As your family grows, so does your need for space. If you’re looking to add more room to your existing home, Tata Capital’s Home Extension Loan provides the perfect solution. It offers you the financial flexibility to extend your home and create the extra room you need—without the stress of upfront costs or draining your savings.

Tata Capital Home Extension Loan Highlights

Get an overview of the key details—interest rate, loan amount, and tenure—to quickly determine if this loan suits your needs.

| Aspects | Details |

|---|---|

| Interest Rates | 8.75% p.a. onwards |

| Maximum Loan Amount | 2 lakhs to ₹ 5 crores |

| Maximum Tenure | Up to 30 Years |

| Processing Fees | 3% of the Loan Amount + GST |

Suggested Read: What is Home Loan Moratorium?

Tata Capital Home Extension Loan Interest Rates 2025

Discover the starting interest rates for salaried and self-employed individuals to understand your potential EMI and borrowing cost.

| Aspects | Details |

|---|---|

| Salaried | 8.75% p.a. onwards |

| Self Employed | 8.85% p.a. onwards |

Suggested Read: Top 10 Home Renovation Loans

Tata Capital Home Extension Loan Eligibility Criteria

Make sure you meet the basic eligibility criteria to qualify for this loan and unlock your home extension dreams.

| Eligibility Criteria | Details |

|---|---|

| Age Requirement | Applicant should be between 24 to 65 years (at the time of loan completion). |

| Salaried Employees | Minimum monthly salary: ₹30,000 required. |

| Self-Employed Applicants | At least 3 years of experience in the same business. |

Suggested Read: How to Reduce Home Insurance Premiums Legally?

Tata Capital Home Loan Processing Fees Structure

Know the processing fees based on your employment status, so you’re prepared for the upfront costs.

| Fees Category | Charges Applicable |

|---|---|

| Salaried | Starting @ 0.10% of Loan Amount + GST |

| Self Employed | Starting @ 0.20% of Loan Amount + GST |

Suggested Read: Is Rental Real Estate Income Still a Good Investment in 2025?

Tata Capital Home Loan Other Charges

Understand the various charges such as foreclosure fees and late-payment penalties that might impact your repayment plan.

| Categories | Salaried | Self Employed |

|---|---|---|

| Foreclosure Charges | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds |

| Delayed EMI Payments | 2.00% P.M. (24.00% P.A.) on the defaulted amount | 2.00% P.M. (24.00% P.A.) on the defaulted amount |

| Cheque Dishonour Charges/ Rejection of NACH/ECS Mandate | Rs 700/- per instrument per process | Rs 700/- per instrument per process |

Suggested Read: Small Bathrooom Renovation Ideas

Tata Capital Home Loan: General Documents

General documents form the foundation of your Tata Capital home loan application. These essential papers verify your identity, employment status, and residential address, ensuring that all applicants meet the basic eligibility criteria set by Tata Capital.

| Document Category | Accepted Documents |

|---|---|

| A. Age Proof | – Life Insurance Policy – PAN Card – Passport – Birth Certificate – Driving Licence – School Leaving Certificate |

| B. Photo Identity Proof | – Aadhaar Card – Voter ID – PAN Card – Driving License – Passport |

| C. Address Proof | – Bank Statements – Property Tax Receipt – Voter ID – Utility Bills – Property Registration Documents |

Tata Capital Home Loan: Income Proof

Income proof documents are important for assessing your ability to repay the home loan.

| Applicant Type | Employment/ Business Proof | Income Proof |

|---|---|---|

| Salaried | – Appointment Letter – Yearly Increment Letter | – Salary Slips (last 3 months) – Salary Bank Account Statements (last 12 months) – Certified true copy of Form 16 |

| Self-Employed | – Business Profile on letterhead – Business Registration Certificate | – Income Tax Returns (last 2 years) – P&L Projection Statement (last 2 years) – Operative Current Account Statement (last 12 months) – CC/OD Bank Statements (last 12 months, if applicable) |

| NRIs | – Appointment Letter or Previous Employment History | – Pay Slips (last 6 months) – Overseas Salary Account Statements – NRE/NRO Bank Statements (last 12 months) |

Tata Capital Home Loan: Property Documents

Property documents establish the legitimacy and value of the property you intend to purchase. These papers ensure that the investment is secure and compliant with all regulatory standards.

| Property Documents |

|---|

| Permission for construction (where applicable) |

| Registered Agreement for Sale (only for Maharashtra)/Allotment Letter/Stamped Agreement for Sale |

| Occupancy Certificate (in case of ready to move property) |

| Share Certificate (only for Maharashtra), Maintenance Bill, Electricity Bill, Property Tax Receipt |

| Approved Plan copy (Xerox Blueprint) & Registered Development Agreement of the builder, Conveyance Deed (For New Property) |

| Payment Receipts or bank A/C statement showing all the payments made to Builder/Seller |

Tata Capital Balance Transfer Documents

Transferring your existing home loan to Tata Capital can help you take advantage of better interest rates and favorable terms. To facilitate a smooth balance transfer process, you need to provide specific documents that verify your current loan details and financial standing.

| Balance Transfer Documents |

|---|

| KYC Documents |

| Home Loan Statements from Previous Bank |

| Bank Account Statement |

Suggested Read: How to Remove Vastu Dosh in Your Home?

How to Apply for Tata Capital Home Extension Loan?

The application process is simple—just fill out your details online, upload documents, and wait for your e-sanction.

Step-by-step online application process for Tata Capital Home Loans:

- Visit the Tata Capital official website.

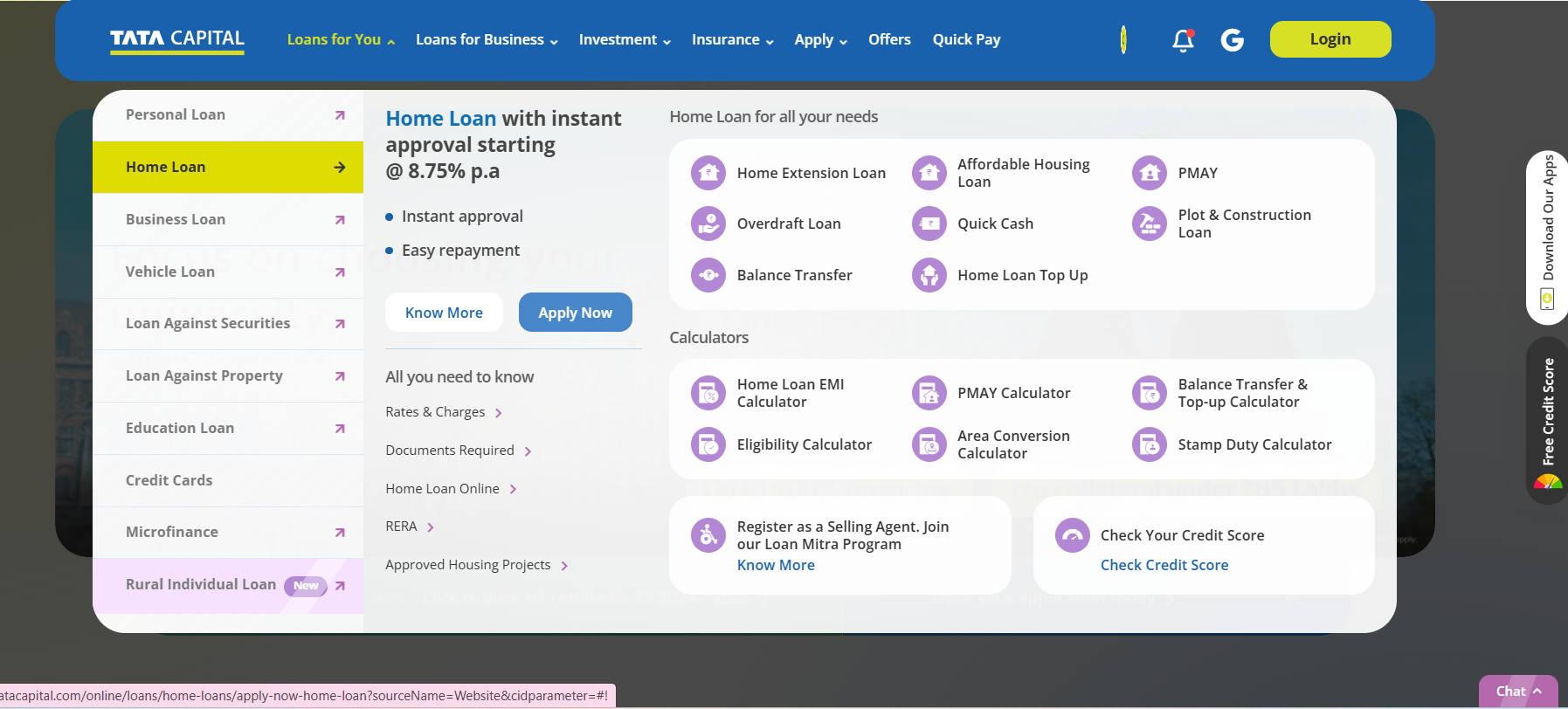

- Navigate to the “Loans for You” tab. From the dropdown menu, select “Home Loan > Apply Now” to begin your application.

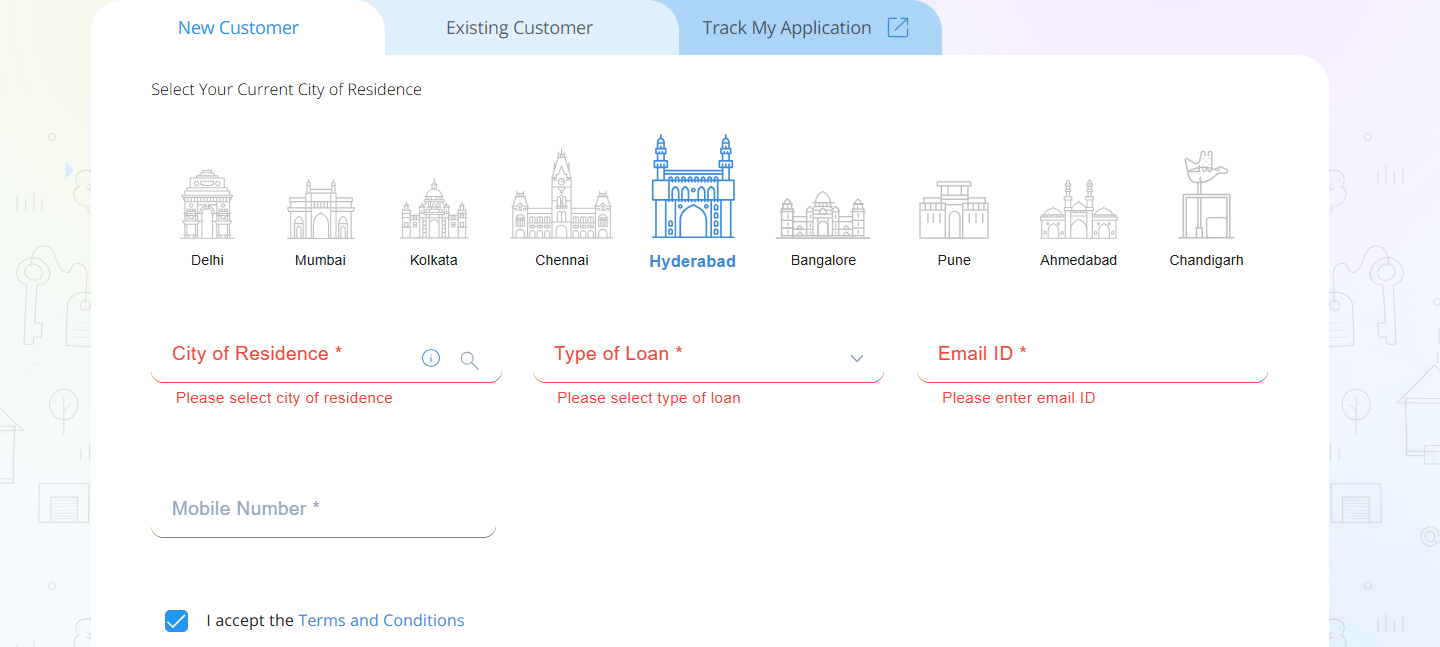

- Fill in the required details in the online home loan application form. Once done, enter the OTP to proceed.

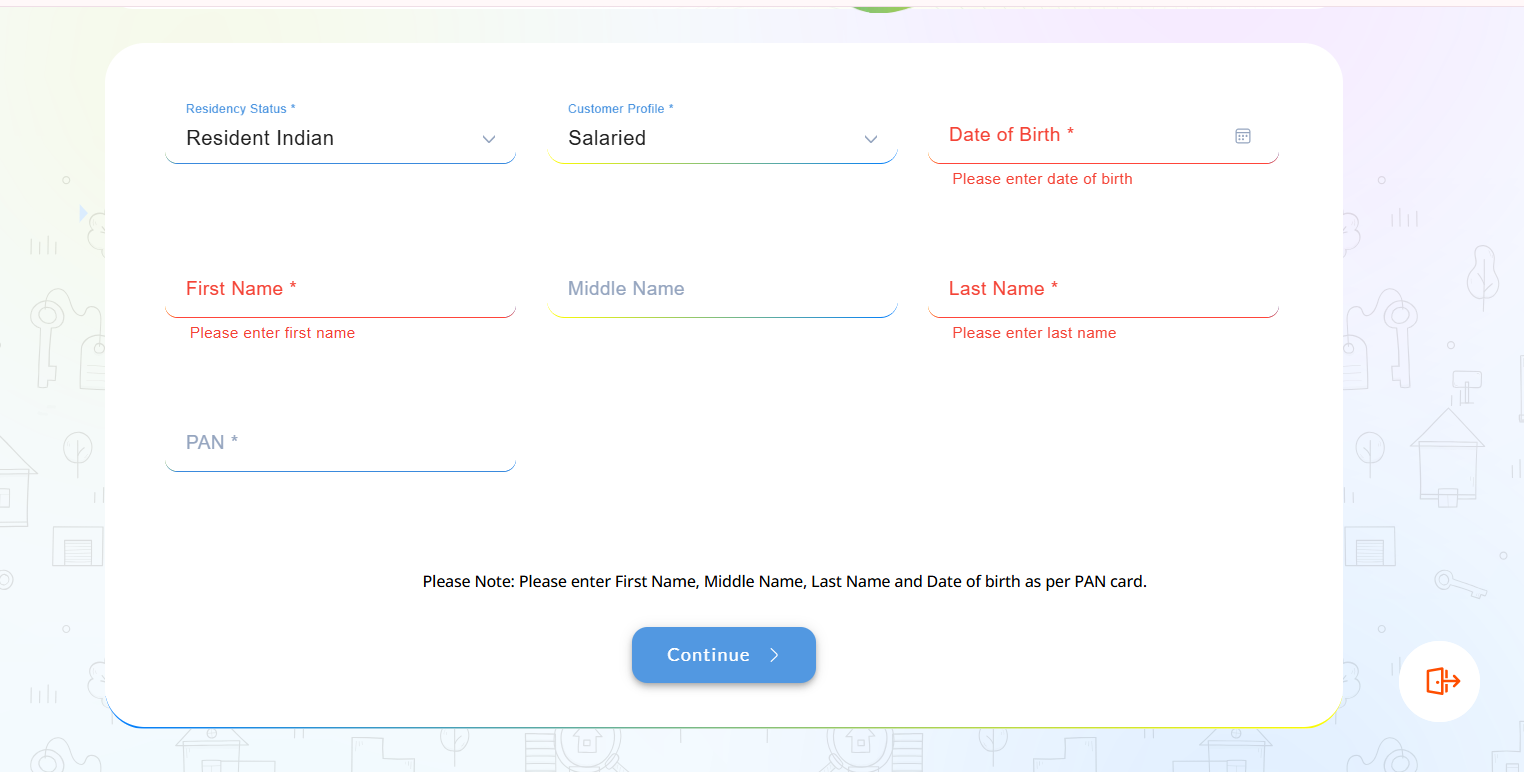

- Provide your basic information and click “Continue” to move to the next step.

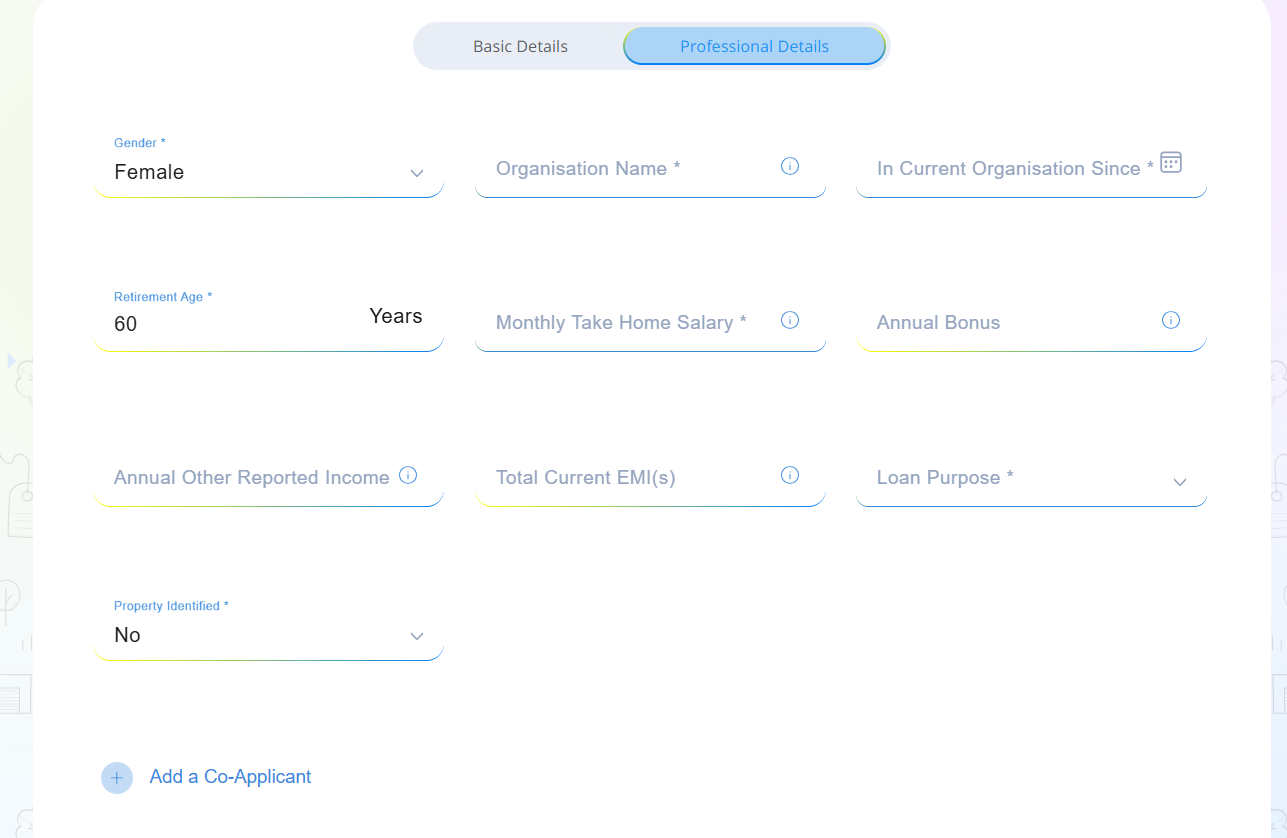

- Fill in your professional details and, if applicable, add your co-applicant information.

- Upload all the necessary financial documents for verification.

- If you qualify, you will receive an e-sanction for your loan.

Suggested Read: 10+ Positive Vastu Colours

Tata Capital Home Loan Application Process with Credit Dharma

Credit Dharma makes it even easier; just follow their simple steps, and a home loan expert will call you within 24 hours to assist.

- Visit Credit Dharma’s official website.

- Enter your name, city of residence, and mobile number.

- Choose your preferred loan type, for example “home loan”.

- Enter the OTP and click on “verify.”

- Enter your property details, employment type, income, and CIBIL score.

- Now sit back and relax. Home Loan Experts from Credit Dharma will call you in next 24 Hours.

Suggested Read: 1 Acre Land Prices in India

Compare Top Banks Home Loan Interest Rates 2025

Review and compare the top banks’ interest rates to find the best deal for your home loan needs.

| Bank | Up to Rs. 30 Lakh | Above Rs. 30 Lakh to Rs. 75 Lakh | Above Rs. 75 Lakh |

|---|---|---|---|

| SBI Bank | 8.50% p.a. onwards | 8.5% p.a. onwards | 8.50% p.a. onwards |

| HDFC Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| LIC Bank | 8.50% – 10.35% p.a. | 8.50% – 10.55% p.a. | 8.50% – 10.75% p.a. |

| ICICI Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Kotak Mahindra Bank | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

| Punjab National Bank | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. | 8.50% – 11.05% p.a. |

| Bank Of Baroda | 8.40% – 10.65% p.a. | 8.40% – 10.65% p.a. | 8.40% – 10.90% p.a. |

| Bajaj Housing Finance | 8.50% p.a. onwards | 8.50% p.a. onwards | 8.50% p.a. onwards |

| Axis Bank | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. | 8.75%-10.30% p.a. |

| Bank of India | 8.40% p.a onwards | 8.40% p.a onwards | 8.40% p.a onwards |

| TATA Capital | 8.75% p.a. onwards | 8.75% p.a. onwards | 8.75% p.a. onwards |

Conclusion

Renovating or expanding your home shouldn’t feel overwhelming. At Credit Dharma, we understand the importance of creating a space that truly reflects your lifestyle. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Eligibility requires applicants to be Indian residents, NRIs, or PIOs aged 21–65 years (at loan maturity). Salaried individuals need a minimum monthly income of ₹30,000, while self-employed applicants must have 3+ years of business experience.

Tata Capital offers home extension loans up to ₹5 crores, depending on eligibility and property valuation. The minimum loan amount is ₹2 lakhs, with interest rates starting at 10.10% for specific schemes.

Interest rates start at 8.75% p.a. and vary based on factors like loan tenure, borrower profile, and market conditions. Tata Capital ensures transparency with no hidden charges, and a processing fee of 1% applies.

Yes, Tata Capital extends home extension loans to NRIs and PIOs with attractive interest rates and flexible repayment options. Applicants must meet income stability and age criteria (21–65 years).

Disbursement timelines depend on document verification and property valuation. Tata Capital prioritizes quick approvals and provides regular updates to ensure transparency throughout the process.

Yes, borrowers can choose from flexible EMI plans aligned with their financial capacity. Tata Capital’s EMI calculator helps estimate monthly payments based on loan amount and tenure.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan