement for Sale—Maharashtra only |

| Occupancy Certificate | Ready‑to‑move properties |

| Share Certificate | Maharashtra housing societies |

| Maintenance, Electricity & Property Tax Bills | Latest copies |

| Approved Plan Copy (Blueprint) | Xerox blueprint of sanctioned plan |

| Registered Development Agreement of Builder | New property projects |

| Conveyance Deed | New property projects |

| Payment Receipts / Bank Statements | Evidence of all payments to builder/seller |

Account Statements

| Statement | Period to Submit |

|---|---|

| Bank Account Statements (all accounts) | Last 6 months |

| Existing Loan Account Statement | Last 1 year |

Suggested Read: SBI NRI Home Loan Eligibility Criteria

Income Proof – Salaried Applicants / Co‑applicants / Guarantors

| Document | Period |

|---|---|

| Salary Slips / Salary Certificate | Last 3 months |

| Form 16 | Last 2 years |

| IT Returns (acknowledged) | Last 2 financial years |

Must Read: How to Get a Home Loan With Out Income Proof?

SBI Home Loan to Non-Salaried Processing Fees

Processing fees are nominal and designed to keep upfront costs low. SBI occasionally offers fee waivers or discounts to simplify the loan journey for non-salaried applicants.

| Processing Fees |

|---|

| 0.35% of the loan amount + GST |

| Minimum: ₹2,000 | Maximum: ₹10,000 |

Suggested: Check Out the Nearest SBI Branch

SBI Home Loan to Non-Salaried Other Charges

Standard charges apply for services like prepayment, late payments, or legal checks. SBI ensures clarity with no hidden costs, keeping the process transparent.

| Charges/Reason | Details |

|---|---|

| CERSAI Registration Charges | ₹100 + GST |

| Fee for Switching to Current Card Rate | ₹5,000 + GST |

| Safe Custody Charges | ₹1,000 + GST per quarter or part thereof for delayed collection of original title deeds (beyond 60 days). |

| Conversion Charges for Switching Loan | Switching loan from MCLR/Base Rate/SBAR to EBLR is allowed at ₹1,000 per account + GST. |

| Penalty for Failed/Non-Payment of EMI | ₹250 + GST per EMI missed |

| Penalty for Cheque Returned (Insufficient Funds) | ₹500 + GST |

| Penalty for Failed SI/NACH | ₹250 + GST per failed SI/NACH transaction |

Check Out : Calculate Your Down Payment Now

How to Apply to SBI Home Loan to Non-Salaried?

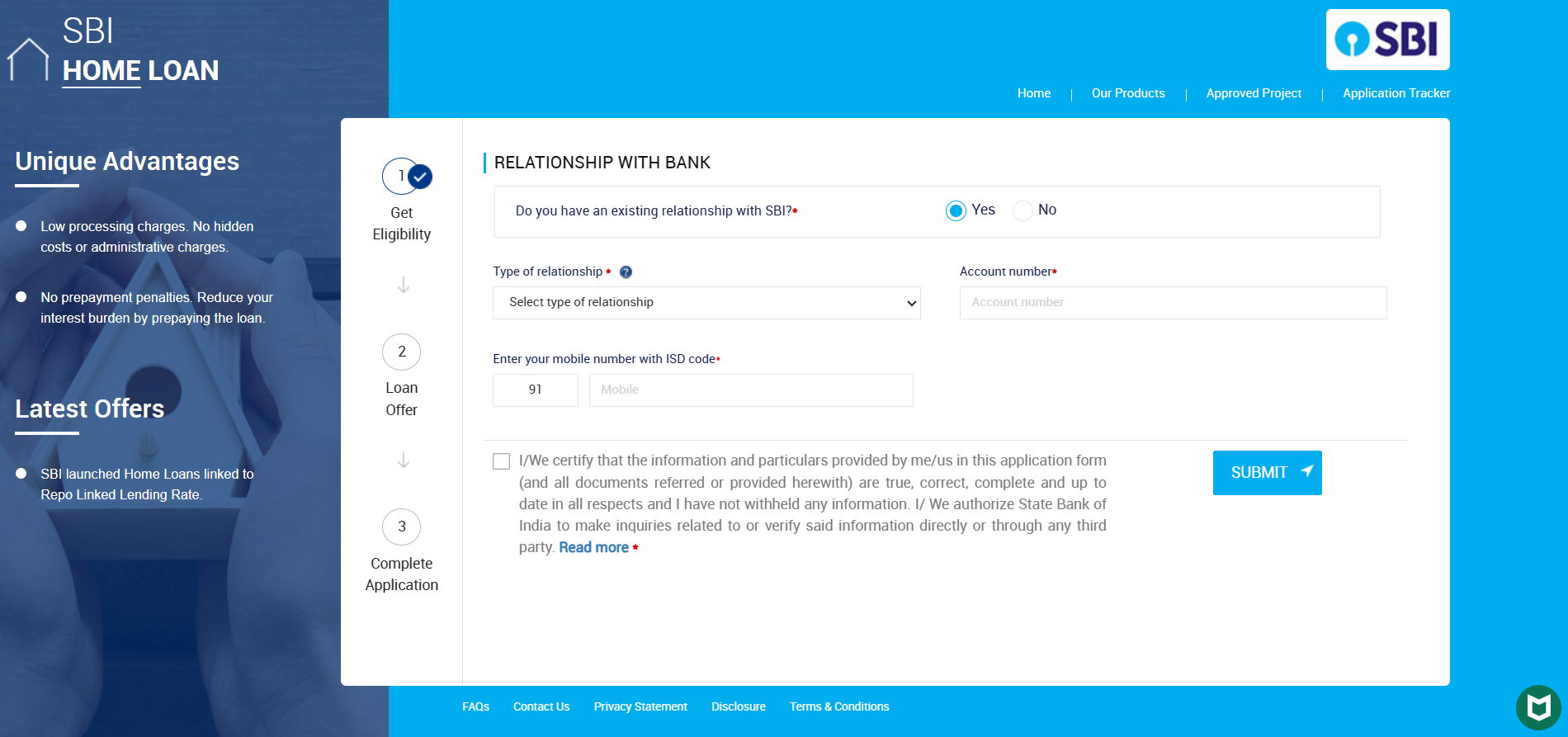

Apply online or visit a branch. Submit your documents, and SBI’s team will guide you through approval and disbursal. Dedicated support ensures a smooth experience for non-salaried borrowers.

- Visit the official SBI Home Loan Application Form.

Form A – Personal Details: Fill in your personal details such as name, date of birth, PAN, contact information, KYC, and marital status.

Form B – Employment & Income: Provide your employment status and income details to assess your loan repayment ability.

Form C – Property & Loan Details: Enter specifics about the property and the loan amount, tenure, and other details.

Form D – Declaration: Read and sign the declaration to confirm your agreement.

- Submit Required Documents

After completing the application, gather the necessary documents. SBI offers a doorstep document collection service for your convenience.

- Application Processing

Once you submit all the required documents, SBI will process your application. Upon successful application approval, you will receive a loan sanction letter.

Suggested Read: SBI Home Loan Customer Care

Compare Top Banks Home Loan Interest Rates for Non Salaried

Explore interest rates and terms from leading banks to find the best fit for your income profile. Online tools simplify comparisons, helping you choose the most affordable option.

| Bank | Loans Up to Rs. 30 Lakh |

|---|---|

| SBI | 8.00%-9.15% p.a. |

| HDFC Bank Limited | 8.70% p.a. Onwards |

| Bajaj Housing Finance | 7.99%-17.00% |

| ICICI Bank | 8.75% p.a. Onwards |

| Axis Bank | 8.75%-12.80% p.a. |

| Federal Bank | 8.80% p.a. Onwards |

| Punjab National Bank | 8.05% – 9.85% p.a. |

| Kotak Mahindra Bank | 8.65% p.a. Onwards |

| Bank of Baroda | 8.00% – 9.60% p.a. |

| Canara Bank | 8.00% – 10.75% p.a. |

| IDFC FIRST Bank | 8.85% p.a. Onwards |

| IDBI Bank | 8.40% p.a. Onwards |

| Punjab & Sind Bank | 8.30% – 11.50% p.a. |

| RBL Bank | 9.00% p.a. Onwards |

| LIC Housing Finance | 8.00% p.a. Onwards |

| Tata Capital Housing Finance | 8.75% p.a. Onwards |

| Sammaan Capital | 8.75% Onwards |

| Aditya Birla Capital | 8.60% Onwards |

| India Shelter Home Loan | 11.59% Onwards |

| L&T Finance Limited | 8.65% p.a. Onwards |

| Godrej Housing Finance | 8.55% Onwards |

| Home First Finance | 11.90% Onwards |

| Easy Home Finance | 8.95% Onwards |

| Piramal Capital Housing Finance | 9.50% Onwards |

| Cholamandalam Investment and Finance | 10.50% Onwards |

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Banks assess your average net profit over 2-3 years via ITR, GST returns, and business vintage. They consider 30-50% of your net income as eligible for EMI. Stable cash flow, credit score, and business type also influence eligibility.

Submit ITR filings (2-3 years), audited profit/loss statements, GST returns, and 6-12 months of bank statements. For freelancers, contracts or client invoices may help. Lenders verify consistency and income stability.

No, rates are similar if your income is stable. Lenders prioritize credit score, loan tenure, and repayment capacity. Some may offer lower rates for strong financial profiles, even for self-employed individuals.

Most lenders require 3 years of operations, but some accept 1-2 years with strong finances. Collateral (e.g., property) or a salaried co-applicant can help offset shorter vintage.

Lenders average your income over 2-3 years to assess stability. High volatility may reduce eligibility. Provide explanations for income dips (e.g., pandemic) and maintain clean financial records.

Yes, loans for under-construction properties are allowed. Disbursal happens in stages. Ensure the project is RERA-approved. Risk depends on project credibility, not employment type.

Lenders average your income over 2-3 years. Highlight peak seasons and provide bank statements showing consistent cash flow. Avoid large income gaps.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan